Is the four-year cycle dead?

Breaking the halving beat: Do liquidity and institutional flows dominate now?

Every four years, just like the Olympics or the World Cup, Bitcoin (and the rest of the crypto market) has a moment in the sun.

The Bitcoin halving — the pre-programmed trigger that cuts the block subsidy in half — was crypto’s ritual eclipse, a built-in scarcity event that set the stage for a new bull run.

Traders and crypto Twitter pundits treated the halving as the beat to dance by: Supply shock, rally, mania, crash, repeat. A neat four-beat rhythm, a crypto metronome for FOMO and chaos.

Entire trading strategies, memes, and even careers were built on the promise that if you could just count blocks, you could count your future gains.

But, this time around, the same experts and outspoken voices are asking if maybe this cycle is different. Bitcoin’s price action looks less like a simple four-year drum circle and more like a Wall Street chart, tied to ETF inflows, Treasury yields, and Asian market pulses.

The halving still flickers as a symbol — but the stronger beat this time might be the liquidity cycle of global finance.

📈 Bitcoin’s 4-year cycle has lost its dominant role, as analysts point to ETF flows, global liquidity, and macro conditions as drivers for BTC.#Bitcoin #BTCHalvinghttps://t.co/nFCusBD6ma

— Cryptonews.com (@cryptonews) August 11, 2025

The rise of the halving myth

To understand why the cycle feels broken now, we need to remember how it began.

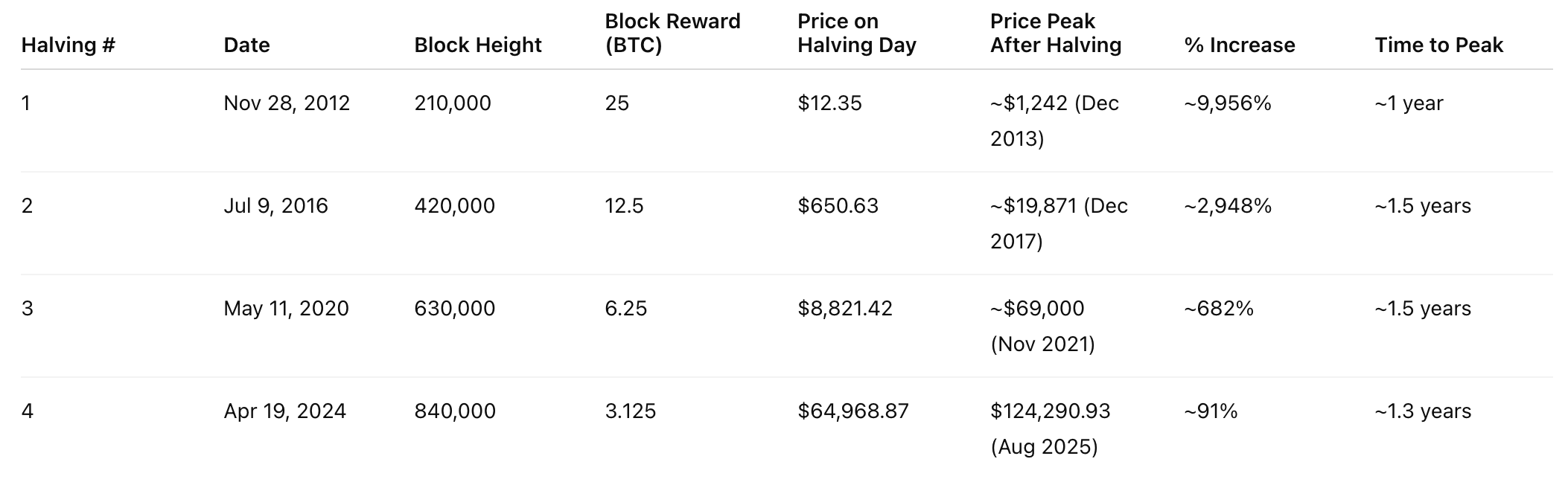

Bitcoin’s supply is baked in its code: every 210,000 blocks, the block reward drops by half. Bitcoin scarcity acts more like physics and less like policy. In 2012, the first halving cut the subsidy from 50 BTC to 25 BTC. A year later, Bitcoin bubbled into the mainstream for the first time.

The rhythm repeated. 2016 halving → 2017 mania. 2020 halving → 2021 peak. Each time, a neat chart, an echo of inevitability.

The cycle became more than data. It became folklore. Charts went viral. Memes did the rounds. Entire Telegram groups timed their narratives to the block clock. The halving was not just an event but a promise: number go up is coded in the protocol.

Was it correlation or causation? Economists and talking heads on cable news debated. For most of the community, the distinction didn’t matter. The halving cycle was the price-driving event.

Why the old playbook may not work anymore

But myths have half-lives, and by 2025, the halving’s magic looks weaker.

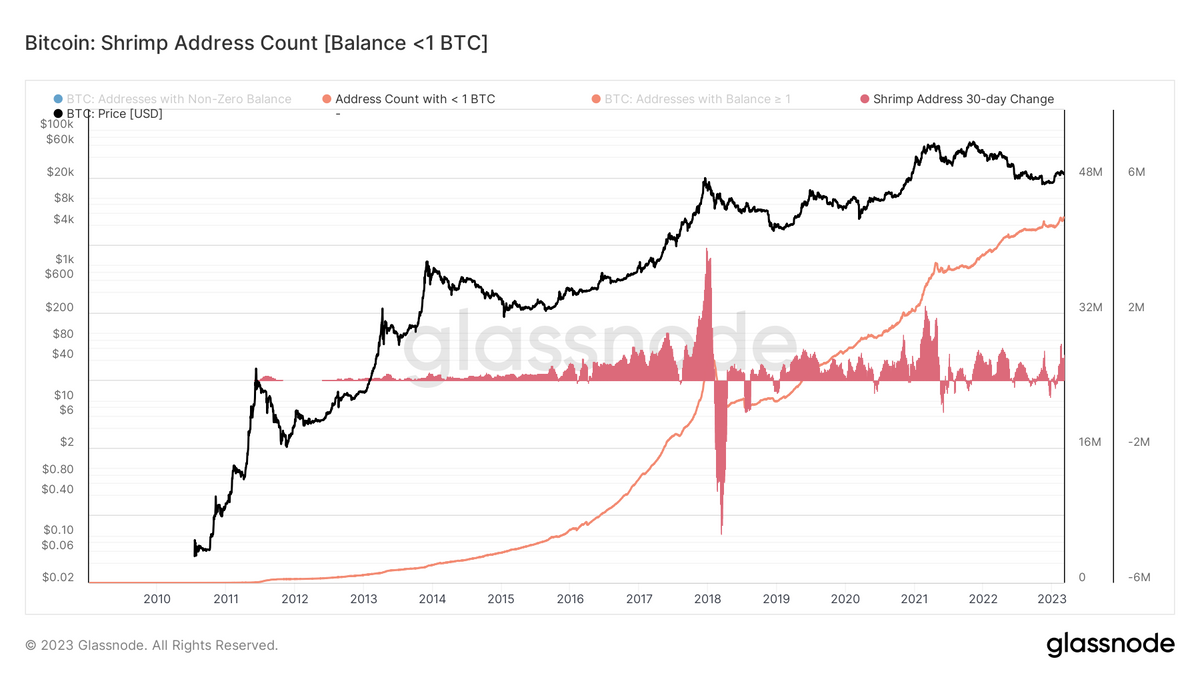

With 93% of all Bitcoin already mined, each new issuance cut has less and less bite. A market worth more than a trillion dollars doesn’t move on the same supply shock that once rattled a scrappy billion-dollar experiment.

And the crowd has changed. Earlier cycles were driven by retail traders with Robinhood accounts and Discord chats. Today, the whales are ETFs, pensions, and RIAs feeding capital into Bitcoin through carefully managed allocations.

The buying now is different. It’s less impulsive or meme-driven and instead is about rebalancing, liquidity-sensitivity, and tied to broader portfolio construction strategies.

The result? Bitcoin no longer trades to the rhythm of its own halving clock. It trades like a macro asset, pushed and pulled by global liquidity conditions, interest rates, and the appetite for risk in equities.

In other words, it’s possible that Bitcoin’s retail-driven calendar has been replaced by Wall Street’s more methodical buttoned-up need for steady upside.

The new dominant forces

So if the halving beat is fading, what’s keeping time now?

Global liquidity conditions

Markets are like rivers of liquidity, and Bitcoin is now part of that larger system of currents.

Federal Reserve policy, U.S. fiscal deficits, Bank of Japan yield curve control, Chinese capital flows — all of these shape the risk appetite sloshing across borders.

The clearest example came in 2020: Massive fiscal stimulus and monetary expansion poured liquidity into global markets. That tide lifted everything — tech stocks, meme stocks, housing, and the crypto markets, which rocketed to new highs.

The result was that it became hard to tell if it was the 2020 halving that sparked the rally, or was Bitcoin just part of broader “everything go up” bubble.

Institutional inflows: ETFs and custody

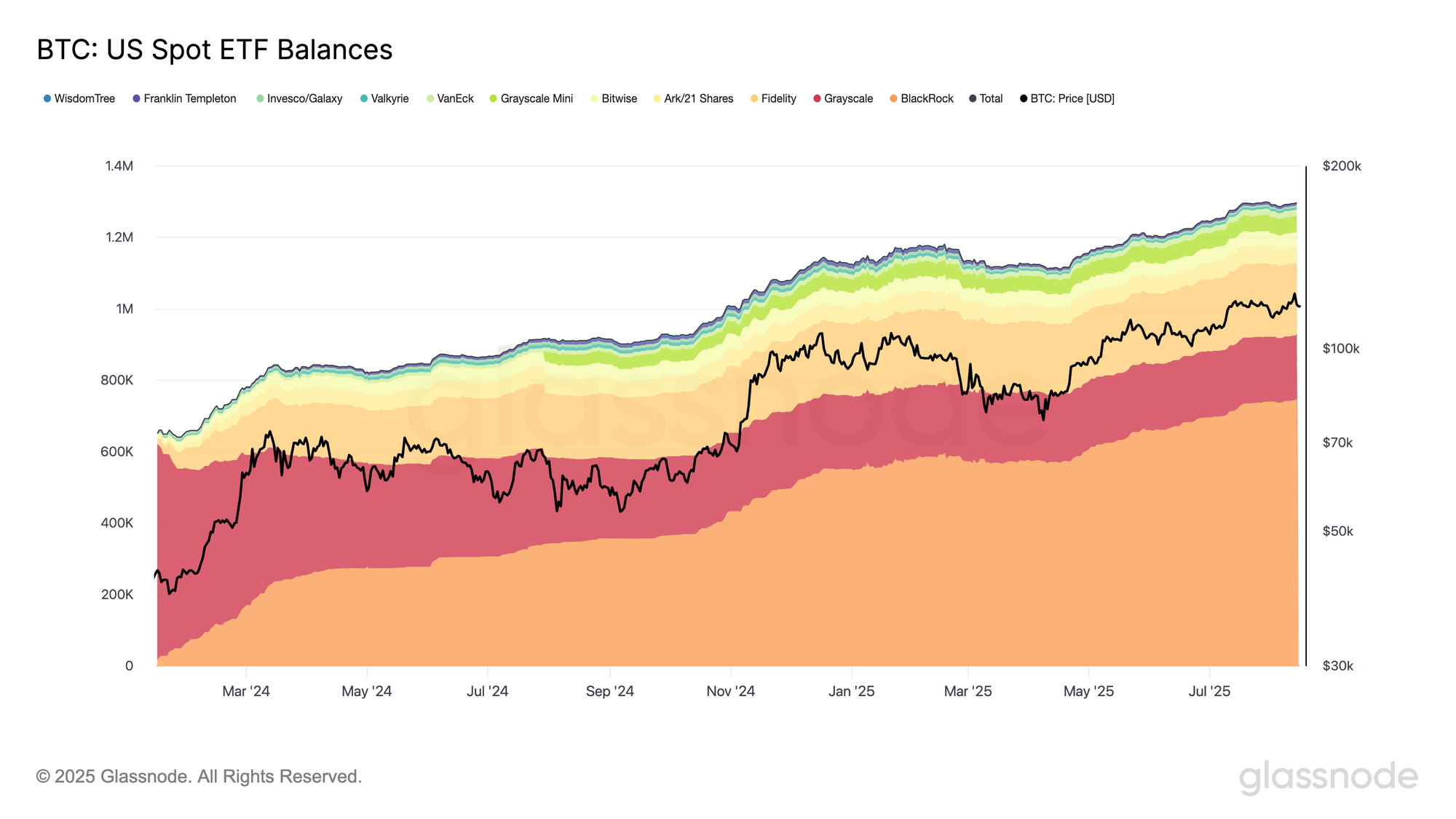

We’ve covered this at length, but it needs repeating in the context of the four-year cycle conversation: The launch of spot Bitcoin ETFs in the U.S. in early 2024 was a watershed.

Within months, funds like BlackRock’s iShares Bitcoin Trust absorbed tens of billions in inflows, dwarfing the activity of retail traders. These products have transformed Bitcoin’s investor base: pensions, hedge funds, and registered advisors now allocate to Bitcoin not because of memes, but because it fits neatly into their portfolio models.

An ETF doesn’t FOMO at 2 a.m. on Twitter — it rebalances at quarter’s end. The tempo is slower, the moves more correlated with broader risk markets.

Result: Bitcoin looks less like an online casino and more like a bond desk — albeit one with sharper swings.

Other crypto ETFs are following in terms of inflows, which only reenforces the trend.

The financialization of Bitcoin

Derivatives markets, structured products, ETF arbitrage—the machinery of Wall Street has wrapped itself around Bitcoin.

What began as “digital gold for the people” now trades like a structured asset class, complete with CME futures and options desks in traditional finance firms.

Financialization brings liquidity and legitimacy, but it also ties Bitcoin’s fate more closely to macro positioning, leverage cycles, and capital-market plumbing.

Instead of the boom-bust calendar, Bitcoin is now scored against the same liquidity charts and yield spreads as every other risk asset.

But wait: Is the cycle truly dead?

Not everyone is ready to bury the halving myth.

Some argue the cycle persists — only layered with new forces. The issuance cut is still coded into Bitcoin’s DNA. Scarcity is still scarcity, even if its marginal impact has shrunk.

Others point to politics: U.S. presidential terms, fiscal cycles, and liquidity waves often line up with the four-year rhythm. Is it coincidence that every major Bitcoin bull market to date has coincided with a U.S. election cycle?

And there’s a bolder claim: that ETFs may actually amplify the halving cycle. As Cointelegraph noted, institutions could front-run issuance cuts by allocating more aggressively around the event, preserving the narrative while changing the mechanics.

The halving may no longer be the main driver that it once was, but it could still be a major force in the overall crypto market.

Why does any of this matter to Open Money?

The halving once symbolized Bitcoin’s separateness — an alternative system running on its own internal clock, independent from the rhythms of Wall Street or Washington.

The block height was the calendar. The subsidy, the heartbeat. It was crypto’s way of saying: we don’t need the mechanisms of traditional markets.

Now, with ETFs and macro correlations, Bitcoin feels less autonomous and more integrated. This new sense of alignment brings legitimacy, capital inflows, and regulator attention. But it also means Bitcoin is increasingly tethered to the same liquidity cycles that govern equities, bonds, and global capital flows.

For Open Money, this shift cuts both ways. On one hand, it validates Bitcoin as a permanent fixture in global finance. On the other, it risks reducing Bitcoin to just another ticker on Bloomberg, an ETF wrapper in a BlackRock portfolio.

If price no longer moves by protocol alone, then the adoption story must evolve. What drives the next wave may not be halving hype, but the building of new infrastructure: decentralized rails, stablecoin liquidity, Bitcoin L2s, and the practical integration of crypto into global commerce.

The fading of the halving puts the spotlight back on utility.

From myth to macro

The four-year halving cycle gave Bitcoin its folk rhythm, a mythic beat that retail traders, meme-makers, and chart-watchers could rally around.

But 2025 feels different. The halving hasn’t disappeared — but it has been outshouted by louder forces: global liquidity, institutional inflows, and financialization.

What was once a cycle of insiders timing block heights has become a global macro asset moving with dollar liquidity, bond yields, and ETF flows.

This is a sign of maturity. Bitcoin has graduated from its self-contained myth to its place in the world’s financial markets. But with that maturity comes a loss of innocence.

The halving beat is fading into the background. The music of global liquidity is just getting louder.