What is DeFi?

What is DeFi? And how does decentralized finance differ from traditional finance, and why do those differences matter?

Decentralized finance – DeFi – refers to an emerging suite of blockchain-based bank-like services.

But DeFi is not banking, at least not in the traditional sense.

Rather than interacting with companies and corporations, DeFi participants leverage distributed computing networks (blockchain) that are programmed to follow rules and are created to achieve specific objectives, like earning a certain interest rate, or taking out a crypto-collateralized loan.

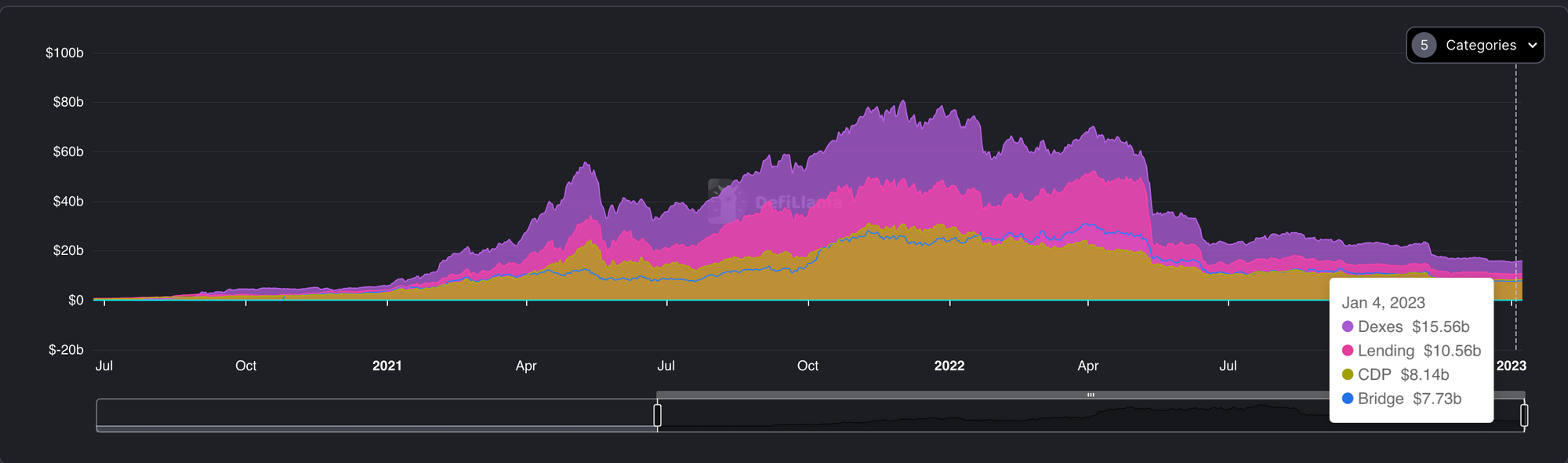

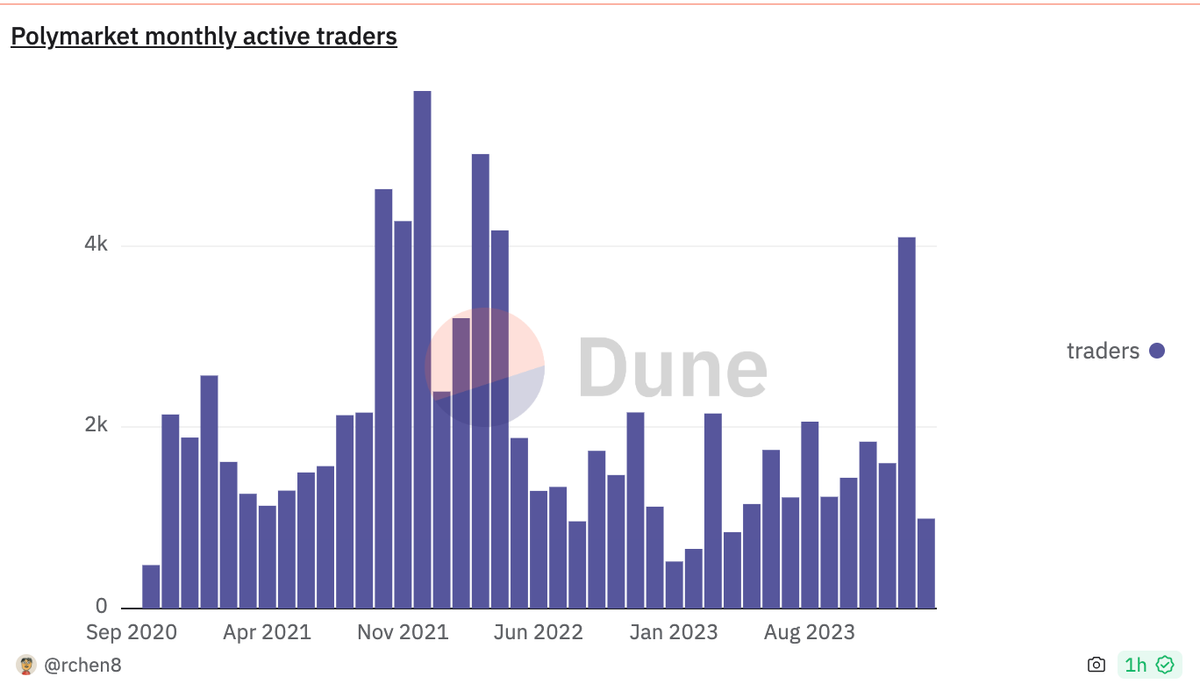

So far developers have designed DeFi networks or protocols to handle all kinds of tasks including borrowing, lending, trading, prediction markets, and interest-bearing accounts that are known as yield farming.

One of the key components (and major selling points for DeFi) is that a user can set up a non-custodial wallet. This arrangement means the user holds the private key and has ultimate authority over the assets inside the wallet, which is way different from traditional centralized finance or even centralized crypto exchanges (such as Voyager, Celsius, and FTX).

Overtime, the ability to self custody assets and have control while leveraging financial products will become easier to manage and likely be standard operating procedure, which will open up even more possibilities and financial products.

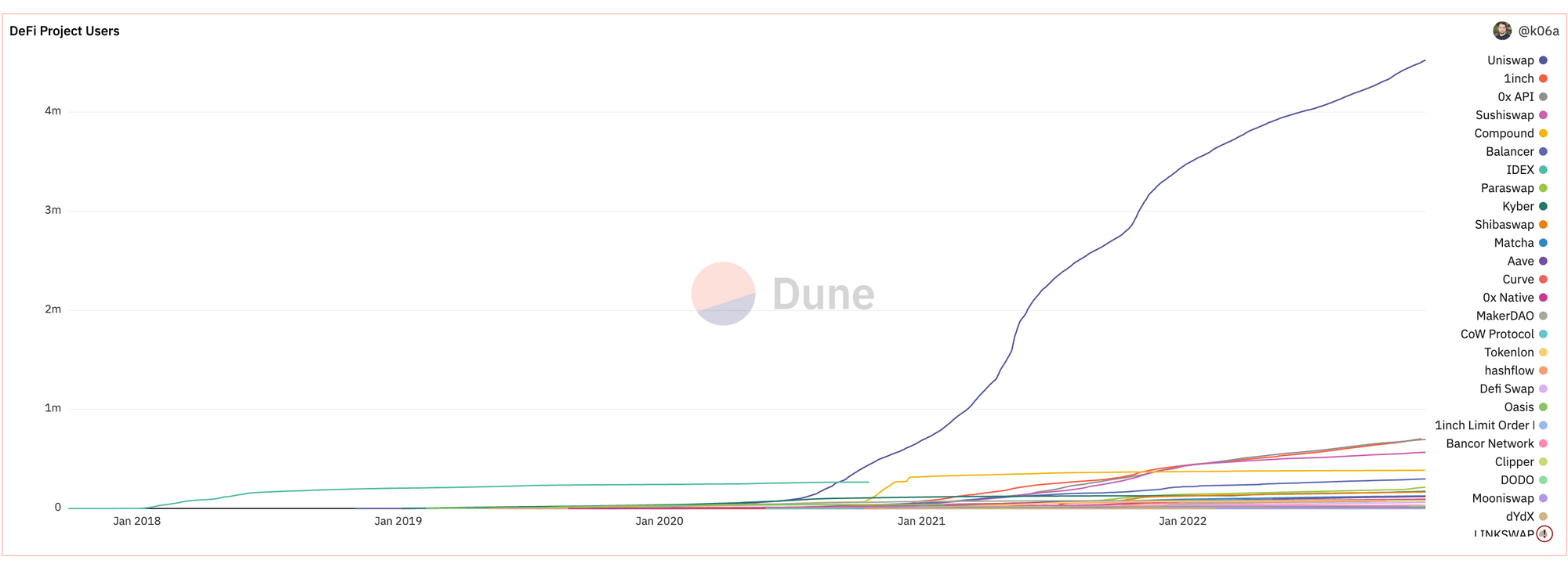

DeFi is still relatively young. The crypto space has grown up since the launch of Bitcoin in 2009 with the ideals of peer-to-peer, decentralized, and algorithm-driven consensus. Over the past decade, the crypto/blockchain space has developed niches along with companies and products within those specific niches.

DeFi and the ability to use blockchain to create more complex financial products is one of those niches.

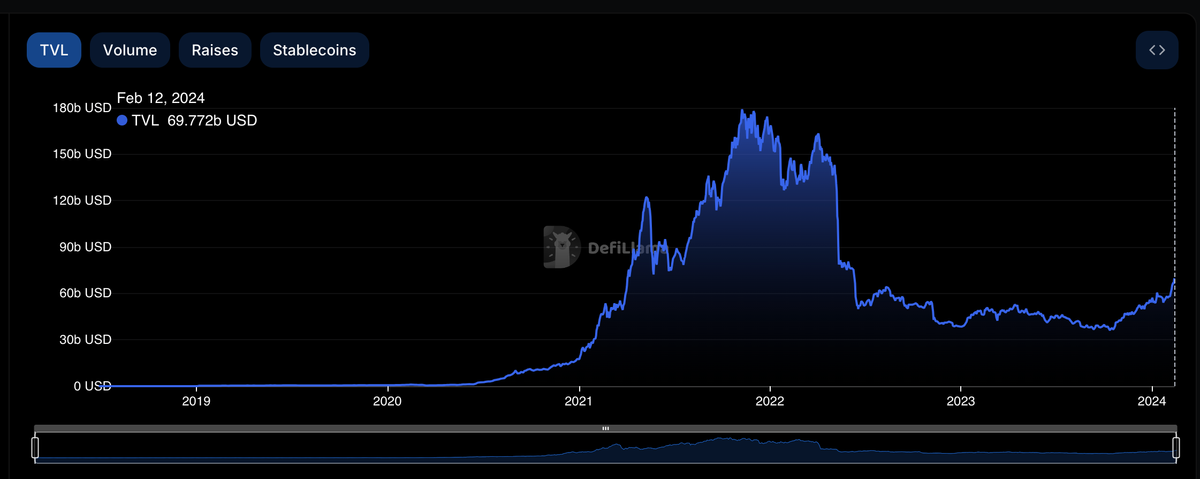

This chart show the growth in DeFi protocols since 2018:

Here’s a quick overview of the key differences between traditional centralized banking and the new kinds of decentralized financial products and services:

DeFi access versus traditional banking access

DeFi

There are generally no requirements for access. Users only need to set up a supported wallet and the ability to transfer assets into the wallet. Most commonly, people are still using centralized crypto exchanges to convert fiat currency to digital currencies and centralized crypto exchanges do have certain levels of access requirements, such as verifying identity.

Traditional banking

Traditional banking has a number of access requirements including things like minimum balance requirements to open an account, or strong credit ratings and history to access things like loans.

Cost of using DeFi versus traditional financial products

Cost of using DeFi products and protocols

Accessing DeFi services often requires paying gas or blockchain transaction fees. These fees can range from inconsequential to a certain percentage of the transaction value, depending on the type of network used and factors like network congestion.

Costs associated with using traditional banks or financial products

There are a number of fees associated with traditional banking, but they largely vary from bank-to-bank and from product-to-product.

Risks associated with using DeFi versus risks of traditional banking

Risks related to using DeFi

DeFi is extremely risky for a number of reasons, but mainly because DeFi protocols are based on new technologies that are still maturing.

Risks associated with using the traditional banking system

Using traditional bank products carries less risk when compared to decentralized finance. Bank accounts are generally insured, and users are generally protected if a bank goes bankrupt or out of business.

Regulations related to DeFi versus regulations for traditional banking/finance

DeFi regulations

There are no clear-cut regulations that govern how DeFi operates. Where DeFi is most heavily regulated, like the rest of crypto itself, is when people use centralized exchanges to convert crypto to fiat and back again — the on ramps and off-ramps. One risk to DeFi is that regulation done wrong, or poorly applied can damage innovation.

Regulations for traditional banks and financial institutions

The traditional financial system is the most heavily regulated industry in the world. From controls on cash transactions and cash movements to regulations governing investing, traditional banking and finance is heavily regulated. While intensive regulation can come at the cost of speed, efficiency, and innovation, it also means that traditional banking/financial products are insured.

Digitally native DeFi versus traditional banks and finance

DeFi

DeFi requires setting up a supported wallet for the products and protocols involved, which does require getting familiar with new systems and technologies.

Traditional banking needs to adapt digital infrastructure

No, even online banking and things like direct deposit require the use of databases and practices that require time and or fees to reach final settlement.

Interoperability or reach of DeFi versus traditional finance

DeFi

Once a user creates a DeFi wallet then they can access a number of different decentralized products and protocols, mixing and matching services that work best for them.

Traditional finance

Some traditional financial institutions offer a number of products such as cash management and investing, but often users have to have multiple accounts at several different institutions in order to accommodate all financial needs.

Custody of DeFi assets versus traditional banks/financial system

DeFi custody

One major attribute of decentralized finance is that it allows people to self-custody assets or hold assets in a wallet with a private key.

Asset custody at traditional banks and financial institutions

Centralized financial institutions custody assets on their clients behalf.

Benefits of building decentralized financial applications, products and services

There are a number of reasons why building new DeFi apps, products, and services will be useful:

Interoperability

Maybe one of the primary reasons is that software-based (also called digitally native earlier in this post) is interoperability, or the ability to easily move between different tech and platforms.

Cutting the friction or switching costs between different kinds of financial apps and products will ultimately make the user experience better in terms of the time it takes to settle a transaction and the overall cost associated with the transaction.

Code-based

DeFi infrastructure is based on smart contracts, making DeFi customizable and scalable from a programmability perspective.

From the application-side, it means that DeFi can be used to create all kinds of financial apps and then those apps can be forked or modified to fit exact needs.

Code-based finance also allows for faster innovation while keeping costs low.

Non-custodial

The nature of DeFi is that it allows users to self-custody their assets while also accessing financial products like borrowing, lending, trading, and staking.

Self-custody models offer better security and control than other types of custody arrangements. The need for self-custody became more apparent after the collapse of several high-profile centralized crypto exchanges in 2022 resulting in widespread losses of user funds.

Check out the non-custodial wallet explanation for more details.

Access

One major attribute of decentralized finance, like the cryptocurrency protocols that DeFi is built on, is that they are permissionless, meaning anyone can create, participate, and access a DeFi service (as long as they can create and fund a supported wallet).

The open access of DeFi creates a system of transparency and accountability (because transaction data on a blockchain is publicly viewable).

Common DeFi use cases

DeFi isn’t a one-size fits all approach. New kinds of DeFi products are getting rolled out all of the time and include everything from trading crypto assets to decentralized exchanges.

Here are a few of the high level DeFi use cases:

Asset management

Fundamentally, DeFi is about a new way of holding and controlling digital assets. It’s like a hub and spoke model, where the hub is a user’s wallet and the spokes are all of the various financial products and services that they interact with.

This is a new kind of model or way of operating when compared to the siloed approach of traditional finance that makes it easier for DeFi users to move between apps and products. Rather than have to start a new account (like in traditional finance), DeFi users can connect an existing wallet and start using a new service.

Decentralized Autonomous Organization (DAO)

Decentralized finance allows for the creation of an entirely new kind of organization or entity known as a Decentralized Autonomous Organization or DAO.

A DAO is created to define and enforce rules via code but without the need for a top-down authority structure like a corporate board.

In other words, a DAO is a new way for people to organize. DAOs can be formed for any number of reasons — and the people who participate in the DAO often make decisions on governance and execution and vote on rulemaking via asset allocation.

Tokenized ownership

The future will be tokenized, or so the saying goes. The idea is that DeFi protocols can be leveraged to tokenize and then manage real world assets. This would mean that things like real estate or company ownership can be broken down into fractions and then purchased and controlled in the form of token ownership.

One example of combining both the DAO idea with derivatives is when a group of Denver Broncos Fans got together to try and buy the franchise by creating a DAO, which would entitle each member to fractional ownership of the team.

Lending and borrowing

This was a popular early use case for DeFi. The basic idea is that a user can take out a crypto-collateralized loan and then pay the loan back over time. Or, a user can lend out their crypto and earn interest.

The issue is that since the underlying asset is volatile, borrowers can run into issues when the crypto market starts to go down. This is what happened during the 2020-2022 period. When the markets were going up, there was little risk of losing collateral, but when the markets started going down, users had to re-collaterialize to try and maintain the required loan-to-value ratio, which

Trading

The emergence of DeFi brought the functionality for more sophisticated trading, such as trading on margin (or borrowing money to trade).

More sophisticated trading is often viewed as a sign of a maturing market. Depending on perspectives, a downside risk to DeFi trading is that the space is unregulated and margin trading can cause catastrophic losses — especially in hyper volatile crypto markets.

Even large crypto funds were engaging in margin trading with money borrowed from other crypto firms (in this case centralized exchanges), which led to major collapses and market downturns in 2022.

Yield farming

Yield farming is the practice of paying users interest when they lock up assets with a platform. The platform in turn uses those assets for things like staking or to provide liquidity for something like the borrowing and lending mentioned above.

Paying high interest rates, or yield farming, is also used as an aggressive growth tactic — as a way for new DeFi platforms or communities to attract users. However, paying for users is a risky tactic.

Also yield farming from the user perspective can be risky as underdeveloped platforms are targets for fraud.

So how do DeFi and crypto relate?

In the early days, crypto assets were static by today’s comparison.

At first people weren’t sure how, why, or where to use bitcoin and the other digital assets that followed.

Over time people started to buy and hold crypto as a speculative investment. This strategy provided returns during several bull market cycles, but during market downturns, the buy and hold strategy showed its limitations.

Then, when Ethereum was launched in 2015, its smart contract functionality changed everything.

The first wave of blockchain innovation was dApps, or decentralized apps which were varied and covered everything from file storage to prediction markets.

Over time, the idea of dApps gave way to DeFI — a specialized focus on finance within the eve growing world of decentralized products and services.

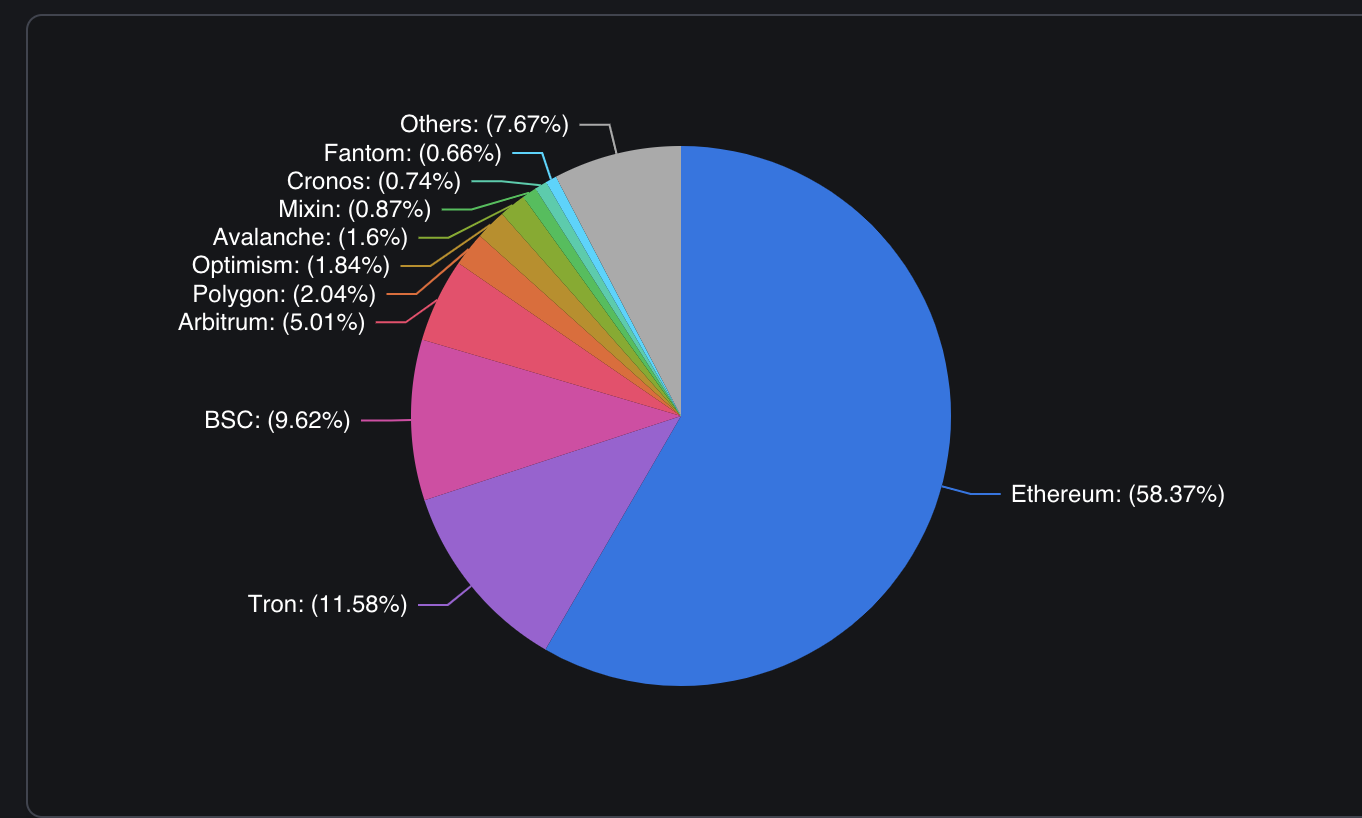

Today, crypto and DeFi are linked in that DeFi applications leverage the networks, currencies, and infrastructure of established cryptos like Ethereum (and related chains, like Polygon, for example).

The easiest way to think about it is that DeFi is just a specialized niche within crypto and people are constantly moving assets back and forth between traditional crypto infrastructure (like exchanges, for example) and DeFi infrastructure (such as non-custodial wallets) to access new kinds of blockchain-based financial services.