Crypto network production costs | DYOR

Understanding the production costs associated with different cryptocurrency networks is another important part of figuring out how they are valued — or where their value comes from.

Understanding the production costs associated with different cryptocurrency networks is another important part of figuring out how they are valued — or where their value comes from.

This is the third part of an ongoing series that takes a look at different ways to come up with cryptocurrency valuations. The first part of the series unpacked fundamental analysis for cryptocurrencies, while the second part of the series looked at comparative or relative values.

There are a handful of ways that cryptocurrencies networks are created or maintained, but for the purposed of this article, we’ll focus on proof-of-work cryptocurrencies, like Bitcoin and proof-of-stake cryptocurrencies, like Ethereum.

Why production cost matters when thinking about cryptocurrency values

Understanding they dynamics that come into play when trying to come up with a full picture of production costs for a cryptocurrency network can help inform an overall valuation.

Open, permissionless, cryptocurrency networks are a different kind of animal from both traditional financial assets and/or information networks or network companies. One of the biggest differences is that the network provides the infrastructure and the assets native to the network provide productive assets that support the operations and the growth of the network.

(*This model of creating digital assets is both wildly innovative and also a massive opportunity for fraudsters and crooks. Just because someone or some group creates a crypto network, doesn’t mean there is any kind of inherent value to the underlying assets. The value only comes through network adoption, growth, and overall utility. But all of that good stuff only comes from experimentation and trying new ideas.)

Maybe a simpler way to think about it is that each crypto network also creates its own economy with distinct rules and ways of operating.

So, in that regarding, looking at the cost of production of a crypto asset on a crypto network provides a good place to start thinking about how the valuation of the overall network or the potential valuation of the network.

Here are some waypoints to consider when thinking about the cost of production of crypto network and how those costs relate to overall valuation models:

Economic floor for price: The cost of production effectively sets a floor for the price of the cryptocurrency. Miners will be less inclined to sell their mined coins below the cost of production, as doing so would result in a loss.

With a proof-of-work crypto network, there is an interplay between If the market price falls below the cost of production for an extended period, some miners may halt their operations, reducing the supply of new coins entering the market.

Network fees also play a role. Generally network fees are correlated to network use. When the network is busy or congested, network fees scale up. When no one is using the network, fees scale down.

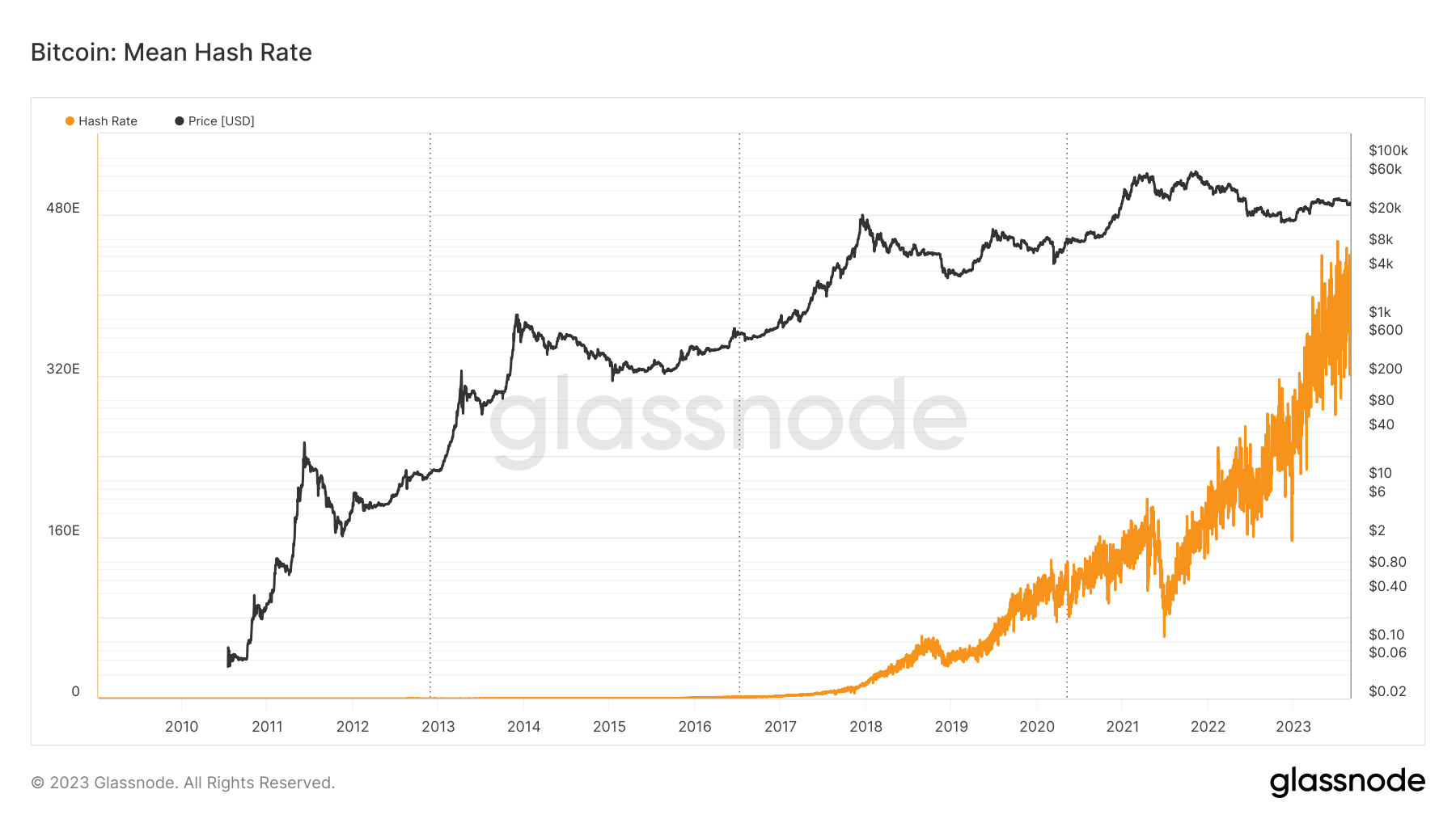

Security of the network: The cost of production is directly related to the security of the network. A higher cost of production means that it's more expensive for malicious actors to launch attacks, such as a 51% attack, on the network. A secure network can enhance the perceived value and trustworthiness of a cryptocurrency.

One of the reasons why Bitcoin’s proof-of-work network is so secure is because of the computational power it would take to corrupt or interfere with the

Another way to think about network security is that it aligns the incentives of the miners and network users (the people that pay fees). The result of this alignment of incentives, in the case of the Bitcoin Network, is a secure and reliable distributed network.

Supply dynamics: The cost of production can influence the rate at which new coins are introduced into the market. If the cost is too high relative to the market price, fewer miners will participate, potentially slowing down the rate of new coin production. Conversely, if the market price is significantly higher than the cost of production, it can incentivize more miners to join the network, increasing the rate of coin production (until the next difficulty adjustment in the case of Bitcoin).

If you’ve taken an Econ 101 course then you know about supply and demand. So far in the history of the world, we’ve seen the supply of money controlled by authorities (rulers, emperors, kings, central bankers) or because of physical or natural resource limitations.

Energy consumption and environmental concerns: The environmental impact of cryptocurrency mining, especially for PoW cryptocurrencies, has become a significant topic of discussion. The cost of production is closely tied to energy consumption, as electricity is a major operational cost for miners. A higher cost due to energy prices can influence public perception and, by extension, valuation.

There is a lot of disinformation on both sides of this debate about the true environmental impact of crypto networks. The result is that it’s not really clear what the real costs of energy consumption are and how those costs relate (or should relate) to overall production costs.

Adoption and infrastructure: A higher cost of production indicates a significant investment in mining infrastructure. This can be seen as a sign of the cryptocurrency's adoption and the belief in its future potential. A robust mining community can also foster further development, innovation, and adoption, indirectly influencing valuation.

In other words, a healthy network trajectory is one where the cost of production increases at a rate that matches overall adoption and use. One way that crypto networks are distinctive from other forms of information networks in terms of growth capabilities is the built-in dynamics (like difficulty adjustments) that allow the network to adapt to market conditions.

Price volatility: The interplay of all of the factors above — along with outside, more macroeconomic conditions, are often expressed as price volatility. Things like supply, mining costs, cost of energy, etc., can all impact the overall volatility of a crypto asset.

Price volatility, especially when viewed from the framework of overall production costs can also be a bit of a feedback loop, where a change in one aspect of production costs can create conditions that impact other elements of the overall cost. Using Bitcoin as an example, there have been times when mining was disrupted because of regulatory changes in certain parts of the world, or when high network fees drove the adoption of new kinds of mining technology.

Trying to evaluate cryptocurrency networks The key takeaway in all of this is understanding the overall inputs of production costs of a crypto asset can help to uncover its potential value.