The post‑crypto narrative and the birth of the crypto‑lite super app

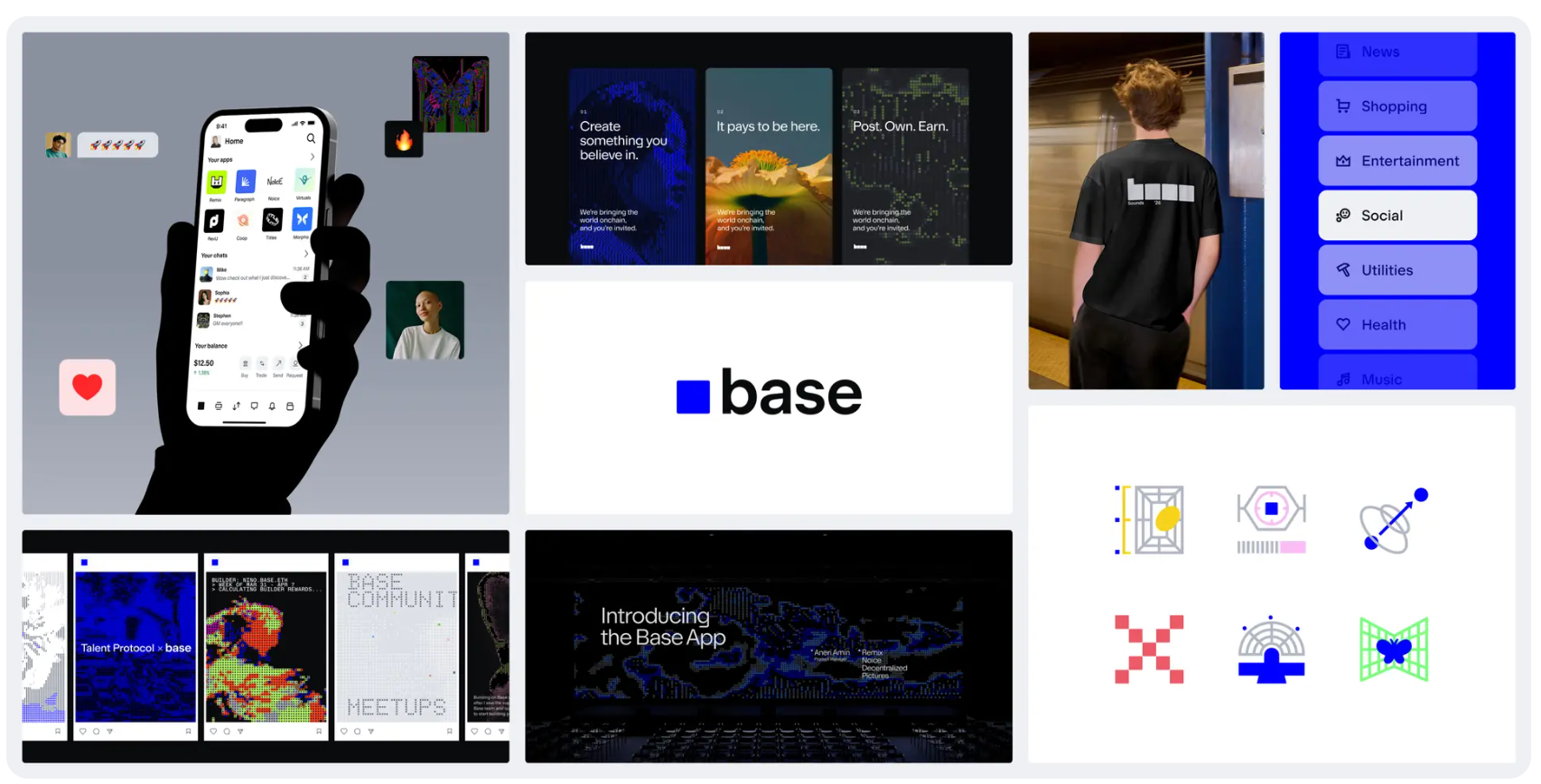

Coinbase just buried “Wallet,” rebranded its L2, and dropped Base App — a crypto-lite super app where posting memes mints coins and USDC moves like Apple Pay.

It was a loud week for crypto headlines. In the U.S., legislators crowned “Crypto Week” by passing the GENIUS Act, a watershed bill that every trade publication dutifully dissected (we recently covered it here, too).

Yet beneath the bill‑signing fanfare, another milestone slipped in: Coinbase quietly folded Coinbase Wallet into a freshly launched Base App. The new mobile hub splices a Farcaster‑style social feed, Zora tipping, USDC “tap‑to‑pay,” and one‑tap swaps — all running on its own layer‑2, now retitled Base Chain. The word wallet disappears, and crypto jargon never shows up, positioning Base as a lifestyle network rather than a finance tool.

Setting the scene: How a layer-2 became the everything app

Seven days ago Coinbase wore three faces: the brokerage everyone knows, the developer‑centric Base layer‑2, and the self‑custody Coinbase Wallet. This reorg changes: the consumer front end becomes Base App, the L2 infrastructure is renamed Base Chain, and, along with new dev tooling, they form the Base Stack.

Inside the app, the feature list reads like a mash‑up of Twitter, Venmo, the App Store, and Uniswap. A Farcaster‑powered timeline scrolls beside onchain tipping via Zora. A bright‑blue Pay button fires USDC with Apple Pay ease, while encrypted XMTP chat hides in the share sheet. Mini‑apps replace the old “connect your dApp” flow, and a swap engine promises “millions of coins” in a single tap.

None of those features are novel. The novelty is that they now sit side‑by‑side in a single pane — and that the launch felt distinctly post‑crypto. In the 80‑second promo video you will not hear crypto, blockchain, or even wallet. The verbs are everyday: post, chat, tip, trade. Fortune immediately labeled the move America’s first shot at a “WeChat‑style super app.” For anyone tracking the Open Money thesis, the messaging pivot is noticeable and refreshing.

Why the rebrand and the reset?

From a marketing perspective, one brand equals one funnel. Coinbase Wallet once harvested NFT tourists from Twitter threads, while Base Chain attracted fee‑sensitive devs.

Now every new Base Chain address is nudged into Base App, and every retail user lands on Base Chain by default. That closes retention loops and collapses ad budgets into a single north‑star metric: daily active Base users.

The economics compound. Coinbase already pockets spread revenue from swaps and creator royalties. By controlling the layer‑2 sequencer it now captures gas fees and MEV as well — think of it as collecting admin fees for ordering on‑chain blocks.

Optics matter, too. Coinbase can pitch Base as a social‑payments network that merely happens to settle onchain, sidestepping the C‑word while legacy fintechs are still figuring out their crypto stance.

Finally, there’s a linguistic gambit to consider. Policymakers police assets; they struggle to legislate verbs. By recasting onchain actions as everyday behaviors —posting, tipping, paying — Coinbase ducks the “speculative asset” stigma while lobbying for stablecoin clarity.

A hybrid model — or a fault line?

A consolidated super‑app feels unapologetically web2: one walled garden, one brand, one data moat. Yet Base App also grafts unmistakably web3 limbs onto that trunk.

Users own their social graph through Farcaster handles, stored onchain and portable to any compatible client. Every JPEG or meme tipped via Zora funnels royalties straight to creators and collectors. Base, in short, combines web2‑style scale with web3‑grade portability.

Where things blur is value capture. Public blockchains are meant to crystallize public goods — open liquidity pools, open social graphs, open compute. But Base App remains a Coinbase surface: discovery, fees, and front‑end controls flow through a single corporation If sequencer fees, ad slots, or social‑ranking algorithms accrue mainly to Coinbase shareholders, the win for the commons is less obvious.

The optimistic read: Base becomes a distribution megaphone that pulls millions into Farcaster and Zora, proving public‑good primitives at consumer scale. The cynical read: Web3 rails hide inside a branded vault, turning protocols into SaaS micro‑services.

The real test will be the export verbs: Can a creator yank their Farcaster followers, Zora revenue history, and USDC balance into a rival wallet without friction?

Alignment with the Open Money framework

There are overlaps between the Base App reorg and the Open Money thesis:

- Open rails. Flashblocks on Base Chain cut confirmation to ~200 ms, clearing a transfer before your thumb lifts.

- Creator‑first economics. Every post is a coin. Tip a meme and royalties route automatically — no ad broker, no 30 percent toll.

- Modular identity. A Base Account rides through every mini‑app like an email address moves across clients, freeing users from OAuth lock‑ins.

- Cash‑like payments. USDC tap‑to‑pay becomes a network dial tone — tap, ping, done — so cryptography feels as casual as sending a text.

Individually, these could read as clever flourishes. Together they form a bridge: the muscle memory of web2 fused to the self‑custody guarantees of web3. If Coinbase sticks the landing, Base won’t just hide the pipes — it will prove that open‑system primitives can scale without losing their public‑good soul.

Open Money project update

The manuscript’s first two acts are locked. I’m stitching transitions so the chapters read like a cohesive narrative rather than a chain of standalone posts. More soon.