The new, new circus | Brand and narrative predictions for the 2024 crypto market

Every crypto hype cycle so far has been defined by narratives. Usually these narratives anchor on some kind of utility of talk about what's coming next. This post provides some predictions about what the narratives for the upcoming hype cycle can (or maybe should) look like.

We are barreling toward the end of another year. And that can only mean one thing. It’s almost “year-in-review” and “the year ahead” report time.

As predictable and somewhat formulaic as the publication of these reports are, I do like reading a whole bunch of takes on where the market has been and where we are headed.

In review, 2023 hit different for a lot of reasons. On the back of several big scandals and massive fraud, crypto has gone through a massive identity crisis. Before 2023, it felt exciting to work in crypto. Like you were out on the frontier, nurturing a new technology with world-changing possibilities.

Then several high-profile projects fell apart and big names in the industry got thrown in jail and lots of people lost a lot of money because it turned out a big part of the dream was too good to be true.

Give people open money systems and one of the first things they will do is amass a scammy empire built on fake coins, too much leverage, bad math, or some combination of the three.

The result of the past year or more — against the backdrop of tell-all books and increased scrutiny across the board — is that a lot of people have become disenchanted with the space and moved on to new opportunities and new frontiers (by which I mostly mean AI).

But, despite the downward pressure and tough market conditions, there is still a lot of activity and reason for an optimistic outlook, like maybe a sea change is happening.

At a very high level, over the past few weeks, we’ve already been getting a glimpse of the big picture stuff. Generally, the old heads have been dusting off the socials and posting hype charts about the 1-2 combo of the pending Bitcoin ETF and the upcoming Bitcoin halving.

The bullishness of the Bitcoin ETF approval centers on the idea that institutional money — including some of the trillions of dollars handled by financial advisors and family offices will find its way into crypto via traditional retirement and investment products.

Currently, the SEC is deciding whether or not to approve a Bitcoin ETF because there are continued concerns about things like market manipulation, etc. The ETF hype is not new, and in the past the SEC has rejected dozens of similar proposals. Nevertheless, many market watchers feel like there is pent-up demand and a lot of people are saying that an approval will bring a lot of liquidity to the space.

Another reason for the change in tune is that next Bitcoin halving is right around the corner. By design, the Bitcoin halving happens every four years, with Olympic-like timing. Right now, because of the way Bitcoin’s block reward system, the amount of bitcoin issued as a reward for mining a new block (which happens every ten minutes or so) will be reduced from 6.25 BTC to 3.125 BTC sometime in April 2024.

The halving is part of Bitcoin’s pre-determined issuance schedule. The regular reductions in block reward create built-in scarcity, which combined with increased demand overtime, results in the upward price movement dynamic that bitcoin is known for.

Both of these market-driving forces are focused on bitcoin, but historically, when the price of bitcoin moves the rest of the crypto market follows.

Another factor underpinning the reformulation of the hype cycle is that free markets can be brutal, but they can also be efficient. In some regards, the self-regulatory mechanism of the crypto free market flushed out the bad actors or the projects that were vaporware.

If there is a silver-lining to crypto’s comeuppance, it’s that the projects and protocols and people that remain had a strong enough foundation to survive through a series of worst-cast scenarios. In a lot of ways, this past year was a test of how resilient decentralized systems really are.

Now the question is: Where does this all go from here?

Predictions about what kinds of new narratives will emerge

Beyond speculation | Pivot from the aspirational to utility

Making crypto human-centric in the lates Coinbase ad.

Every hype cycle so far has been defined by a trend which helps bring new people into the market. After the first halving, the big thing was just making it easier for everyday retail consumers and investors to buy, sell, and hold bitcoin and other cryptos.

This is when a lot of the big-name exchanges and wallet services launched, or at least the idea of having centralized exchanges to facilitate ease of use took hold.The next hype cycle was largely fueled by the initial coin offering craze, where new crypto projects with massive valuations seemed to be launching every day.

Most of the projects were overvalued and were built on a flimsy whitepaper and little else. Eventually, the ICO boom died, taking a lot of investor money and market attention with it.The last hype cycle was largely fueled by speculation around the idea of non-fungible tokens (NFTs) and the idea that we were all going to move to the metaverse.

For good measure, there was also excitement and massive amounts of money flowing into other kinds of tech, such as algorithmically-back stablecoins (such as the Terra Luna project, which collapsed in May 2022, erasing about $50 billion of value with it, and was a main trigger of the crypto market wipeout events of 2023).

Undoubtably, there will be a focal point of the upcoming hype cycle. It will be interesting to see how this time is the same or different and what will anchor the main narratives.

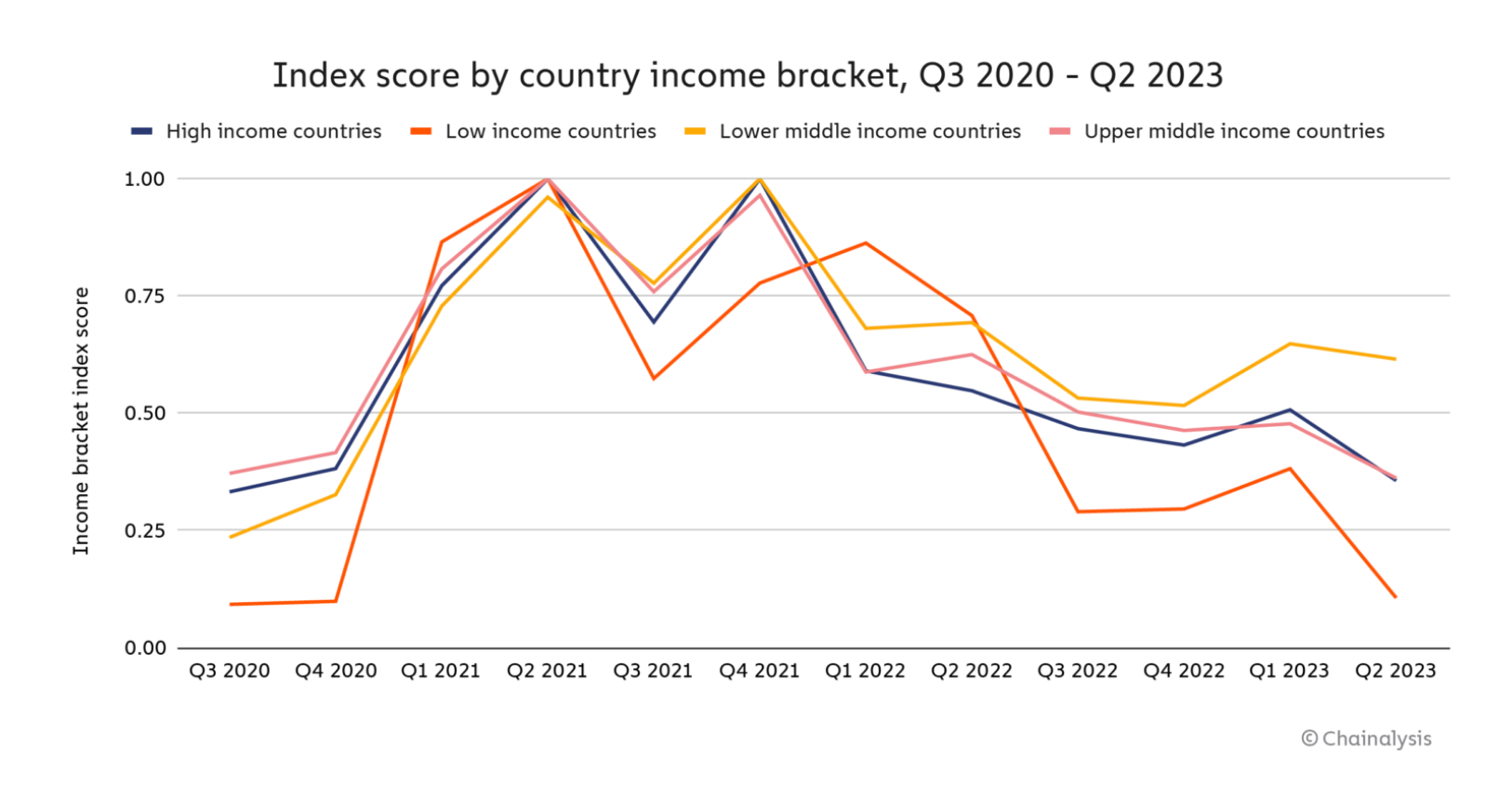

Likely everyday investors are skeptical of crypto markets and products. But as overall utility and ease of use increases, maybe the focal point moves past pure speculation and instead people start to understand crypto as an alternative to the traditional financial system — and one that offers efficiency made possible by digitally-native technology.

Crypto-based services like payroll, easy to use DeFi, or super cheap payment apps will go a long way to make crypto feel useful for everyday activities.

Eventually, for most people, crypto protocols are like wiring that is hidden from view, but helps to power useful tech that works better than anything that’s come before.

On-chain is the new online | Visibility and accountability help maturity

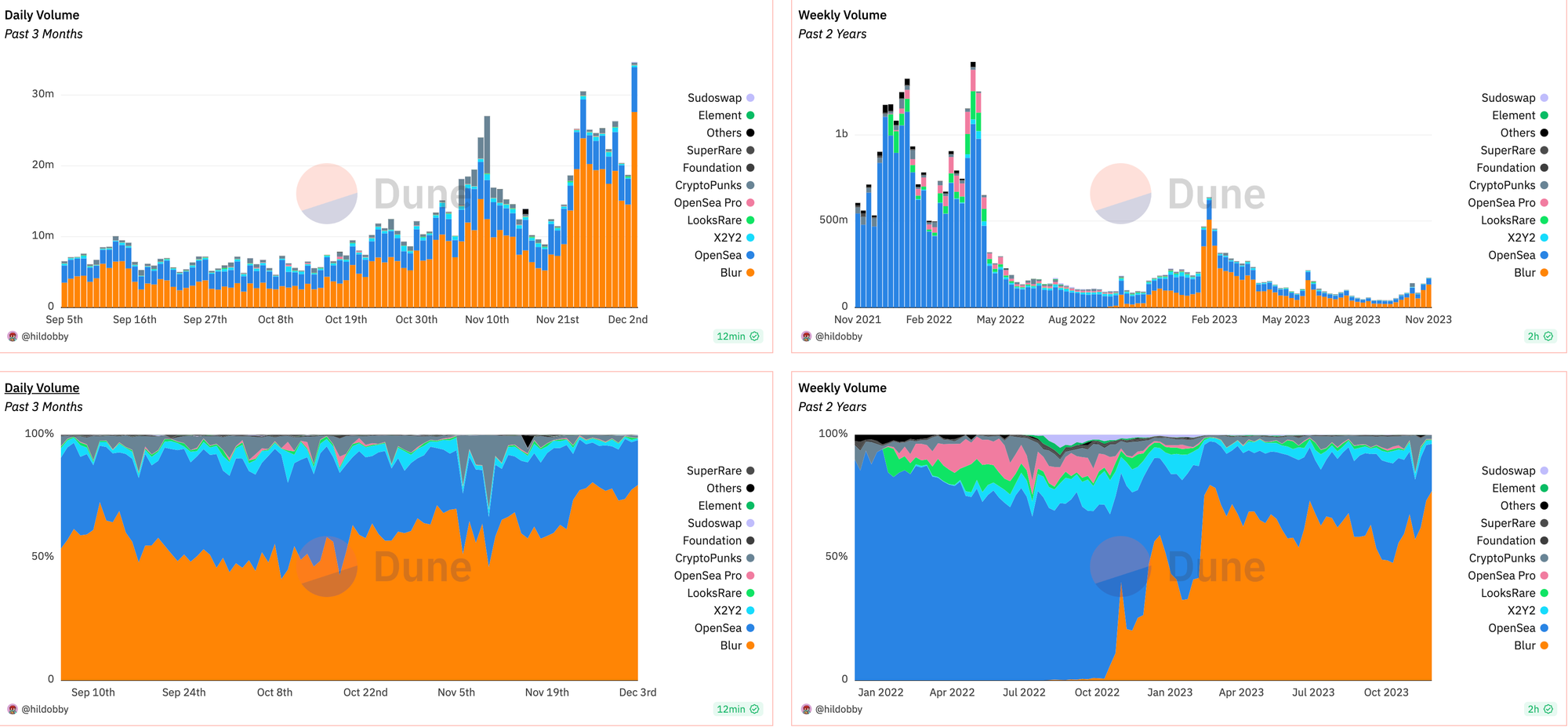

The accessibility and overall ease of use of on-chain data has got to be one of the biggest developments since the last hype cycle. Now there are are a number of ways to query on-chain data and to view things like transactions or asset movements or overall use and activity.

This visibility helps everyone to better understand which projects are actually useful and useable and which ones don’t have active user bases. User-centric analytics help everyone better understand crypto uses, and the sense of public accountability will likely become more important following the massive fraud and other sketchy behavior of last year.

As more and more real world data move on-chain, the analytics will become increasingly robust, further driving an understanding of how various protocols, apps, and products are solving problems and driving a more digitally-native experience.

End the days of tribes | Era of composability

Since the beginning, crypto has been dominated by tribes. There’s probably some kind of psychological reason why humans have to develop groups of fierce proponents and advocates in order to get new ideas off the group at scale.

We’ve seen these echoes before in other corners of life.

Crypto’s big personalities are also a product of the internet. In the early days crypto was internet money for internet people. But that edgy-ness needs to dull for digital assets to start to make more sense for more people.

In time, maybe the tech makes the tribe irrelevant. One word that seems to becoming more and more popular across crypto is composability. The basic idea is that a well designed protocol or app should be composable, or customizable in a way that it can work and be useful across a range of systems.

The most useful internet will be a network of networks, with little friction and little cost to move between protocols to achieve the best and most efficient objectives.

The tribes might have served a purpose, and maybe they filled a void of marketing for projects like Bitcoin in the early days. But over time, decentralized becomes more like the rails that new systems run. Sometimes those rails will intersect. Sometimes they will overlap. And sometimes they will go off into unknown and unexplored directions.

It’s likely that tribalism becomes less important and is replaced by how well a protocol or app can work across multiple protocols and ecosystems.

Bitcoin is its own thing | An asset with its own place on the space time continuum

This might seem to counter the previous point, which just underscored how distinctions will become less important over time.

But even still, it’s an important distinction. There will be new kinds of protocols that are built within the crypto ethos, and there will be a tremendous amount of value created and captured.

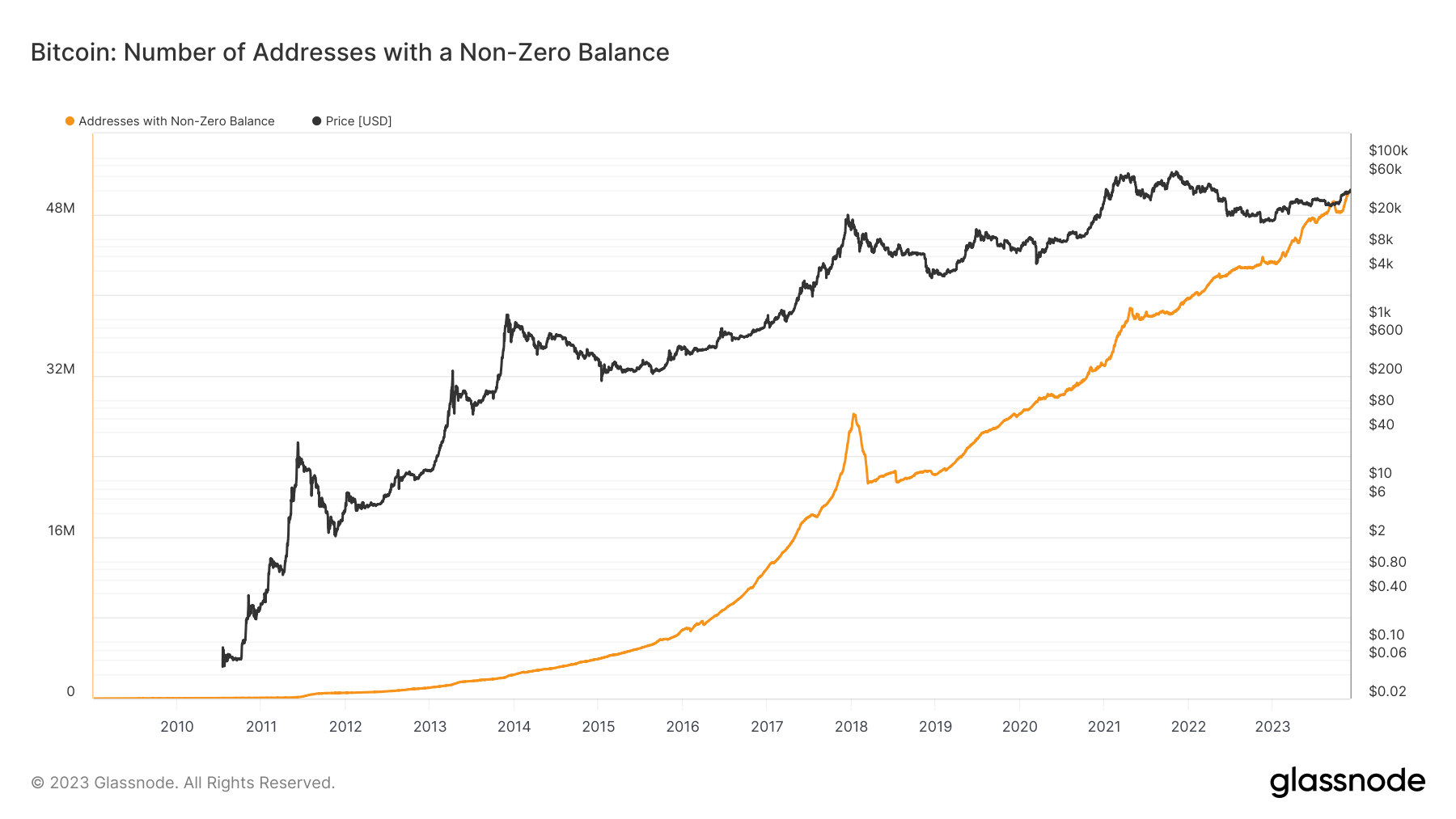

And as more time goes on, it will become increasingly obvious that Bitcoin is a one-of-a-kind asset. It exists because it created a way to transfer value over the internet without the need for intermediaries.

But there are a lot of other factors that make Bitcoin unique, including the simplicity and elegance of the Bitcoin protocol, its founding story, the way (or fairness) of its launch, its early network effects, its first mover advantage, and even the timing that can never really be replicated or repeated in the exact same way.

The next hype cycle with all its various inputs and offshoots likely reinforces that there will never be another kind of network with all of the attributes of Bitcoin.

Inevitability of digitally-native money

In the early days of the industrial revolution, as machines started to replace labor done by hand, people who practiced trades found themselves out of work. Their jobs were lost to mechanization.

This didn’t happen all at once, and it didn’t happen without a lot of upheaval, to the point where there were movements of people literally raging against the machines. And then governments passed laws (and executed people) for raging against the machines.

There are some parallels with what’s happening today — and the ongoing digital transformation.Right now, people are scared. People are losing their jobs to technologies like ChatGPT, and all of the prosperity and cushiness of the information age feels like it’s at risk.In a lot of ways, crypto began as protest movement. Bitcoin was born on the backend of the financial crisis of 2008. But somewhere along the way, the protest part got dulled by the get rich quick schemers.

The future of crypto will echo its protest past, which focused on issues of empowerment and user-centric ideals of privacy and security.

As the digital future unfolds two things will become more obvious: That old systems based on bureaucracies and analog technologies won’t be able to keep up with the real-time pace of transaction and interactions. And that digital technologies can create a more level baseline to build from, but only if the systems are accessible.

This all means that by design future systems need to be permissionless, or open, otherwise we run the risk of just rebuilding new versions of the old gated, wonky systems.

2024 and beyond

So, as the year ends and the industry looks behind and ahead, there will likely be a lot of processing. Undoubtably, the next hype cycle brings new ideas and new ways of understanding what crypto is and why it is useful. Eventually, some of those ideas will be human-centered and will move past the hard to understand, fast money ideas. Likely, it’s only then that mass adoption can really happen.