21 Capital and the bitcoin-first economy

21 Capital’s bitcoin-native metrics mark a turning point in how institutional investors measure success.

On Wednesday, 21 Capital announced its SPAC merger with Cantor Equity Partners, bringing a $3+ billion bitcoin-holding company public. The new company is backed by stablecoin giant Tether, SoftBank Group, and will have Strike CEO Jack Mallers at the helm. 21 Capital debuts with 42,000 BTC in its treasury, a significant sum by itself and even more impressive compared to the total amount of bitcoin in circulation.

There are a lot of reasons why the new venture is noteworthy, but among the most significant is that the company is promising to measure success in an entirely new way — by creating the financial metrics of bitcoin per share (BPS) and bitcoin return rate (BRR).

Unlike traditional companies that denominate value in dollars or other fiat metrics, 21 Capital is pioneering a bitcoin-native valuation model. Investors aren’t just buying exposure to an enterprise, they’re buying a claim to a growing bitcoin base. Over time, as the company accumulates more bitcoin or manages its treasury well, the BPS ideally rises — offering shareholders an ever-increasing slice of the bitcoin pie.

This compares to the more traditional earnings per share metric but aligns the measure of success more closely with 21 Capital’s underlying goal: to accumulate as much bitcoin as possible.

BRR, on the other hand, tracks the rate of increase in BPS over time. It’s a bitcoin-native compounding metric.

Instead of measuring how fast your dollars grow, it measures how fast your holdings of bitcoin grow.

It’s easy to dismiss this stuff as a marketing ploy or a gimmick to get attention. But as we dive deeper into how and why 21 Capital was formed — and the partners involved — it becomes clear that this development signals a new kind of bitcoin investment strategy.

The reframing around what makes bitcoin investments successful — that it’s not just about comparing it to dollars, but instead about making success purely about accumulation — could have profound implications. Traditional metrics like earnings per share or revenue growth are, by design, embedded within a fiat system. 21 Capital rejects this framework, instead anchoring itself to a finite monetary good. It suggests a future where company performance isn't judged by ephemeral fiat earnings, but by its ability to acquire and safeguard hard money.

The institutional surge

We’ve covered how institutional ownership of bitcoin is increasing dramatically. Right now, about 8% of the total supply is already held by major entities, according to Bitcoin Magazine. ETFs, publicly listed companies, and even sovereign wealth funds are all accumulating bitcoin at a record pace. Publicly traded companies alone control over 700,000 BTC — approximately 3.33% of the total 21 million supply.

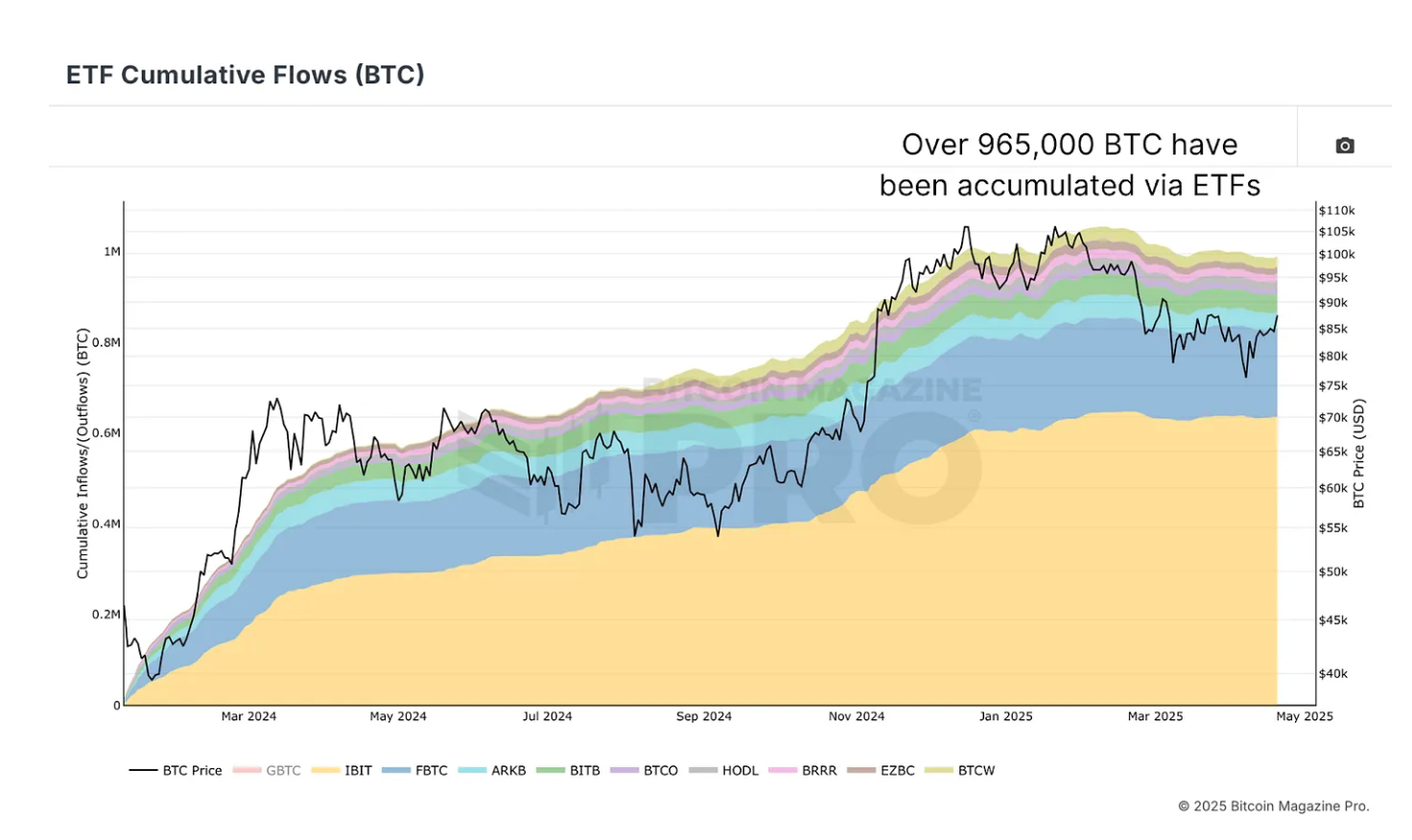

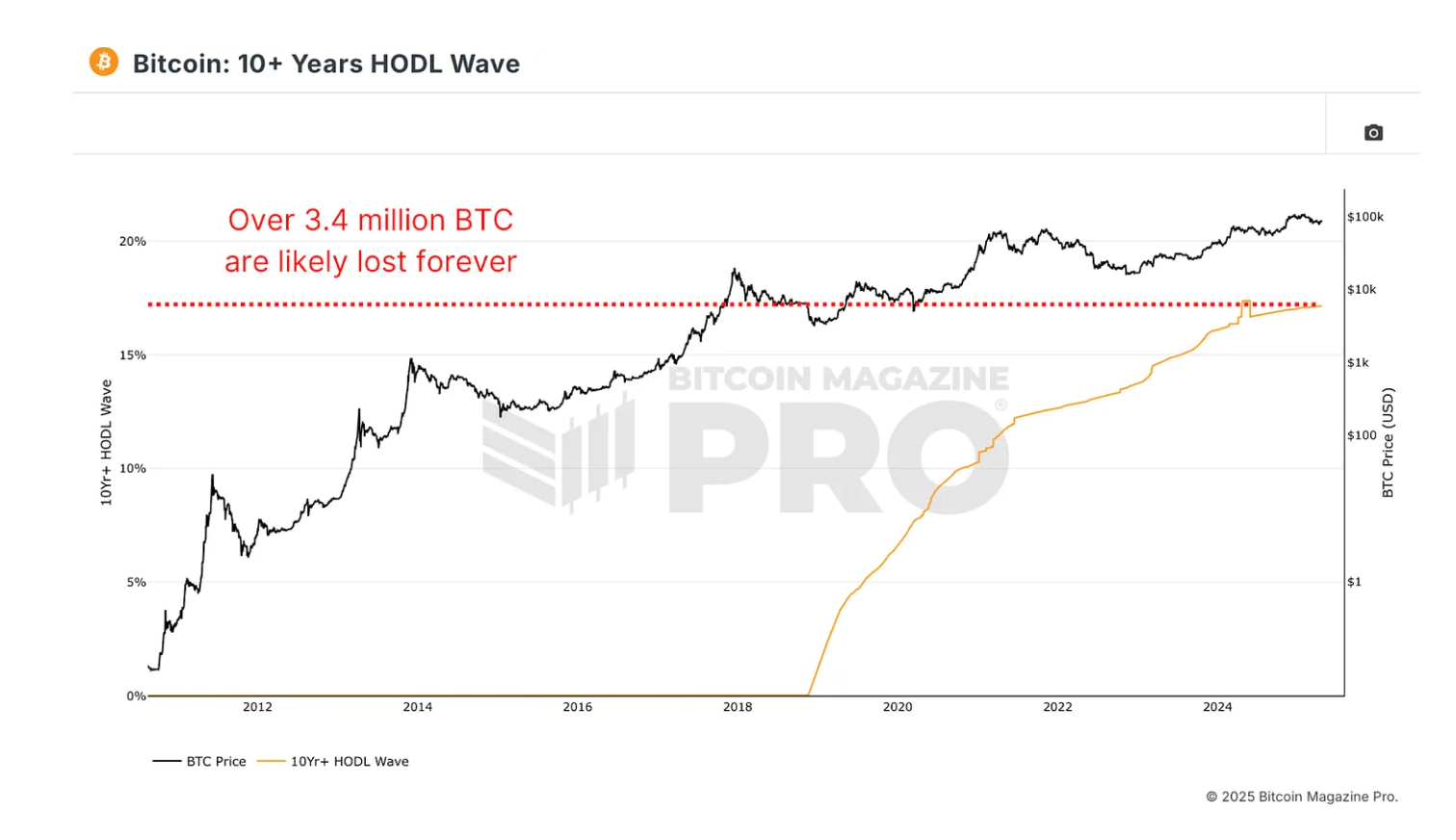

Spot bitcoin ETFs further contribute to the institutional footprint, now holding roughly 965,000 BTC, just under 5% of total supply. When combined with sovereign state holdings — another 542,000 BTC — institutions collectively control more than 2.2 million BTC. Considering estimates that about 3.4 million BTC are likely lost forever, the effective supply shrinks, and institutional holdings rise to approximately 13.44% of the accessible bitcoin market, again according to recent analysis by Bitcoin Magazine.

It’s still not clear how this increased institutional investment plays out long term. On one hand, increased liquidity means more stability. On the other hand, more entities popping up to control and custody bitcoin on behalf of investors waters down one of bitcoin’s key value propositions: the ability to own the asset (or a portion of the network) directly.

Supporting or distorting the thesis?

In previous issues of Open Money (“the financialization of bitcoin”, “crypto’s public market crossover”), we explored the tension between legacy financial systems adapting to bitcoin and bitcoin adapting to legacy finance.

21 Capital leans heavily toward adaptation on bitcoin’s terms. Its BPS and BRR metrics are not just novel accounting gimmicks — they represent a philosophical commitment to denominating reality in bitcoin units. In that sense, 21 Capital supports the Open Money thesis: that bitcoin is not merely an asset to be slotted into portfolios but a new substrate for financial systems.

Yet the model is not without distortion. By mediating bitcoin exposure through corporate shares, 21 distances investors from the core principle of bitcoin self-sovereignty. Shareholders do not own bitcoin directly; they own a financial abstraction governed by corporate structures. Remember the “not your keys, not your coins” thing? It wasn’t that long ago.

In what seems to be a recurring theme, we are back to where we always seem to land: multiple things can be true at the same time. 21 is both a radical endorsement of bitcoin’s value proposition and, at the same time, an advocate for the re-centralization of ownership.

The Open Money Project

We are still working through a series of mini case studies comparing the traditional legacy systems with newer, Open Money systems.

Here are some recent posts: