What are Bitcoin Ordinals and why do they matter?

Bitcoin ordinals challenge the idea that the Bitcoin network is solely a peer-to-peer payment network or digital store of value.

On one level, ordinals serve the same purpose as non-fungible tokens, or NFTs, that are created on smart contract-based networks such as Ethereum or Solana.

At the same time they are different because fundamentally a bitcoin ordinal is a method of recording data (could be text, image, or an audio file with a maximum size limit of 4 MB) as part of a bitcoin transaction. The process, known as inscription, means that the data will be stored and accessible permanently on the Bitcoin blockchain.

After a file is inscribed during the transaction process, the recorded data becomes associated as an ordinal, with a satoshi, or the smallest accounting unit of bitcoin.

Understanding the mechanics of creating and managing ordinals is interesting, but so is thinking about all of the impacts of creating ordinals on overall bitcoin supply and demand dynamics.

According to a report by digital asset management firm, Galaxy, inscriptions and ordinals have the potential to create a $4.5 billion market opportunity by 2025.

Ordinal theory and non-fungible bitcoin

At its simplest, ordinal theory is the idea that individual satoshis can have unique identifying characteristics or labels and then be tracked across the bitcoin supply.

Ordinal information can also relate to the actual satoshis themselves, particularly if the underlying bitcoin was involved in a famous transaction or has some kind of historical significance (like part of the genesis block, for example).

The underlying point here is that the creation of ordinals makes it possible to leverage the underlying properties of bitcoin, such its suitability as durable digital record keeping, to create new opportunities to create multi-dimensional money.

Ordinals make it possible to use bitcoin to create digital collectibles but it also makes it possible to combine data and money in ways that will create new forms of innovative products and services.

One concern about ordinals, and this point is part of a larger debate about the fungibility of bitcoin, is what the impact of creating non-fungible bitcoin would be on the circulating supply.

After all, if satoshis are inscribed with data, what happens to the bitcoin as digital money use case, or the bitcoin as digital gold use case?

Well, numbers-wise, ordinals dominating the bitcoin supply, even if they take off in terms of popularity, will not have a drastic impact on the overall bitcoin supply. According to Galaxy Research, “Our base case scenario finds that it would take 238 years to mint 500m inscriptions, or 5 BTC worth of inscriptions. Because currently ORD uses approximately 10,000 sats per inscription (1 ordinal + 9999 sats added as “postage” to help fund future transaction fees for transferring the ordinal), under this scenario it’s reasonable to suggest that actually 50,000 BTC see a reduction in fungibility, still only 0.24% of total BTC terminal supply (21m).”

Bitcoin ordinals versus smart contract NFTs

Ordinals and NFTs are similar because they create one-of-a-kind digital artifacts. Artifacts in this case could be digital records, titles, messages, collectibles, art — or anything that could benefit from some kind of long-enduring, verifiable digital trail.

So far some of the major advantages of ordinals is that like bitcoin they allow for easy and secure self-custody. Right now the disadvantages are that they are constricted in size (4MB) (compared to NFTs 100MB), which might limit usage.

From an innovation standpoint bitcoin inscriptions and ordinals (like smart contract NFTs) can open up new markets and new kinds of products and services such as:

- Collections

- Marketplaces

- Explorers

- Inscription as service

- Wallets

- Data and discovery

Currently, inscribing a bitcoin ordinal is difficult in that it takes specialized software (called ORD) and knowledge — or at least a comfort level running a Bitcoin Core node. Smart contract-based NFTs, on the other hand, are relatively user-friendly to mint on the most popular NFT chains such as Ethereum. There are a number of platforms and services that guide people through the NFT creation process.

It’s likely, as ordinal interest and usage grows, the ability to create and interact with ordinals will become easier.

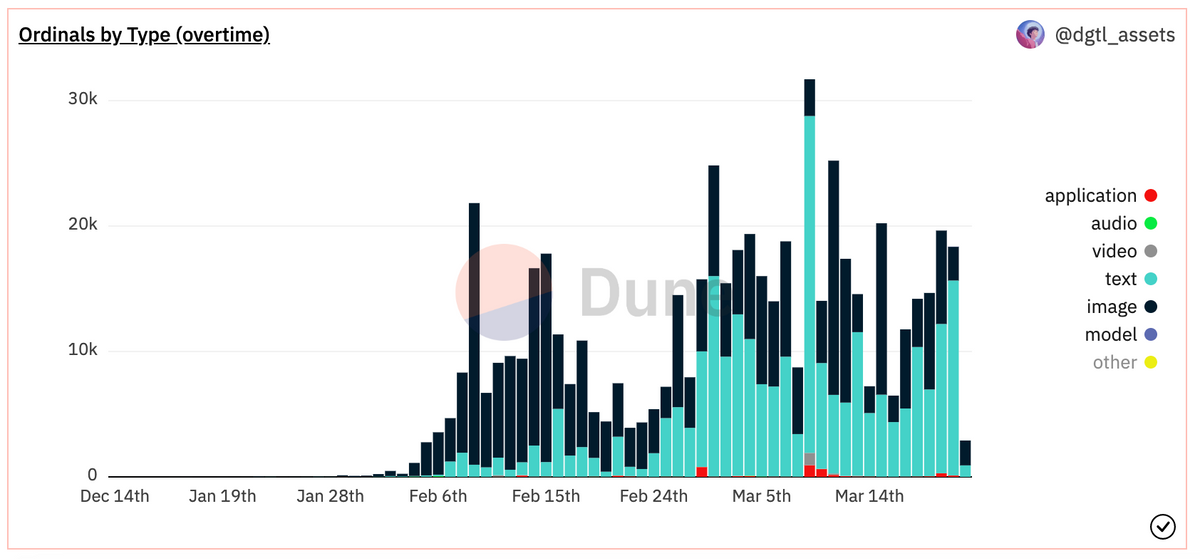

And as bitcoin ordinals become more widely used and more popular, they will increase the bitcoin blockchain transaction size (see the Glassnode chart above), which in turn will drive up the transaction fees collected by bitcoin miners.

The add-on value here is that ordinals help make the bitcoin blockchain more secure by maintaining miner fees even during times of low on-chain activity — and/or as block rewards continue their scheduled reductions over time.