Supply dynamics and the Bitcoin halving

This post is all about the upcoming Bitcoin Halving, including what it is and why it's so important. The halving is a core attribute that makes Bitcoin different than anything that's come before it.

The World Cup, the Olympics, the Bitcoin halving are all highly anticipated events with a lot at stake. They also all happen on a regular interval of every four years.

This week is the run-up to the Bitcoin halving, a pre-planned event with far-reaching impacts on the supply of new bitcoin and miner operations and profitability, both dynamics that have affected the price of bitcoin in the past.

The predictable and mathematical nature of bitcoin issuance and how that built-in supply and demand helps propel the network forward and makes it different than any other kind of monetary system that has come before.

Let’s dive in.

What is the Bitcoin halving?

The Bitcoin halving is when the production or the supply of new bitcoin gets cut in half. This time, pre-halving, each bitcoin block reward is 6.25 BTC. Post-halving, the reward 3.125

As the name suggests, the halving reduces the block reward by 50%. The block reward is what miners earn in exchange for committing computing power to the network.

The proof-of-work system is set up in such a way that the block rewards are distributed among network participants in a way that keeps miners engaged and continually verifying and confirming transactions.

A new block reward is earned about every ten minutes, which is the time interval between when new blocks are added to the blockchain.

In its short but eventful life so far, the Bitcoin network has experienced three other halvings:

- 2009: The Bitcoin network launches. The block reward is 50 BTC.

- 2012: The reward became 25 BTC

- 2016: The reward became 12.5 BTC

- 2020: The reward became 6.25 BTC

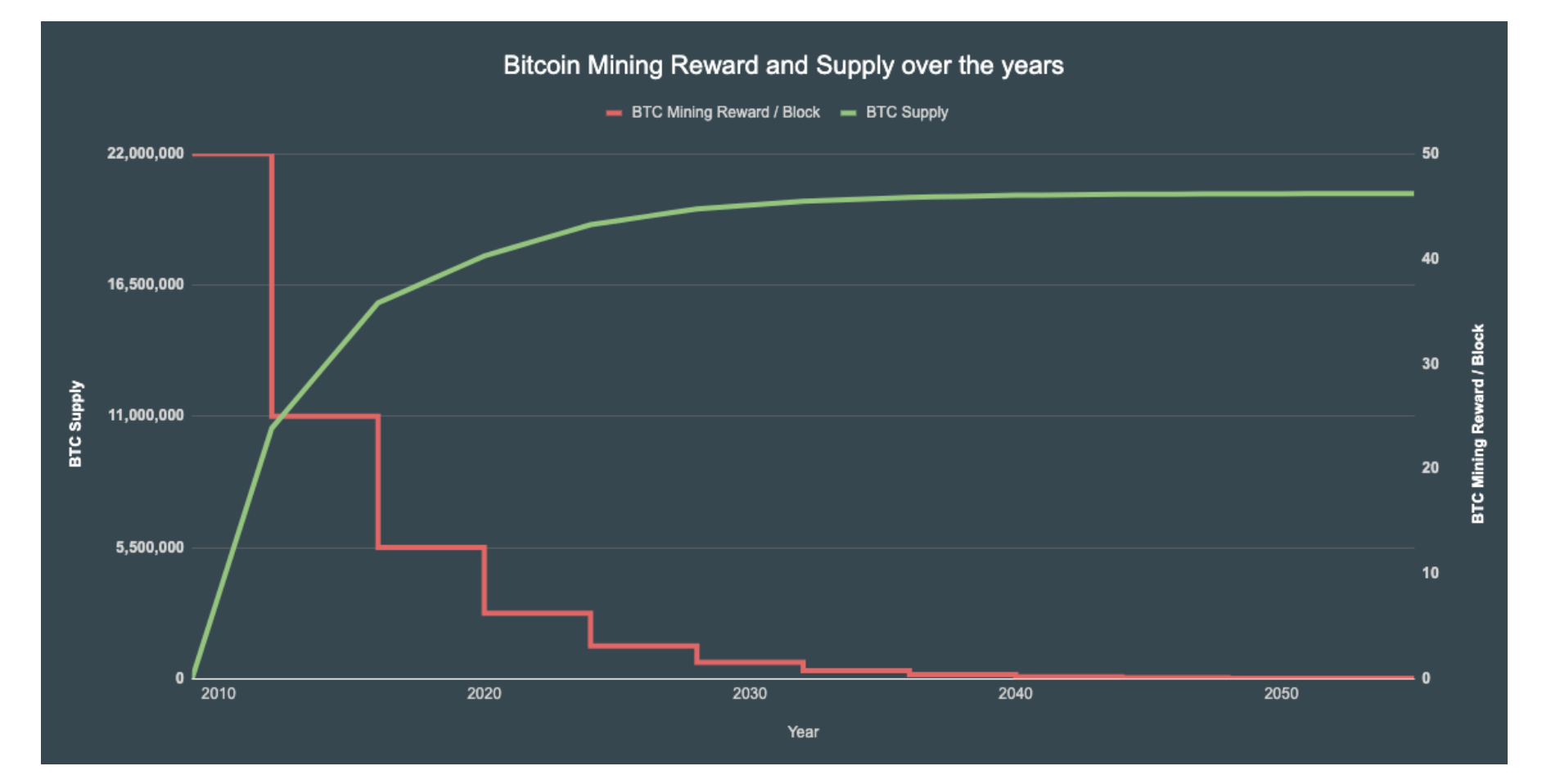

This pattern will continue until approximately 2140 when the last bitcoin will be mined. There will only be 21 bitcoin ever created, and about 19.4 million or 92.5% of the total have already been mined.

When is the Bitcoin halving 2024?

One of the key attributes of the Bitcoin network is that it is pre-programmed and managed by code. This is way different than the way the economic policy of the world’s central banks, or even how financial decisions are made at the world's most powerful financial institutions.

From day one, when the network first launched on January 3, 2009, the issuance schedule of bitcoin was laid out and completely clear to all network participants.

The Bitcoin halving is predicted to happen on April 20, 2024. The exact time is in flux because the timing depends on the specific block height, not a date on the calendar.

The halving happens every 210,000 blocks, which takes approximately four years to happen.

There is some variability between halvings because new blocks are produced roughly every ten minutes.

Why does the Bitcoin halving matter?

The Bitcoin halving is an important network event for a few reasons.

On a very basic level, the halving connects back to basic supply and demand that you might learn in an Economics 101 course.

Over time, the supply of bitcoin shrinks until eventually no new bitcoin will be produced. At the same time, demand for bitcoin is continually increasing because people are using the network for all kinds of things.

The attention and demand for bitcoin is likely to continue. If the past few months are any indication, new uses and new utilities are being introduced all the time.

Here are just a few examples of recent use cases or applications on Bitcoin:

- Bitcoin spot ETFs were recently approved in the US, which makes bitcoin more widely available as an investing tool in traditional financial portfolios.

- Universal money addresses are built on the Bitcoin layer two networks, Lightning, to make it as easy to send and receive money as it is to send an email.

- Bitcoin-based NFTs and collectibles are made possible by Ordinals.

So demand for bitcoin is increasing as the supply continues to shrink over time.

Ultimately this puts pressure on the price.

Sometimes when thinking through the way Bitcoin works and how it is following this pre-programmed path, it can be easy to forget, that all of this — the halving as well as Bitcoin’s general daily operations of mining and creating new blocks of confirmed transactions — is happening across a completely decentralized global network or permissionless nodes.

If anything, the halving is a great reminder of how well Bitcoin works, and how the network can pull off upgrades and organized changes without the need for a centralized authority calling the shots and without any interruptions or outages.

The takeaway

So far the dynamics created by the Bitcoin halving have worked as planned. From a systems standpoint, more bitcoin was available earlier, when the network was first introduced. This got bitcoin into the hands of more people and made it possible to start using bitcoin for early use cases (which were largely for fun or things like online poker).

Eventually, as more and more bitcoin became distributed, constraining its supply made BTC more valuable to miners and more valuable to the people using it. This cycle continued to play out, all the while driving up the price, which in turn attracted more users and more developers to the space.

If nothing else, you have to appreciate the elegance and logic behind Bitcoin’s design. It was created with mechanisms for short-term growth and adoption, but at the same time, with a long-term view of fixed supply and ongoing issuance for the next 120 years.

At some point, even people who are not all about Bitcoin will have to come around and at the very least respect the network from the design and execution point of view.

If nothing else, the halving marks a great way to mark time or record the trajectory of Bitcoin. Each halving coincides with a distinct market cycle, which eventually propelled BTC to new all-time highs.

It’s anyone’s guess what will happen price-wise, it will be interesting to see what projects being built on Bitcoin will come to define this cycle. And what we’ll say when we look back in 2028 as we approach the next halving.