Zcash and the return of the privacy trade

Zcash’s sharp rally put the “privacy trade” back in focus, pairing a clean technical breakout with real product upgrades. For Open Money, the takeaway is practical: private, censorship-resistant payments are getting easier to use and belong in the resilience toolkit.

Zcash had a week. The move was violent: a 60%+ daily spike, triple-digit gains on the week, and fresh multi-year highs that pushed $ZEC back into screens people had stopped watching.

Coverage captured the jump through the $120s into the $150s with momentum stretched and volume ripping. As the dust settles following the week's activity, a clean story story is emerging: the privacy trade is back.

But why? Some headlines framed the rally as “because a new Grayscale trust launched.” That part is not totally accurate. Grayscale’s Zcash Trust, ticker ZCSH, has existed for years and has been quoted on OTC Markets since 2021.

What changed is attention and the return of a regulated wrapper that certain allocators can actually buy. For allocators who will not self-custody, the presence of ZCSH matters because it shortens the path from thesis to position.

The privacy narrative, refreshed

One line traveled far this week: “Bitcoin is insurance against fiat. Zcash is insurance against Bitcoin.” Naval Ravikant posted it on X, and the quote ricocheted through crypto media and back into price. It matched the year’s backdrop of CBDC pilots, biometric ID experiments, and AI-driven surveillance debates, so it stuck.

In parallel, Vitalik Buterin has kept privacy at the center of credible decentralization, from Privacy Pools research to recent writing on why privacy is a precondition for open systems.

Where the tech has actually moved

The product surface finally caught up with the philosophy. On September 16, Electric Coin Company (the company that maintains Zcash) shipped Zashi CrossPay, which lets someone send from a shielded ZEC balance and have the recipient get any NEAR-supported asset, with the route handled privately under the hood.

That reduces one of the most common objections to using shielded ZEC for real-world payments. Two weeks later, THORSwap rolled out native Zcash support via Maya, opening direct routes between ZEC and majors like BTC, ETH, and SOL for users who already live in that interface.

Post-halving economics also help. The November 2024 halving cut issuance in half, placing 2025’s annualized inflation near the low single digits on most community trackers.

Zooming out: the privacy trade in 2025

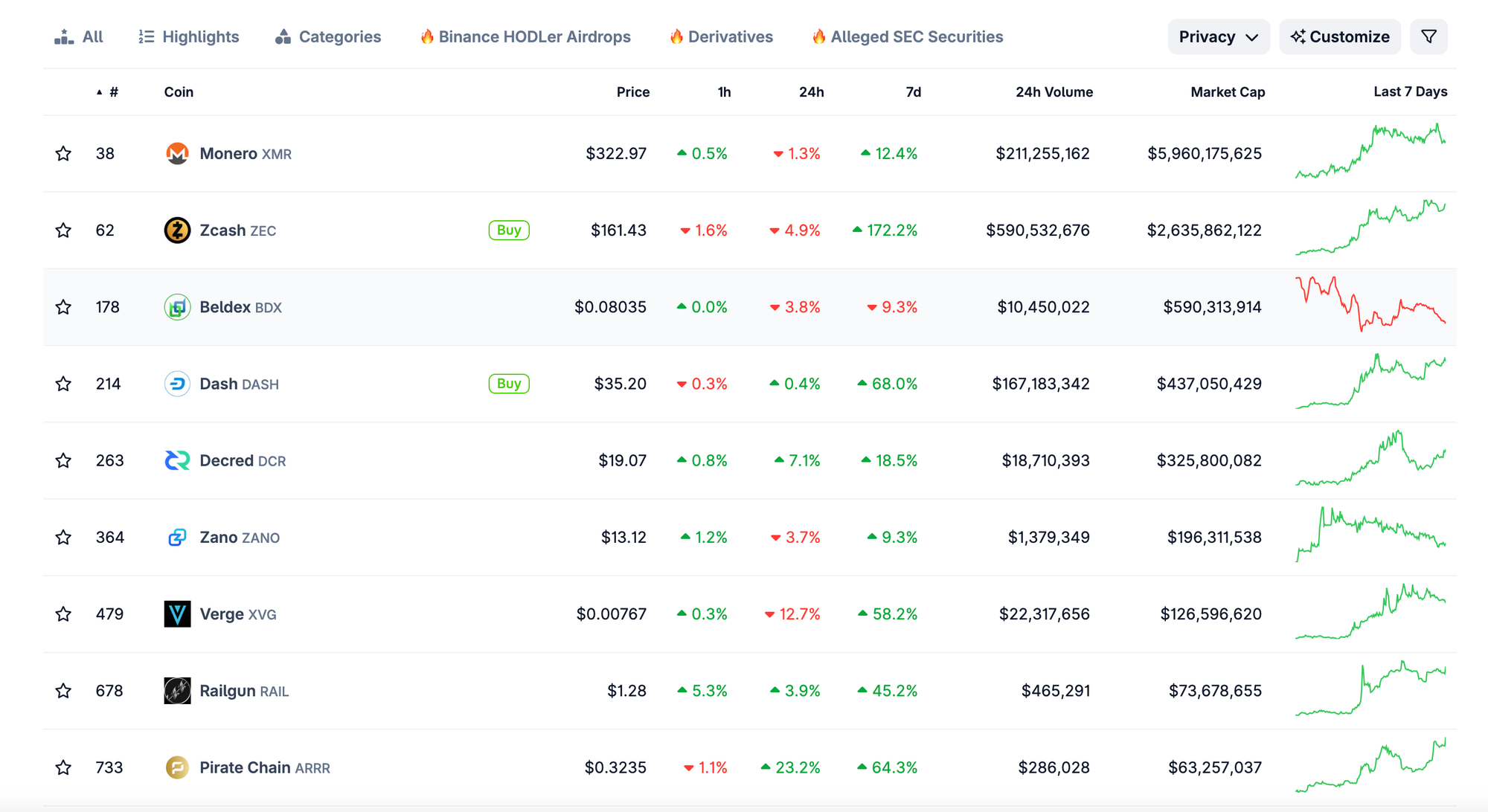

This was not a ZEC-only tape. Privacy names moved as a group, with Dash spiking and category trackers showing heavier flows across the cohort.

CoinGecko’s privacy page, while always a rolling snapshot, captured the rotation toward privacy coins and ZK-aligned assets this week. The shape of the basket makes sense.

Monero still anchors the “purist” approach with consistent anonymity sets and a culture of caution, while Zcash leans toward interoperability, zero-knowledge proofs, and access paths that are legible to institutions. Different threat models, different users, same underlying demand: pay people without publishing your life.

There is a clean bull case. First, narrative alignment. A year of CBDC trials, biometric ID rollouts, and AI-augmented monitoring has made privacy an everyday topic again. That creates ambient demand for assets that behave like cash in digital form.

Second, usable rails. CrossPay makes private-out, stable-in payments realistic for more people. THORSwap support makes routing simple for users who already know the flow.

Third, supply discipline. Issuance has stepped down and will keep stepping down with future halvings.

There are risks that do not fit neatly into a chart. Momentum runs hot, then cools. Liquidity can thin quickly, which makes both up and down moves exaggerated.

Governance timing is tight, and implementing a new funding model always takes longer than a forum post suggests. Venue risk is perennial for privacy assets, because listing and surveillance policies can change faster than product teams can ship.

Why this matters for Open Money

Open Money is about resilient financial behavior. Self-custody when possible, neutral base layers, minimal-trust bridges, and payment paths that work when institutions are closed or captured. Privacy is not a luxury. It is the property that makes digital money usable at internet scale

Zcash’s week is a live-fire test of that idea. The integrations are practical, not theatrical. CrossPay hides the route and preserves the intent: pay someone, privately, in what they want to receive. THORSwap gives an obvious liquidity path for people who already know how to move between majors.

Governance work is converging on grants rather than hard-coding a single corporate recipient. Each step makes ZEC more boring in the right ways: predictable, useful, and harder to censor in real world contexts.

For readers, the takeaways are concrete. Private payments are gaining product momentum. Portfolio access is simpler for institutions that need wrappers like ZCSH. The category is broad enough that you can build for a cohort, not just a coin.

If you are designing products, aim for the “tap and it works” bar users expect from stablecoins and cards, while keeping the default private. If you allocate, treat privacy exposure as part of a resilience sleeve that reacts more to policy and access risk than to tech beta.

If you simply live on the internet, the ability to settle without narrating yourself is not a extra feature set. Instead, it's a necessity for normal life online.