Perps, pressure, and the shape of Open Money

A macro spark meets levered books; we trace the liquidation cascade, unpack how perps keep taking share, and map what this means for onchain finance.

A macro spark found dry tinder. New tariff headlines hit risk assets and the move routed straight into crypto’s favorite transmission belt: perpetuals. Prices lurched, funding flipped, and liquidation engines spun up.

Coverage framed the break as tariff-driven risk-off, but the tell was microstructure — open interest was stretched, basis rich, and books thin where it mattered. That is the recipe for a fast flush.

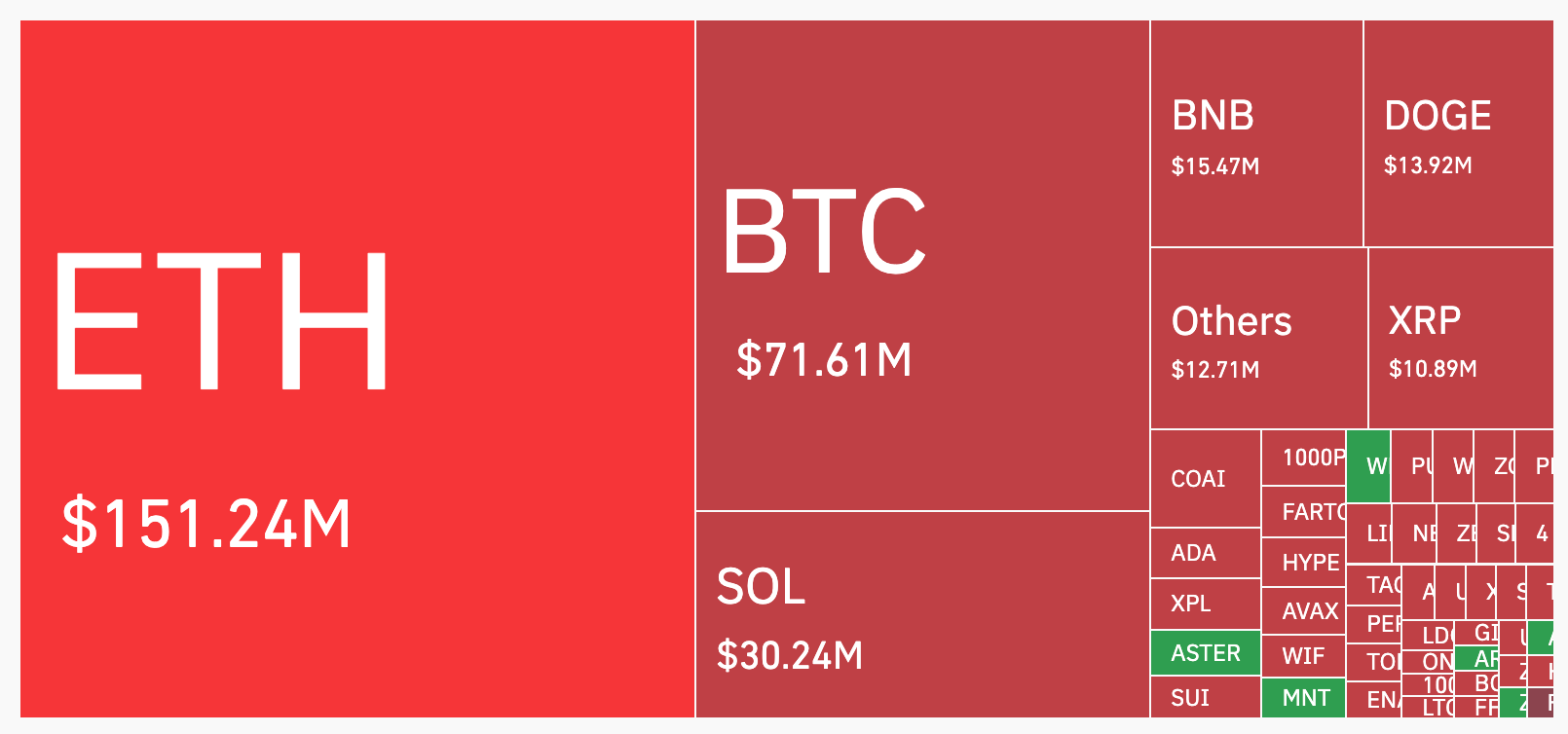

The tape’s big print came on Hyperliquid. CoinDesk tallied more than $1.2 billion in trader capital erased on the venue and roughly $19 billion across the market inside a day, with 6,300 wallets in the red and hundreds down seven figures.

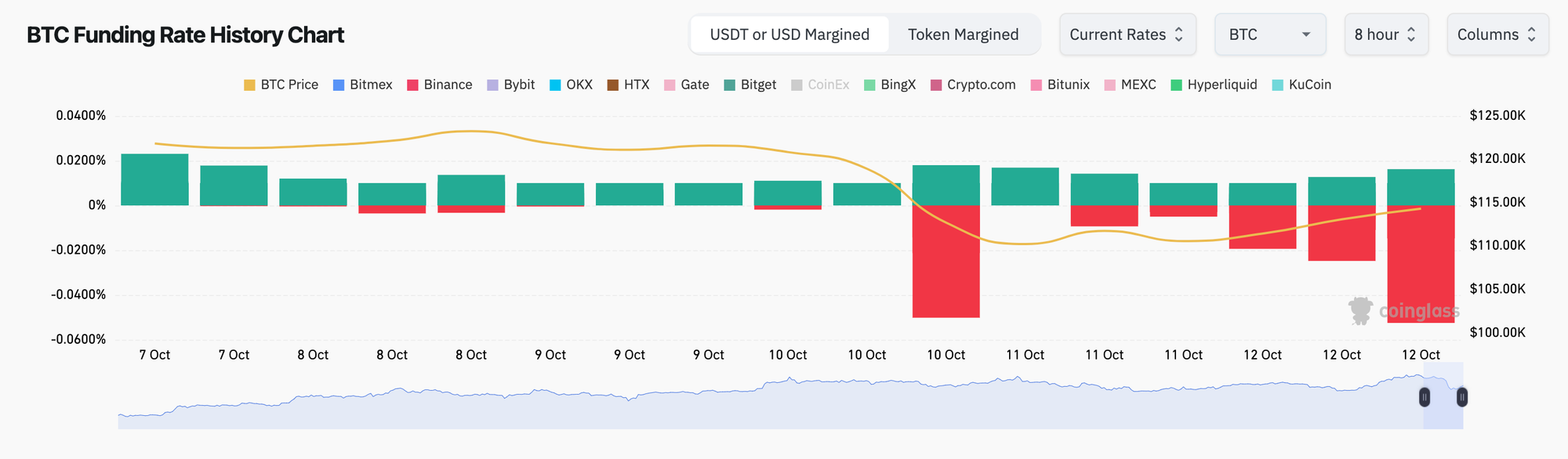

Zoom out and the pattern holds. Market-wide liquidations spiked during the Oct. 10–11 whipsaw, the classic “leverage reset” that turns funding down and cleans out crowded longs. These resets are not bugs. They’re how a 24/7, levered market vents pressure when macro throws a curveball.

Meanwhile, the product conveyor never slowed. On Oct. 10, Binance posted yet another listing — YB/USDT perps with up to 5x — while volatility was still humming. Demand for the format is inelastic: direction, hedging, basis, all in one click. Listings follow the flow.

A final piece of context: spot and perp realities can rhyme until they suddenly don’t. Early in the week, ETFs were pulling in record flows while bitcoin pressed highs.

What perps are, and why they keep taking share

Perpetual futures are futures without an expiry. Funding payments nudge the contract toward spot: positive funding and longs pay shorts; negative funding and shorts pay longs. It’s elegant and ruthless.

In practice, traders watch three dials: funding, open interest (OI), and liquidations. Those dials told the whole story this week.

Why the format dominates is mostly practical. Capital efficiency means you need less cash to express a view. Always-on hedging lets miners, treasuries, and market makers neutralize risk without dumping inventory into thin spot.

Price discovery often leads on perps because levered, continuous markets move first when headlines land at odd hours. And the UX feels familiar: on CEXs a perp ticket is a spot ticket with a leverage slider; on DEXs, order books and AMM-hybrids are now close to that feel.

Kaiko’s recent work underscores another shift: access is broadening as the product shows up in new venues and structures.

Funding is the heartbeat. Persistently positive funding is a crowd of longs agreeing to pay rent. The higher and stickier it gets, the more fragile the stack. Negative funding flips the story for shorts.

Open interest is the accelerant. High OI into macro risk is tinder. A gap prints, collateral haircuts bite, forced sells hit thin ladders, and the cascade feeds on itself.

That’s exactly what Oct. 10–11 looked like: leverage built during calm, a policy shock arrived, then convexity did the rest. The lesson isn’t to avoid leverage. Instead, it’s to recognize when the market will force you to de-lever on its terms.

What the rise of perps means for Open Money

Perps are not a casino bolt-on. They’re infrastructure for open balance sheets.

First, they are the real-time hedge that lets onchain actors hold risk. Miners, protocol treasuries, and market makers can neutralize delta in minutes instead of spraying spot into illiquid books.

That stabilizes inventory and widens participation. The systemic catch: when everyone uses the same hedge, stress syncs. The sell button is shared. Liquidation rules rhyme across venues. Designing risk systems that fail gracefully — on both centralized and decentralized rails — is now a public good for the ecosystem.

We've recently covered why the need to hedge in the crypto markets is so important.

Second, price discovery is collapsing into the derivative layer, and the rest of the stack has to keep up. If the perp leads and spot follows, then bridges, stablecoin rails, and oracles need to be tuned for derivative-first prints. As the product globalizes, small choices about mark price and clawbacks shape how “open” the system feels in stress.

Third, the DEX arc matters for credibility. If perp DEXs keep closing the execution gap while staying self-custodial and transparent, they become the native hedge venue for onchain actors. That pushes more collateral to live onchain, makes margin programmable, and turns liquidation bots into market infrastructure rather than hobby scripts.

It also raises the bar for insurance funds and oracles. Capitalization, rule clarity, and manipulation resistance move from footnotes to first principles. The current wave of challengers is healthy — experimentation is how we learn — but fragmentation only works if we settle on shared standards for indices, funding calculation, and telemetry.

There’s an accessibility edge too. Perps make it simple to express views with small capital. That’s empowering, and it cuts both ways.

Education and guardrails belong in the main flow, not in a help center. Show funding math in-line. DEXs should aim higher, every rule should live onchain and every backstop auditable.

Finally, perps test our definition of “open.” If the instrument that sets price lives behind a few matching engines, the rest of the stack inherits that chokepoint.

A credible alternative requires composable indices, oracle designs that reflect both spot and perp realities, funding rules that can’t be quietly tweaked mid-crisis, and backstops you can see, not just trust. Build that, and open money gets both speed and resilience.

Skip it, and the next headline writes the same story.