What are BRC-20 tokens?

The BRC-20 token standard — or Bitcoin Request for Comment — allows for the creation of an asset on the Bitcoin blockchain. The new standard marks the first time that tokens can be issued on top of the Bitcoin and conceptually similar to Ethereum’s smart-contract-based ERC-20 tokens.

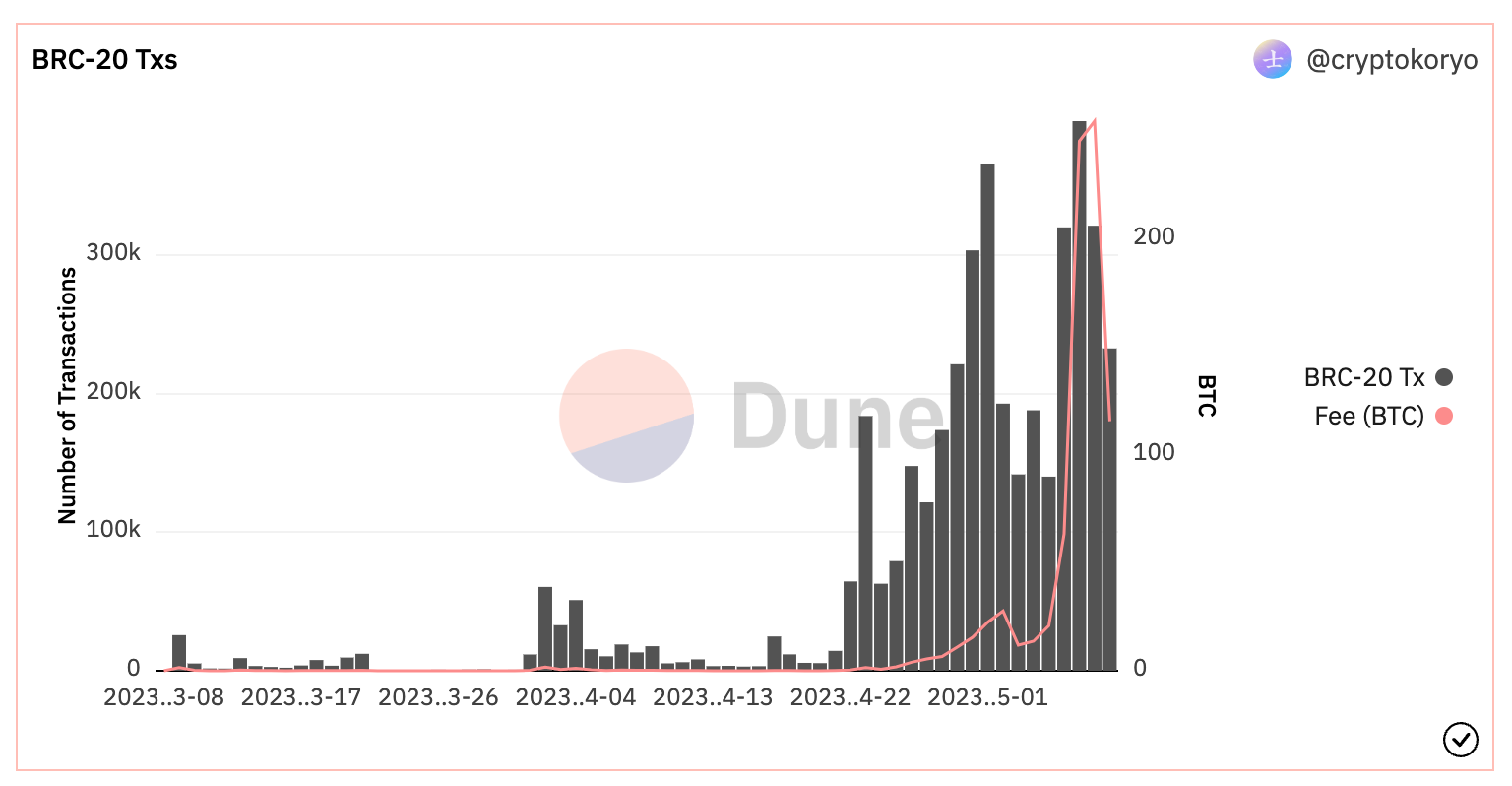

While the new BRC-20 are novel for the Bitcoin Network, they are also controversial in that recent arrival and surging popularity of BRC-20 tokens is dramatically increasing Bitcoin’s transaction fees (see the image above).

BRC-20 tokens are actually a form of Bitcoin Ordinal. Ordinals are a means of creating a non-fungible token on the Bitcoin network. Unlike Ethereum’s smart contract-based system which enables a greater degree of programability for applications and uses Ethereum’s blockchain as a final ledger or settlement layer, Ordinals are a bit more simplistic.

Instead of Ethereum’s dynamic smart contracts, which allow for the development of an economic system or sophisticated token systems (tokenonmics), Ordinals are more like fixed placement NFTs.

A Bitcoin ordinal is a way of recording (or inscribing) a maximum of 4 MB of data to a satoshi, or the smallest unit of accountable bitcoin. Once inscribed — the data can be a text, audio, or video file — the satoshi essentially becomes non-fungible. By nature of carrying a data payload it becomes different than all of the other satoshis.

Ordinals are new. The ability to record data, which essentially created NFTs on Bitcoin just launched in early 2023. At first people used Ordinals to make and inscribe unique digital art or add messages to the blockchain, or create a unique profile picture.

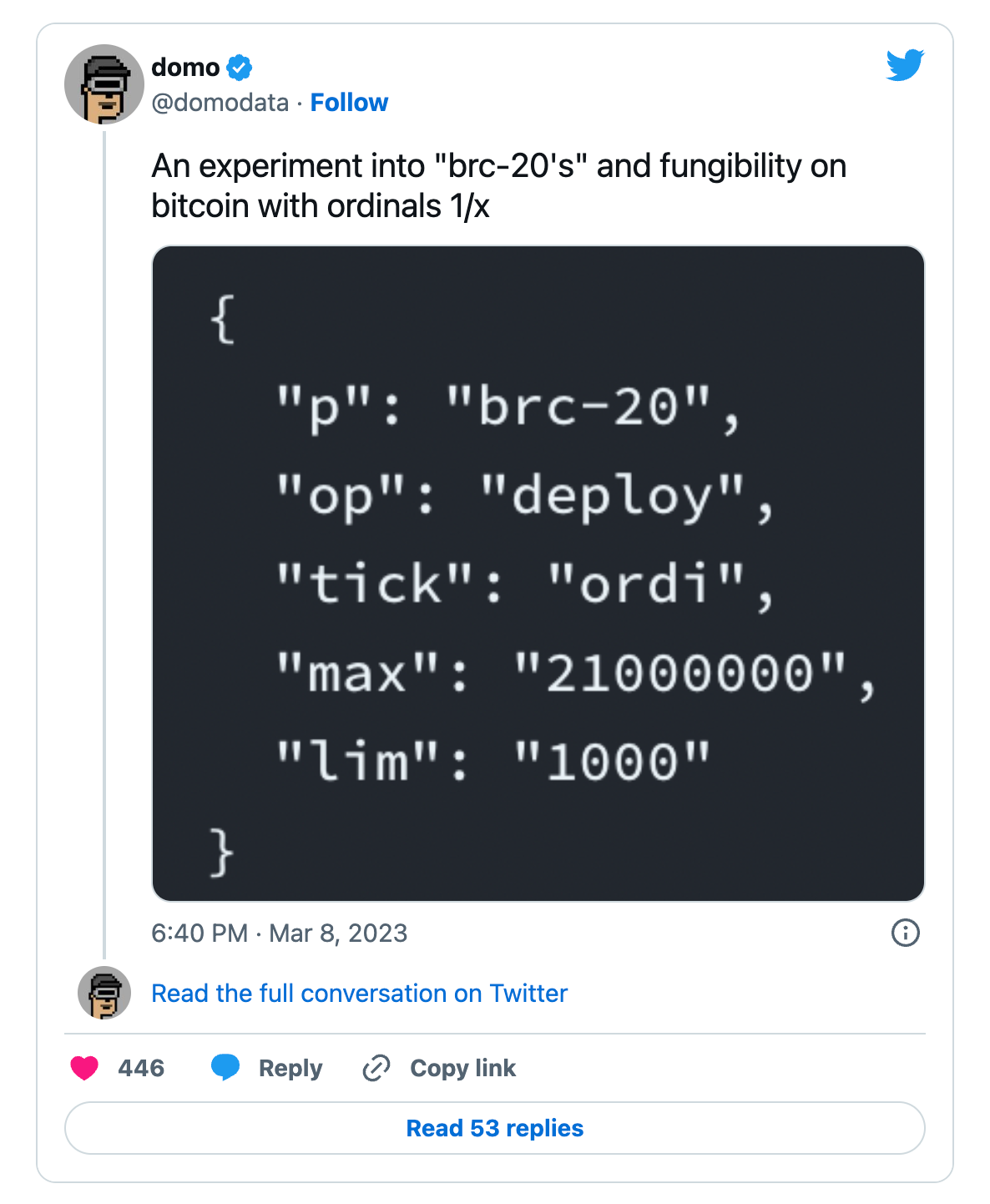

But then a member of the Bitcoin community developed a way to modify inscriptions so that Ordinals could be used to create satoshi-based system of tokens on top of Bitcoin.

SOURCE: https://twitter.com/domodata/status/1633658974686855168

By early May, a number of other developers started piling on and launching their own BRC-20 tokens. Three of the top trending coins are ORDI, OG, and PEPE.

PEPE in particular had a moment where its market cap exceeded one billion USD after it was listed on the crypto exchange Binance.

SOURCE: https://coinmarketcap.com/currencies/pepe/

The hype surrounding BRC-20 tokens have some calling the assets created meme coins. In this case, the hype has larger implications for the Bitcoin Network and will likely lead to more debates about the role of Bitcoin and the future of the network.

The new BRC-20 craze is driving up on-chain transaction fees

One big downside to the hype-driven mania surrounding Ordinal-based meme coins is that they are driving up the transaction costs on the Bitcoin Network. And not just a little bit, but to a point where increased Ordinal activity via more meme coin activity is leading to unsustainable congestion.

SOURCE: https://dune.com/cryptokoryo/brc20

High network fees reduce the overall utility of Bitcoin as a payment network and will have an overall impact on new address creation (adoption) and drive potential new users to lower cost alternatives.

It will be interesting to see how this situation resolves and if the meme coin situation is a passing fad, or a new crypto use case that will require reconfiguring Bitcoin’s resources.