Bitcoin's historicity: The network turns 15

Bitcoin's story only gets more interesting and intriguing as time passes. The idea behind Bitcoin and the network are celebrating 15 years. During that time, a lot has changed. It will be interesting to see how the network grows in the future.

While out in the streets marches the pre-parade of the masses waiting for the liquidity event of a bitcoin spot ETF approval. And, at the same time, against the din of stuttering courtroom testimony and harsh lights of a weeks-long trial of a crypto whiz-kid fraudster, the Bitcoin network, methodically and with little fanfare, chugged through another milestone.

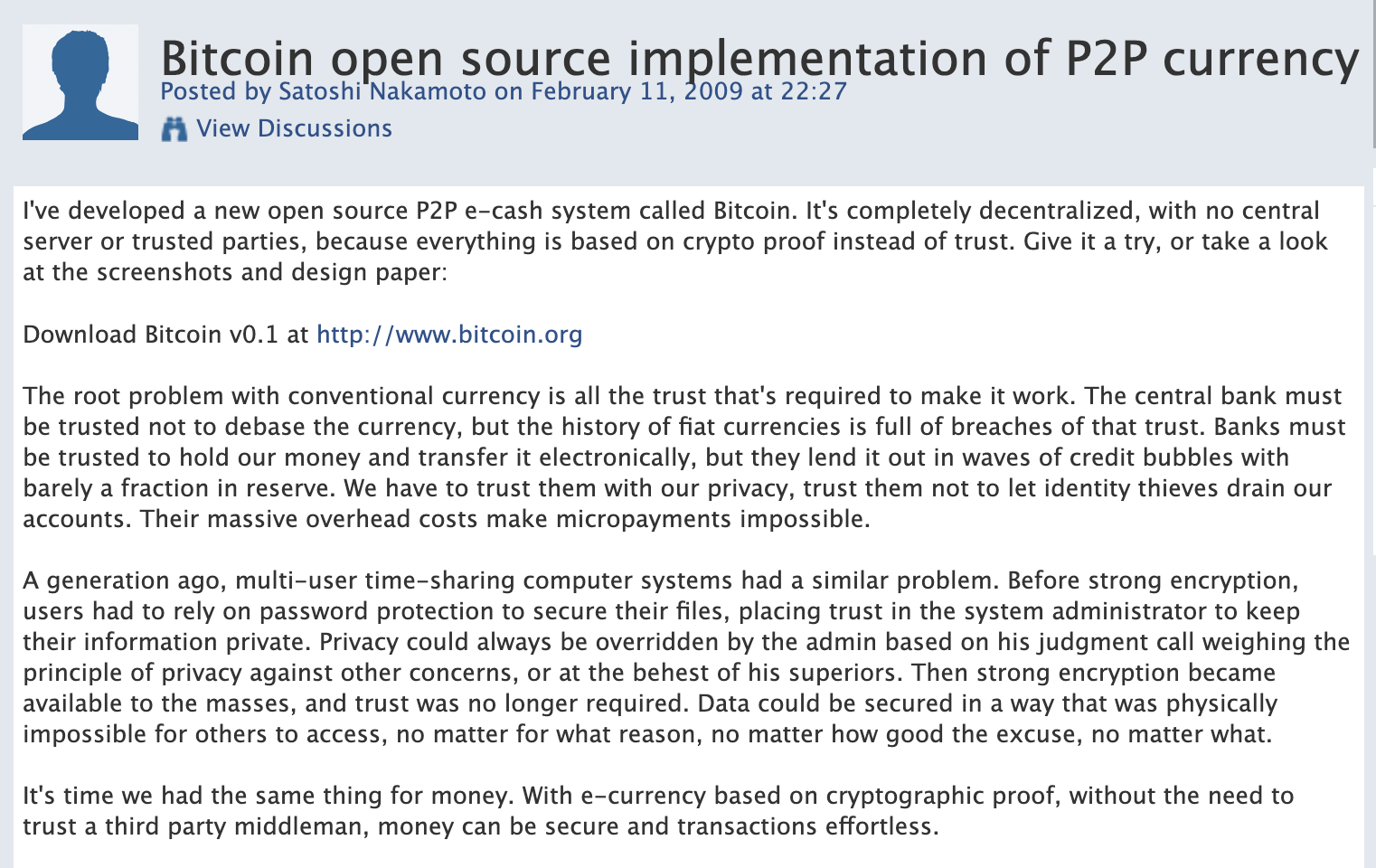

The network, the first of its kind, but also a culmination of decades of pioneering work in permissionless computing and distributed systems thinking, turned 15. At least, the publication of the Bitcoin Whitepaper happened 15 years ago (on October 31, 2008. The actual network launched on January 3, 2009).

I remember learning about Bitcoin when the network was about five years old. At the time, Bitcoin still felt pretty underground. There wasn’t much in the way of an “industry” built up around it.

I remember writing about Bitcoin when it turned 10, which at the time felt like a massive milestone. At the, Bitcoin was definitely a thing — complete with dedicated conferences and a raft of influencers (many of them get-rich-quick kinds of people), and the beginning of what felt like mass adoption.

At 15, celebrating Bitcoin feels different than in previous years.

One of the biggest changes in the past 12 months surrounds the general sentiment of Bitcoin, and cryptocurrencies more broadly.

Bitcoin proponents are quick to point out that the more mature, proof-of-work-backed BTC network is not crypto, or should be in its own category. It’s a significant clarification and worthy of attention. But for people outside of the digital asset space, the nuance gets lost.

Nevertheless, Bitcoin is its own animal is its historicity. Bitcoin benefitted from a fair and transparent launch. Early network users were members of an online forum and a cypherpunk mailing list. They were not venture capitalists, founders, or groups that got special treatment, and therefore allowed to benefit from more upside than the average bag holder.

As time goes on, the founding story of Bitcoin only seems to become more significant.

Historicity is the concept of separating fact from legend — or the idea of synthesizing multiple accounts into an agreed upon thread of what happened in the past. There’s no such thing as getting history completely right, or at least from all points of view. But the concept of historicity helps give more context and color.

If nothing else, as the Bitcoin progresses through the years, the historicity, like the network itself, continues to grow and mature.

Bitcoin: An immutable history

One thing that strikes different about Bitcoin hitting the equivalent of its early adolescence is that the narratives about the how and the why Bitcoin exists are only getting more complex as time goes on.

Growing up with the challenges of intensifying regulatory pressure around the entire digital asset space, along with the handful of high-profile events of fraud, deception, and manipulation — Bitcoin’s story against an increasingly contrasting background becomes more important over time.

Since the launch of Bitcoin, there’s been a pretty fierce headwind of skepticism and doubt that bitcoin and crypto more broadly really is money. Or that it has any utility beyond being some kind of internet novelty. Or that it is merely a fad that will one day be relegated to the derelict pile.

One of the biggest challenges with bitcoin and crypto finding legitimacy is that there is a massive psychological component that underpins our thoughts, ideas, and beliefs about money.

You could probably say that the only reason money actually works as a system is because of the psychology. And trying to convince people that there are alternatives to any kind of deeply held belief system, is well, challenging.

So, it’s in these conditions that bitcoin and crypto more broadly are looking for product market fit. The concerns that all of this stuff is just funny money, or a scam are real. This past year has confirmed those fears for a large part of the consumer base.

If there is a silver lining in the recent market scandals, it’s that Bitcoin as a decentralized network continued to function and confirm blocks without any hiccups — all as designed — while the rest of the crypto industry spent the year imploding.

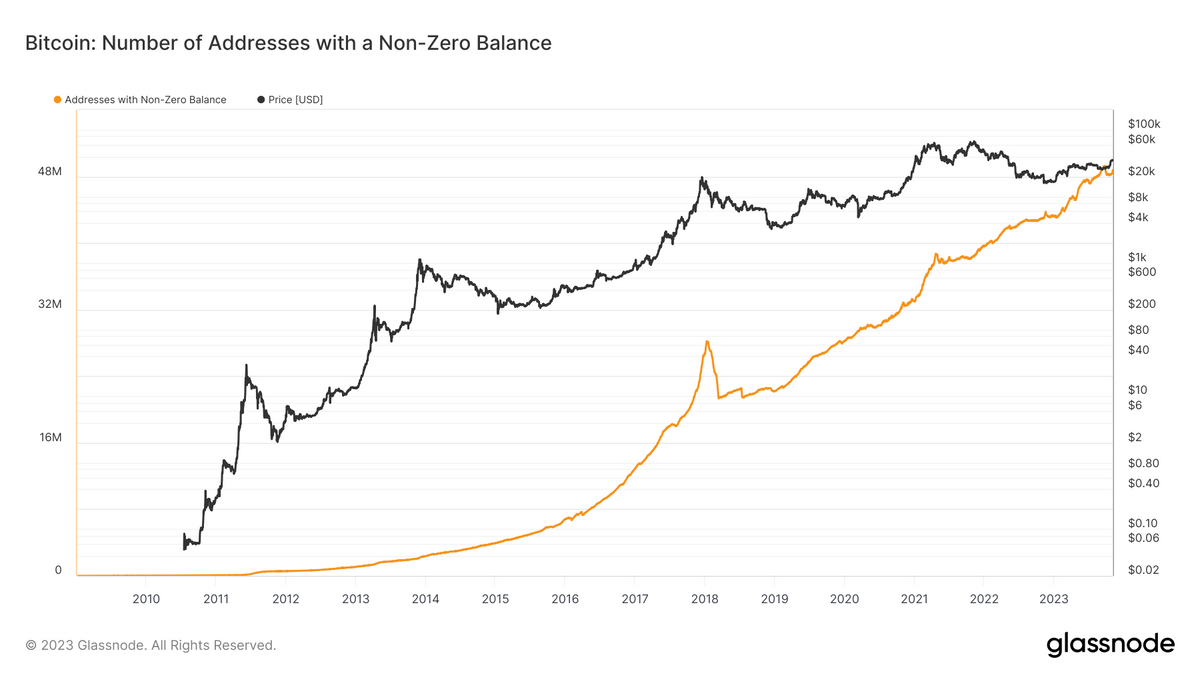

Another big trend that feels emergent, is the idea that on-chain trends and data will become more important, or at least more accessible over time.

This is definitely the case over the last 12 months, and will likely continue. We will known on-chain data and analytics is really a thing when we start to see reporting about on-chain activity in the mainstream media.

At this point, the idea of Bitcoin’s historicity is still dictated by stories, social sentiments, and shifting industry narratives.

Someday, as a true indicator of success, a dominant component of Bitcoin’s history will be the steady growth in number of blocks successfully mined, the amount of value stored and transferred on the network, and the number of global network nodes.

A still unfolding history

One of the reasons that the Bitcoin story is so fascinating is that it is dynamic. Bitcoin changes, grows, and evolves all the time.

It’s also interesting to watch Bitcoin’s backstory change, adapt, and solidify over the years.

I’m sure we will all be reading and writing these milestone posts well into the future. What happens from here — especially after such a dramatic year — will only help to flesh out the story.