Crypto's invisible phase

Open Money tracks how crypto becomes part of the financial and digital infrastructure beneath everyday life. This week, we break down a16z’s State of Crypto 2025 to show how stablecoins, ETFs, and new wallet UX are embedding open systems into how value moves.

Stablecoins are moving money. ETFs are moving capital. Wallets are onboarding users without fanfare. What was once speculation is now infrastructure. That’s the clear message of State of Crypto 2025, the latest annual report from a16z crypto.

Thankfully, the headline isn’t “crypto is back.” Instead, the nuance is more that crypto's distribution problem has started to become less of an issue. Dollar-backed tokens are settling trillions. Spot ETFs are absorbing slow institutional flows. And onchain usage is climbing even when price isn’t.

Here's a look at some of the themes from this year's State of Crypto report and a look at how they fit into the Open Money framework.

Stablecoins are becoming settlement infrastructure

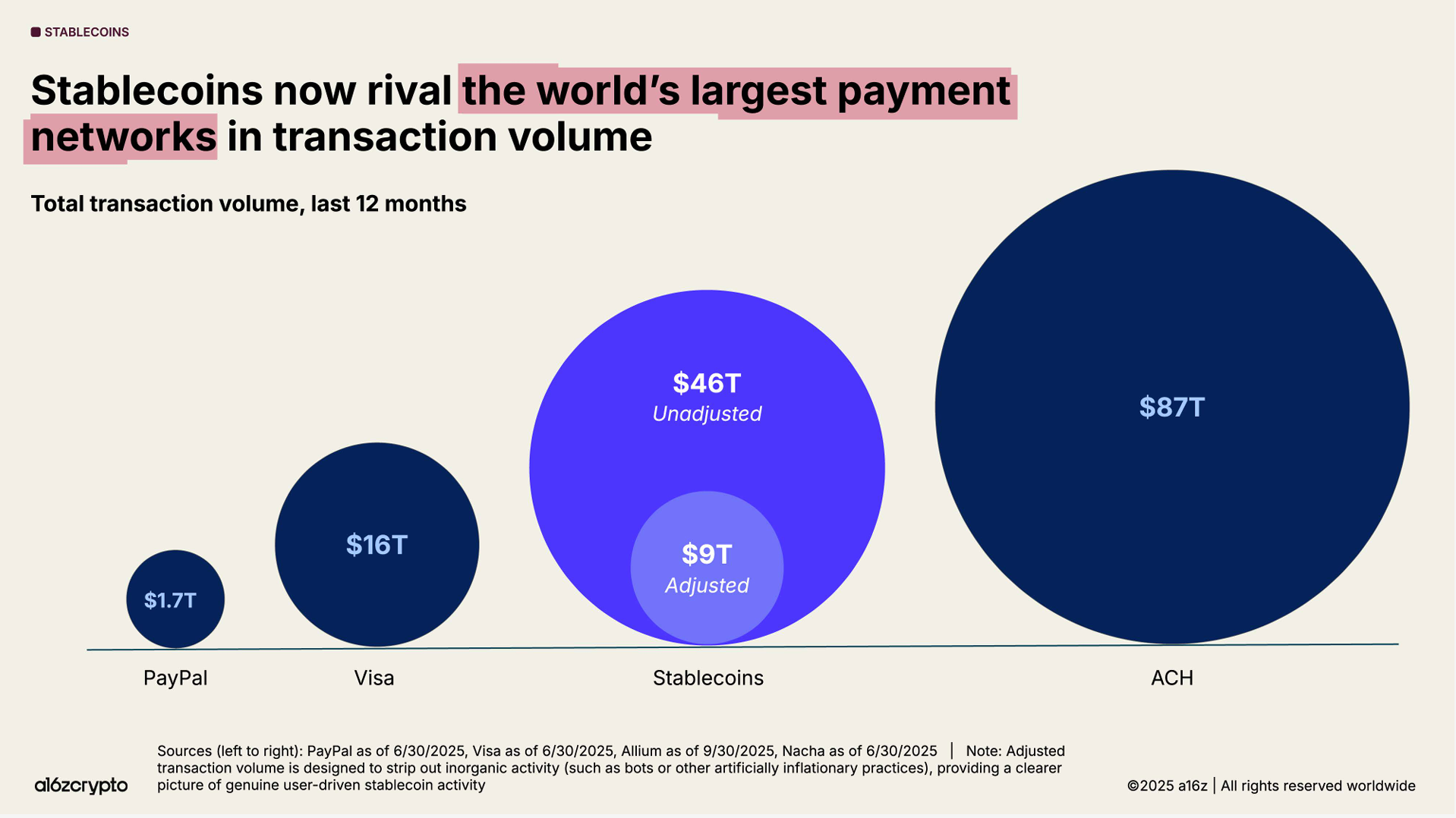

One of the cleanest signals that crypto is moving from niche to mainstream is the surge in stablecoin volume.

In the last 12 months, stablecoins processed more than nine trillion dollars in value. That figure now rivals Visa’s annual volume. And it’s not speculative churn or exchange arbitrage. It’s increasingly made up of enterprise transactions, fintech rails, and international settlements.

That shift matters because it changes who touches crypto and how.

Treasury teams no longer need to run pilots. They’re standardizing on token-based rails.

Payment processors no longer need to build their own infrastructure. They’re plugging into what already works.

What was once informal infrastructure is now entering formal systems — auditable, scalable, and increasingly compliant. Stablecoins are behaving like APIs for dollars. They move money the way software moves data.

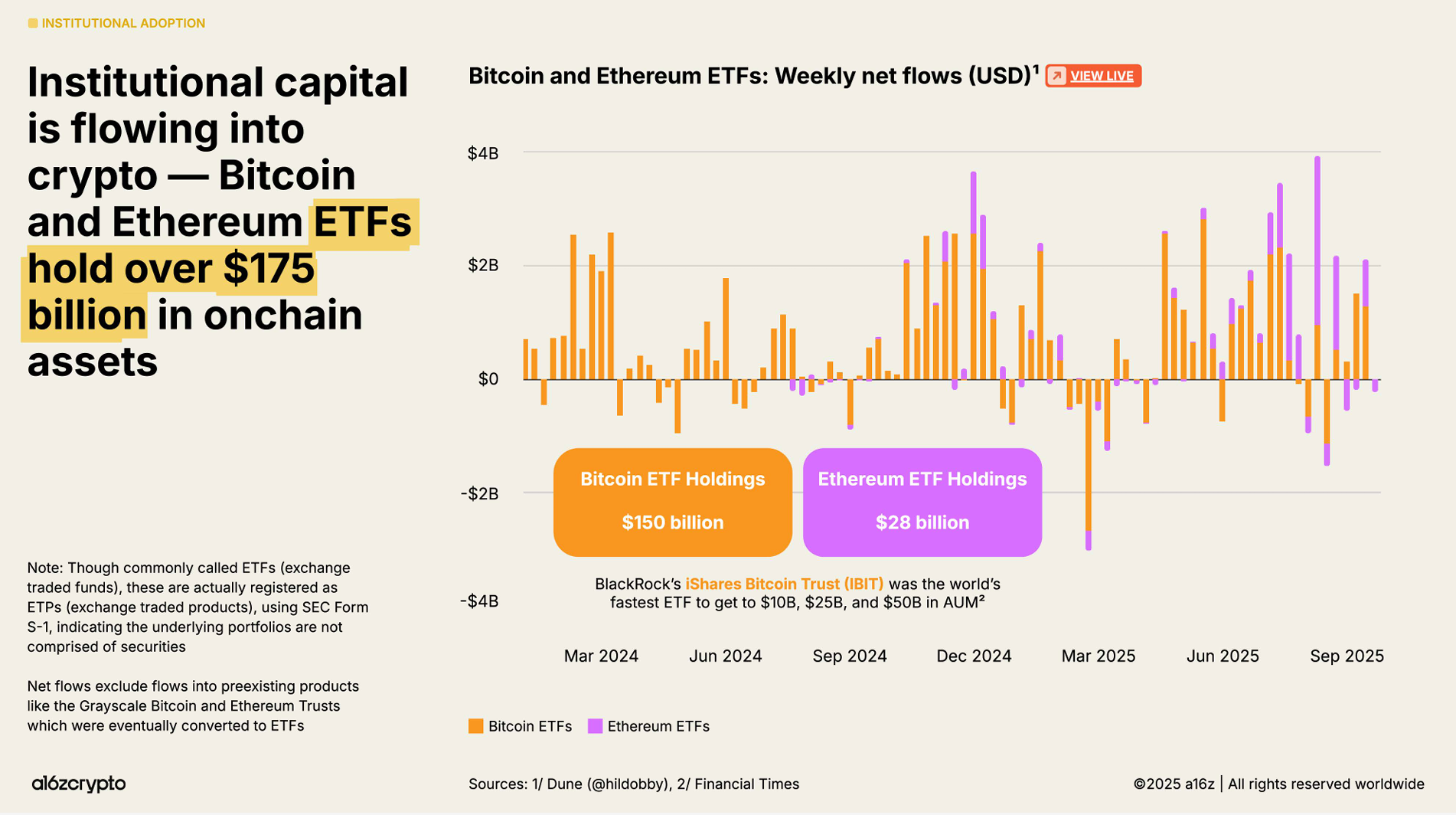

ETFs turned bitcoin into an allocatable asset

The launch of spot bitcoin and ETH ETFs was more than a headline event. It represented a structural shift in how capital allocates to crypto.

According to the report, more than $175 billion has flowed into crypto ETFs since the spring of 2024.

Crypto exposure no longer requires signing up for a new exchange or managing private keys. It fits inside the same models and dashboards used to allocate to equities, gold, or bonds. This invites a new kind of participant: registered investment advisors, corporate treasurers, institutional desks.

These are allocators who want clean exposure, not high conviction. And that’s exactly what ETFs provide — a familiar wrapper for a once-alien asset class.

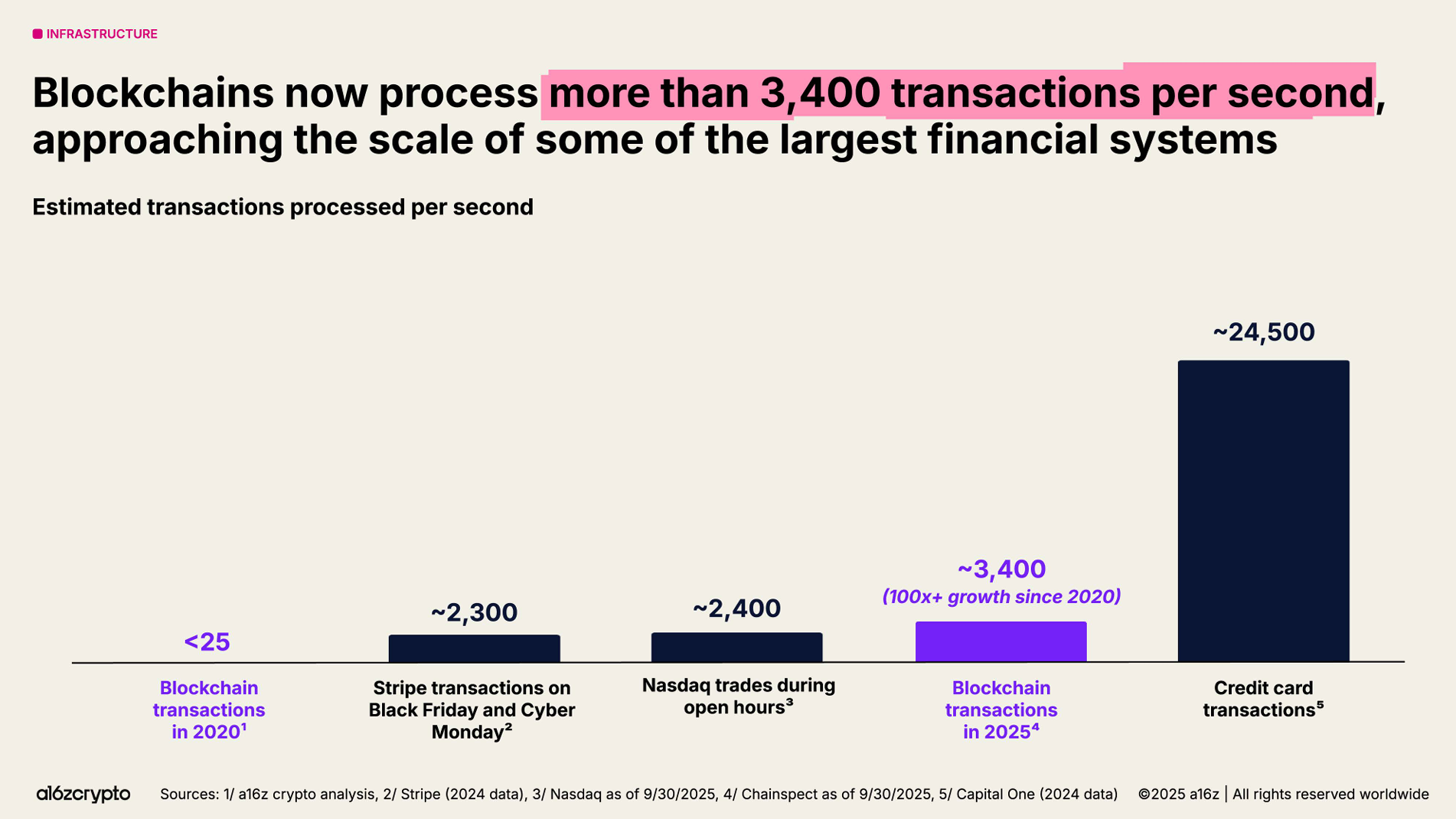

Onchain activity continues even when prices stall

Historically, crypto usage has been tightly coupled with market cycles. During downtrends, activity flatlined. But the latest data from a16z breaks that pattern, raising questions about if the traditional market cycle is dead (or at least changing).

Wallet downloads and active addresses have grown steadily over the past year, even with prices moving sideways. People are still showing up, still interacting, still using.

The shift is behavioral. Users are now doing things onchain that don’t require belief in number-go-up.

Payments, gaming, messaging, voting — these are applications that run whether markets are hot or not. And more importantly, they are increasingly designed in ways that don't require users to know they’re onchain at all. Adoption is becoming ambient. The infrastructure is still crypto, but the experience is increasingly just software.

AI is becoming a crypto-native user

The report also points toward a new kind of user entirely: software agents. As AI systems begin to transact — paying for data, calling APIs, renting compute — they will need financial infrastructure that fits their nature. That means wallets, not bank accounts and permissions that are set by cryptographic signatures, not generic user logins.

Crypto provides the foundation for this: autonomous systems with verifiable identities, programmable spending limits, and fully transparent histories. As agents begin to interact economically, they will need systems of value exchange that live inside software itself.

The platform phase has already started

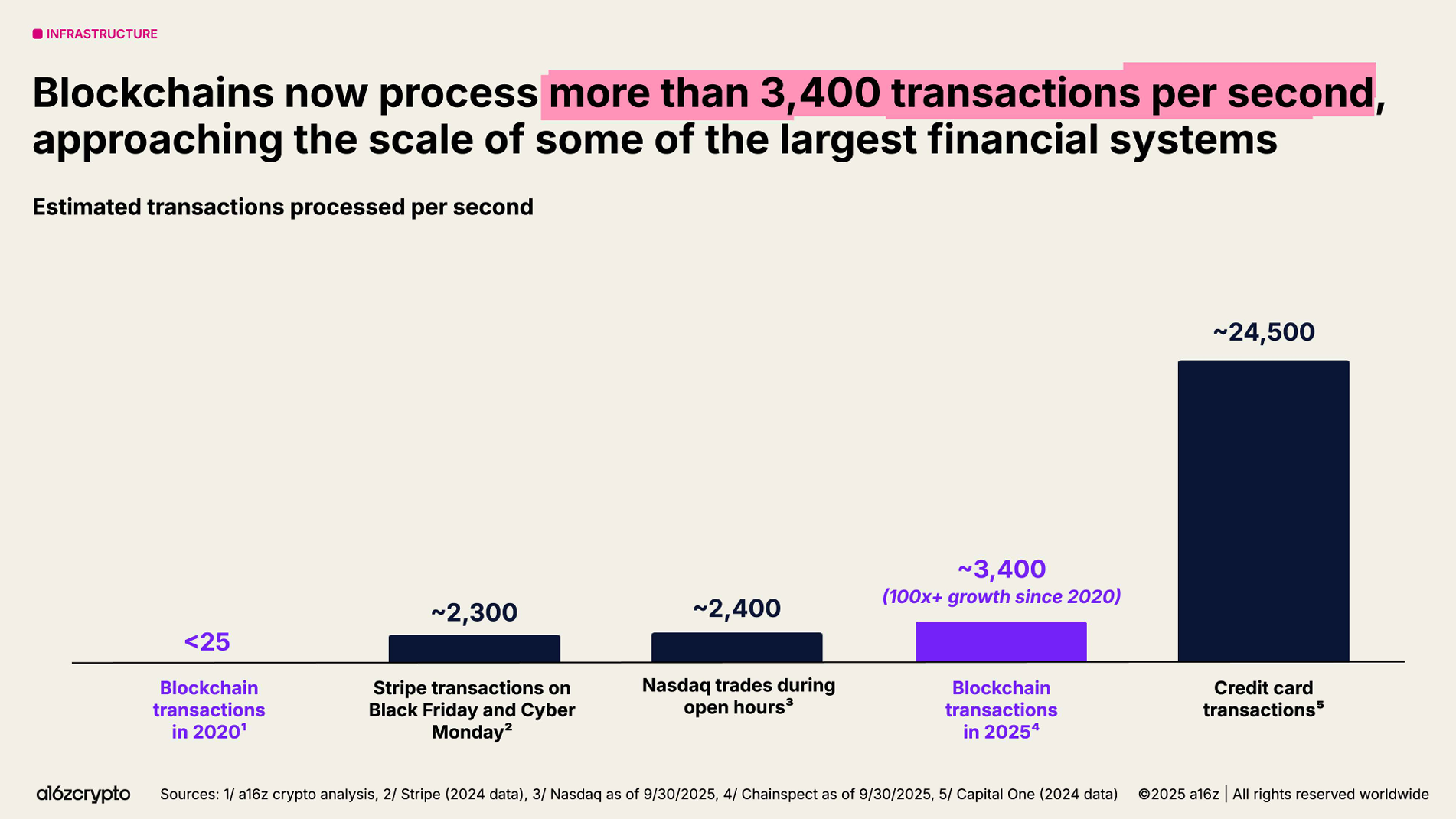

In the past crypto’s story was centered on speculation in one form or another. In 2025, the story is infrastructure that works at production-grade levels. Payments are clearing on token rails. Capital is flowing through ETFs. Consumer apps are onboarding through abstracted wallets. Machine agents are starting to transact without humans in the loop.

This is what real platforms do. They don’t remain a category. They become part of the stack.

So now, the big question is, what comes next?