Welcome to the real-world assets | RWA crypto

For years blockchain advocates have been championing the idea of tokenizing real-word assets (RWA). Bringing RWA onchain will make markets faster and more efficient. It also opens up other complexities. This week bringing RWAs onchain took a big first step.

There exists a vision of the world in which everything is tokenized and all financial assets live onchain.

In this world physical objects, real estate, art, securities, whatever — are represented by smart contracts. The smart contracts are recorded on a blockchain and exist as tradable tokens.

This vision makes it possible for all real-world assets (RWA) to trade onchain. This setup has some major advantages, and some major disadvantages, depending on your point of view.

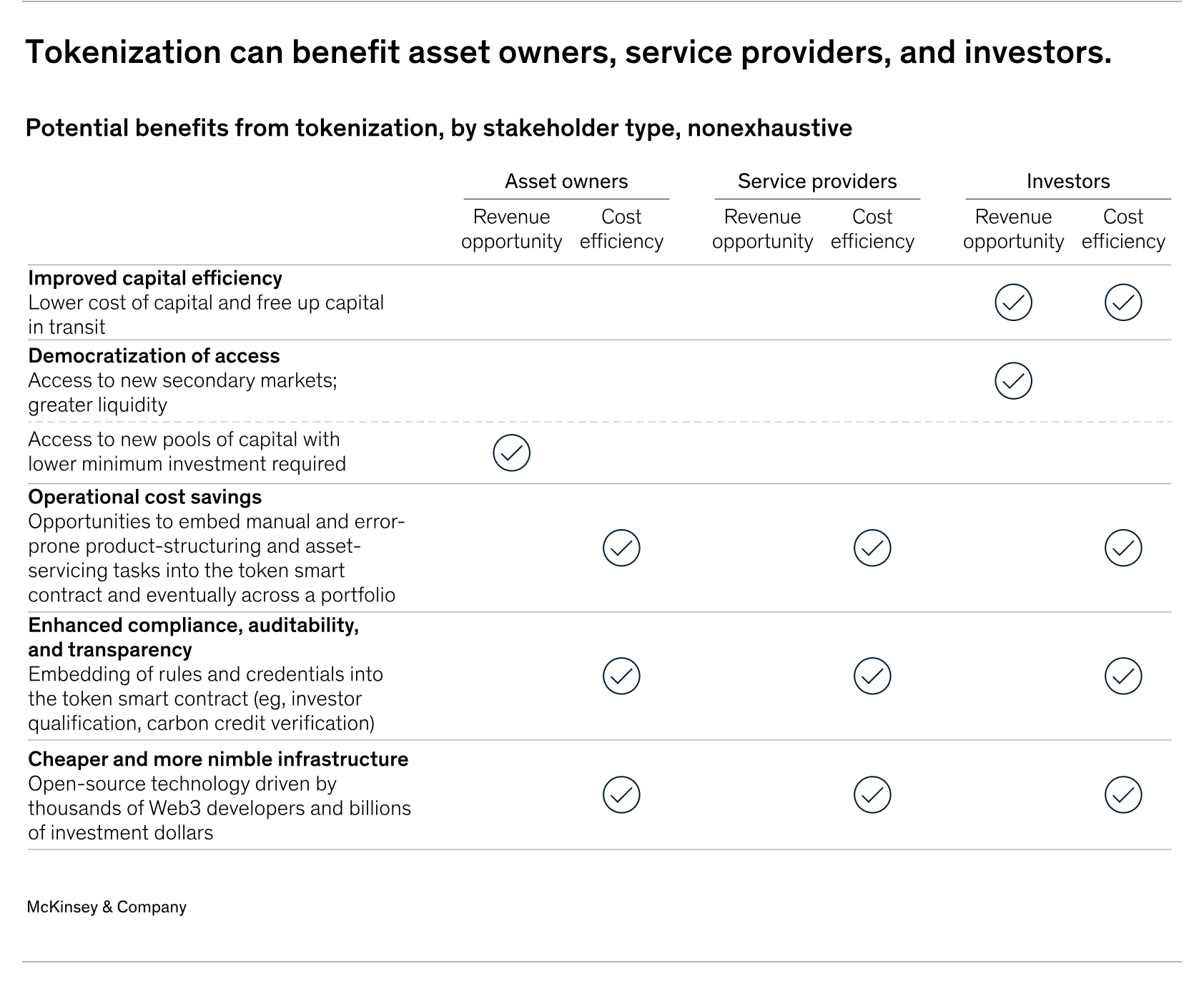

The tokenization of everything, or the move of RWA to crypto systems, will make things like instant settlement and uninterrupted trading possible. Trading RWA onchain will also create new kinds of transparency and accountability because onchain means all of the activity is recorded on open digital ledgers.

But bringing all tradable financial assets onchain also has some costs or raises potential issues that the current financial system is insulated against.

For more context on the financialization of everything

If you lived through the financial crisis of 2008/2009, you understand that adding sophistication to financial fundamentals doesn’t always end well. Near-instant settlement and around-the-clock trading will likely lead to less-than-desirable arbitrage and flash trading scenarios. New kinds of tokenized RWA also open new possibilities for leverage and derivatives, which can be tools or weapons depending on how they are used.

What happens when real-world assets meet crypto (RWA and crypto)

The big news here is that BlackRock just announced that it is creating a tokenized asset fund. The goal of the fund is to start bringing RWA onchain and make them tradable. Crypto and digital asset proponents have been talking about this use case forever. The basic party line is that someday everything will be tokenized, or that all assets will trade onchain.

BlackRock’s tokenized fund, which is called BlackRock USD Institutional Liquidity Fund, will exist on Ethereum. This first fund will consist of stable financial assets such as Treasury bills. The assets, will be held by a custodian, but be fully available to trade as tokens on the blockchain (it sounds like only accredited investors will be able to buy, hold, or sell the token), at all times.

On one hand, this feels new and innovative, because it is. Traditional financial assets like T-bills will now be available onchain, which makes them way easier to buy and sell at any time and across any market.

At the same time, this fund feels fairly…tame, because it is. Buying and selling tokenized shares of things like cash or T-bills isn’t as exciting as buying a tokenized share of a classic car collection or a piece of a medieval castle in some obscure location.

Here’s a snippet from the press release announcing the fund.

BUIDL seeks to offer a stable value of $1 per token and pays daily accrued dividends directly to investors' wallets as new tokens each month. The Fund invests 100% of its total assets in cash, U.S. Treasury bills, and repurchase agreements, allowing investors to earn yield while holding the token on the blockchain. Investors can transfer their tokens 24/7/365 to other pre-approved investors. Fund participants will also have flexible custody options allowing them to choose how to hold their tokens.

This fund feels a little bit like training wheels and that’s probably all by design. Bringing RWA onchain will take time. Bringing exciting or hard-to-invest-in assets onchain might take longer.

But the big takeaway here is that RWA moving onchain is no longer theoretical. It’s happening now, and the movement is being led by one of the largest traditional asset managers in the world.

What’s driving real-world assets onchain?

A few forces are driving toward bringing more real-world assets onchain.

The first is that tokenizing physical assets to make them available for digital trading feels inevitable. It’s not like this move is happening in a vacuum. The world is undergoing a massive digital transformation. The move to digital systems promises efficiency, speed, and accurate data. All of those attributes make the financial sector a prime target for digital adoption.

Secondly, as we’ve seen elsewhere, the financial use cases are the most compelling and the easiest to bring onchain.

After all, blockchain is a digital ledger, but one that cuts out some of the cost and overhead of centralized systems (or at least distributes costs among a network of users rather than holding it in one place, like within a corporate structure, for example.

So there’s this inflection point developing — where financial assets and asset managers are looking for efficiency, and blockchain is becoming well-developed enough to begin testing how distributed financial engineering could work.

You could say that the creation (and early success) of the Bitcoin ETF was the first part of what now feels like it will become a chain reaction. In the near term, we’ll have more overlap between traditional finance and decentralized finance. Eventually, as more assets trade onchain and more of the infrastructure to custody and handle assets in a regulatory compliant way, the lines between the two systems will become blurred.

One of the biggest advantages of moving RWA onchain is speed. Speed of execution speed of settlement and the ability to access markets 24/7 all mean that market movements up and down will also happen faster. The new market efficiency will likely make it possible for people and companies to get richer — or get ruined — faster.