When infrastructure becomes habit

Money is changing how it behaves. Not all at once, and not everywhere, but quietly enough that it’s easy to miss. Stablecoins, wallets, and open rails are becoming everyday infrastructure — chosen less for ideology than because they work.

When infrastructure becomes habit

Most conversations about crypto still orbit visible moments: legislation, enforcement actions, market cycles. Those moments matter, but they tend to obscure a slower, steadier process underneath.

Money is changing how it behaves.

Not all at once, and not everywhere. But in enough places, and often quietly enough, that the shift is easy to miss unless you’re watching the systems rather than the headlines.

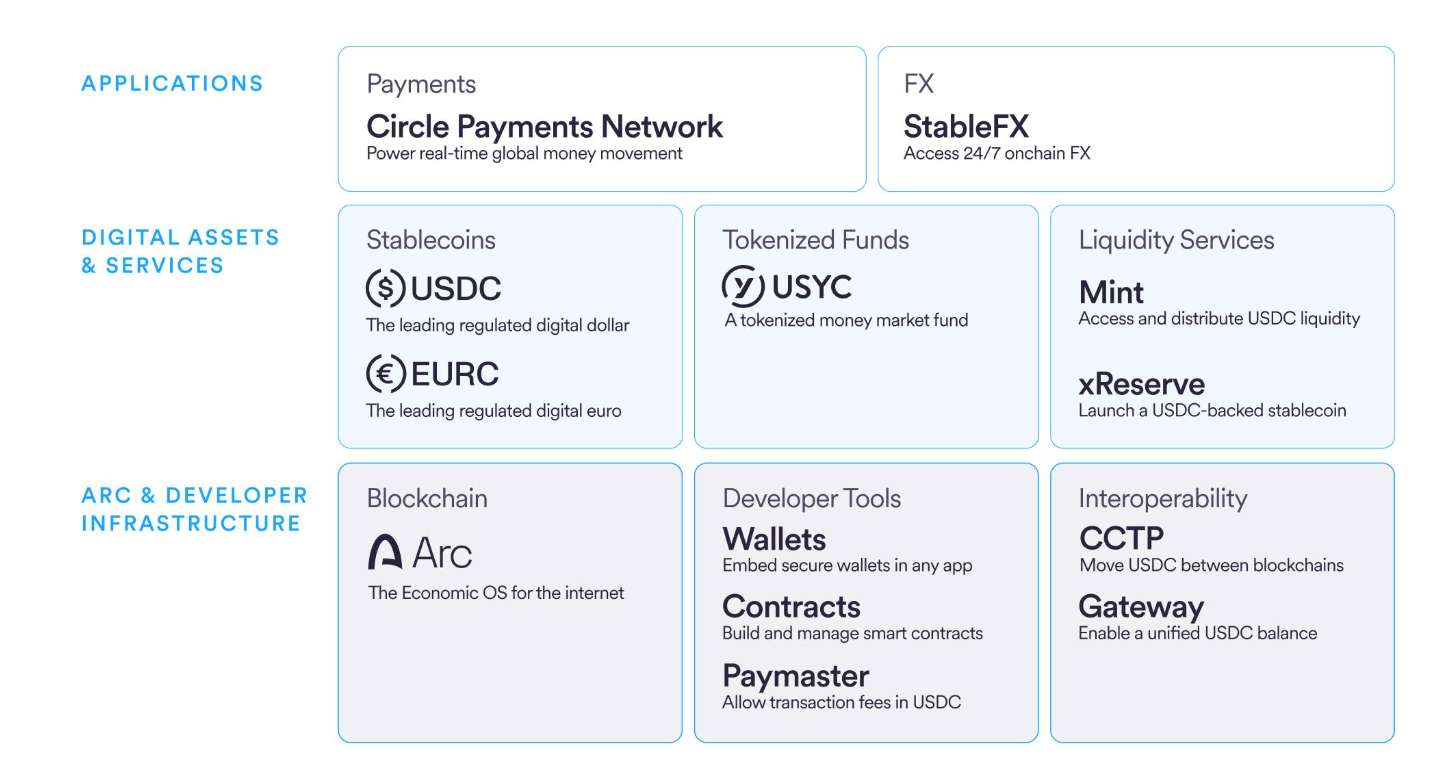

This week offered a clear example. Circle published a detailed product vision for where it sees its platform heading through 2026. It wasn’t framed as a market prediction or a political statement. It read more like a roadmap for how money already moves when friction is removed and coordination is assumed.

Crypto as everyday financial material

In Circle’s view, stablecoins like USDC sits alongside payment networks, cross-chain settlement tools, programmable flows, and institutional distribution channels. The emphasis is not on replacing existing systems, but on being usable within them — reliably, repeatedly, and at scale.

That framing matters because it reflects how crypto rails are actually being used.

Not that long ago, crypto was still portrayed as magic internet money. Now it appears in treasury operations, internal settlement, cross-border flows, exchange infrastructure, and onchain markets that rarely make consumer headlines. They move value without ceremony. They are selected because they work efficiently and/or can save time or money.

In other words, crypto's become more practical.

The open money stack shows up in practice

A few weeks ago, I wrote about an emerging “open money stack,” which felt interesting because it's the way that the industry is now starting to refer to crypto. Obviously, given that all we talk about in this newsletter is Open Money, it's easy to align with this vision.

You can see it forming in how teams operate:

- value moves on public rails

- wallets act as persistent financial endpoints

- liquidity is shared across venues rather than siloed

- settlement happens continuously rather than in batches

- identity and compliance attach to activity rather than onboarding

None of this requires agreement about the future of finance. It only requires that these components are easier to use than the alternatives.

Once that condition is met, behavior follows.

Money stops asking for permission to move

One of the more subtle changes underway is how often value now moves without invoking institutional ceremony.

There is no request, no approval queue, no operating window, or any other kind of traditional intermediated experience. Transactions settle because conditions are met, not because offices are open or intermediaries are available.

This is a shift in how we think about crypto. Instead of competing with traditional finance, or providing a standalone alternative to traditional financial institutions, crypto rails instead are silently making legacy systems better.

Banks, payment providers, and platforms increasingly operate around these flows rather than controlling them directly. They integrate, route, monitor, and support. They adapt to movement instead of authorizing it.

This shift is doesn't make for easy to write marketing slogans for the side of crypto that has leaned heavily into being anti-establishment.

Research backlog

Questions we are actively tracking:

- Which financial workflows adopt stablecoins first, and why those rather than others?

- Where do wallets function as infrastructure rather than products (or when do wallets become as ubiquitious as email addresses)?

- At what point does shared liquidity become a baseline rather than an advantage?

These questions matter because they reveal where open money is already routine.

Closing thought

Open Money does not arrive with a clear beginning, which is kind of the phase we are in now.

By the time systems feel inevitable, the choice has already been made — not by decree, but by habit. This is the phase we are entering.

If this framing is useful, subscribe or reply. I’m especially interested in where you’ve seen these patterns show up quietly, without fanfare.