Using crypto to predict the future | What are decentralized prediction markets and how do they work?

Decentralized prediction markets are growing in popularity. But there's still a lot of issues associated with their use and adoption. Just maybe there is wisdom in the crowd.

A prediction market lets people make a bet on future outcomes of things — all kinds of things.

Within the crypto space, people bet on the price of an asset next month, next year, etc. Other people bet on when a project will go belly up. Still, others create markets about when the next big airdrop is coming.

But decentralized prediction markets are more than just a crypto thing. People are increasingly using the power of prediction to try and make sense of major events — ranging from big games to political elections.

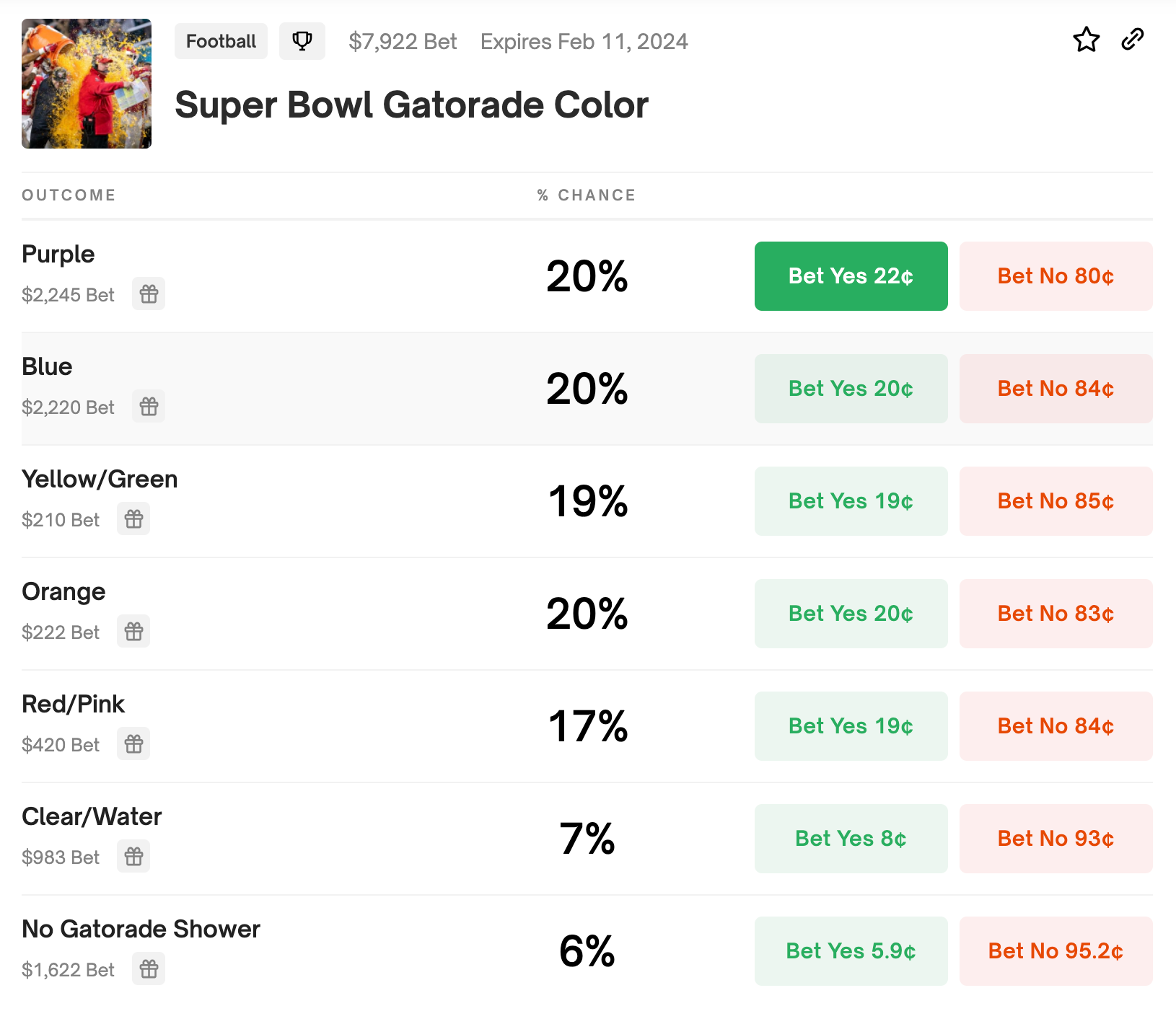

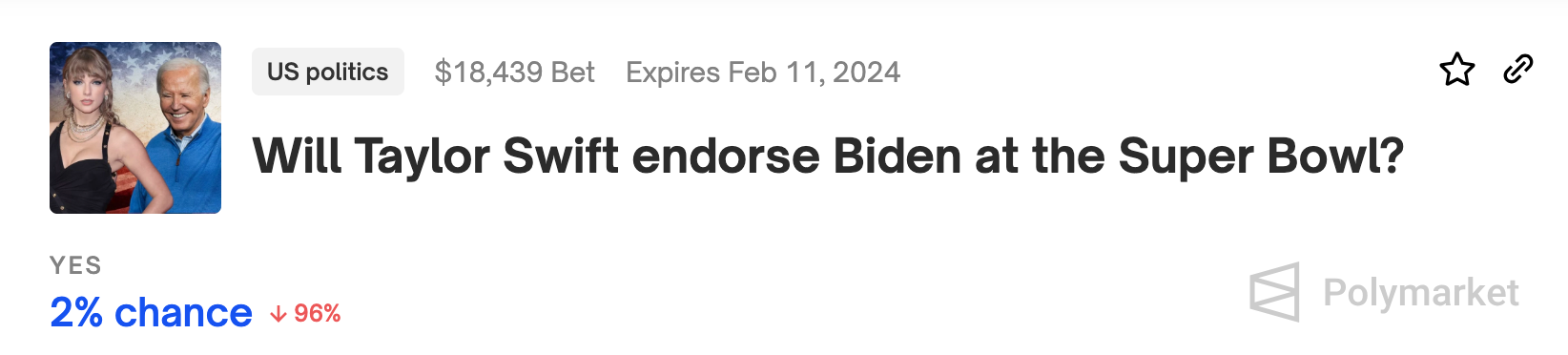

And it is not just particular outcomes that people are trying to predict, but also nuances within the event itself.

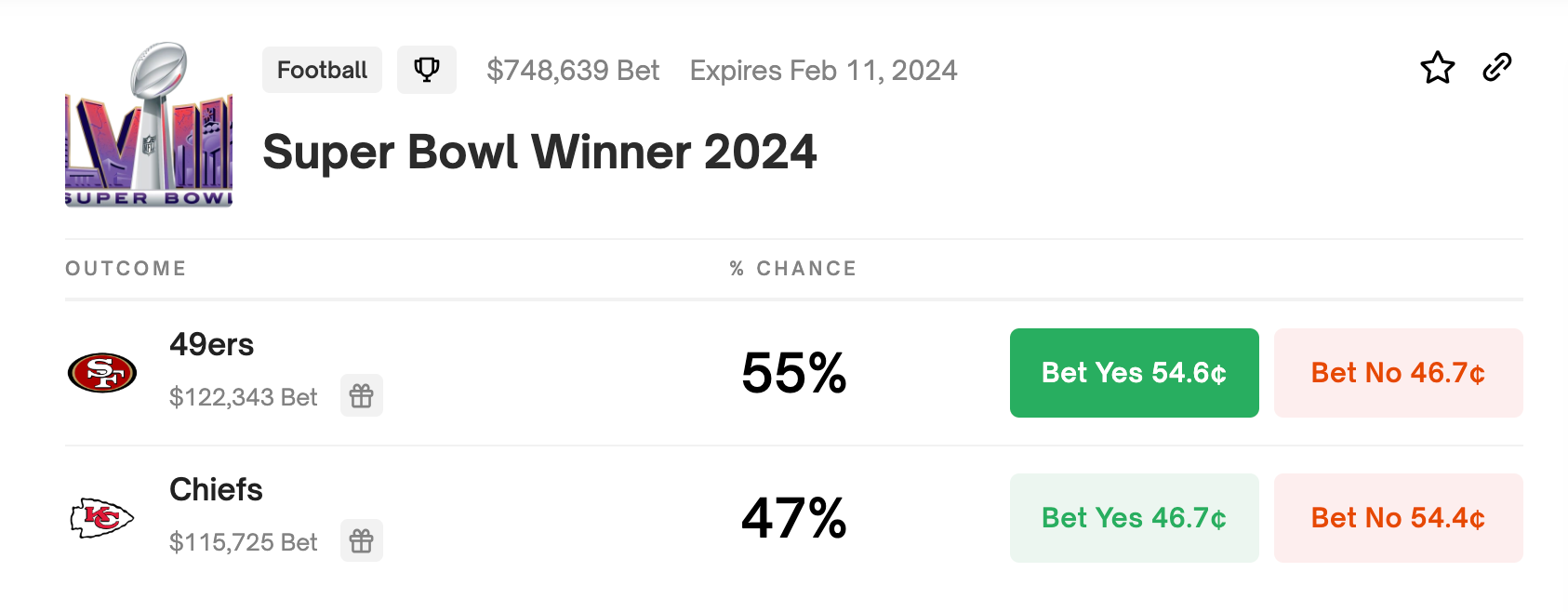

For example, these are some of the prediction markets that popped up on Polymarket leading up to Super Bowl Sunday 2024:

How a decentralized prediction market works

Polymarket is a good example of how a decentralized market functions.

Polymarket is built on Ethereum-based smart contracts and allows people to lock value in a contract until certain conditions are met (for prediction markets, in many cases, this is the outcome of an event).

Right now, the market for the Super Bowl outcome is saying the San Francisco 49ers have a 54% chance of winning, while the Kansas City Chiefs have a 46% chance of winning.

Let’s say that despite the hype, you think the Chiefs will win. You might have an idea about why this will happen. For example, maybe you are convinced about the power of the Chiefs' run game against the weaknesses of the 49er's defense.

Or maybe you are not believing all of the injury reports and you’re convinced that the 49ers are more banged up than they appear publicly, and the Chiefs are well-positioned to exploit those weaknesses. You get the idea.

You might have an informational or experience advantage to make a decision that deviates from the prevailing opinion about an event.

By participating in a prediction market you are essentially buying shares in an outcome.

In the case of our Chiefs' example, each share in the outcome will cost $0.46, because the market sets the price based on probability.

If the Chiefs do win, then you could get a payout of $1 USDC per share. Put another way, you would profit $.54 for every share of the market you purchased.

Prediction markets act like an order book, with the price moving as new information surfaces or new sentiment about an event changes.

Just like other markets, participants can enter or leave at the current price even before the event happens.

Bet: Crypto-enabled prediction markets will be a big deal in the future

At a very basic level, prediction markets are a platform where people place bets on future outcomes. This sounds like gambling, and it is in a sense: people earn payouts if the prediction they backed is the actual outcome.

But there’s more to the story. Prediction markets at scale, where thousands or even millions of people are staking money on certain outcomes, actually have utility beyond wager-making.

In some ways, prediction markets might be more useful for understanding the world and replace reliance on the analysis of a talking head pundit or on media outlets who increasingly showing preferences for reporting.

The wisdom of the crowd is a real thing. Prediction markets make it possible to aggregate and synthesize information and knowledge from the entire market — and from people with a vested interest — rather than a single source, or limited sources, of information.

Maybe this model of crowdsourced wisdom gives us a better way to understand complex events — and maybe crowd-sourcing predictions have just been waiting on the right tech stack (incentivizing input) to become a useful tool.

And all of this leads to our next question…

Are decentralized prediction markets legal?

There are already several legal and regulatory issues related to crypto and decentralized finance.

Access to decentralized prediction markets is likely dependent on where you live. As mentioned at the top, legal access to decentralized prediction markets is unavailable in the US because of legal restrictions.

But maybe that changes. Judging by the run-up to the Super Bowl this year, it looks like some of the trend-setting ad space will feature internet sports betting.

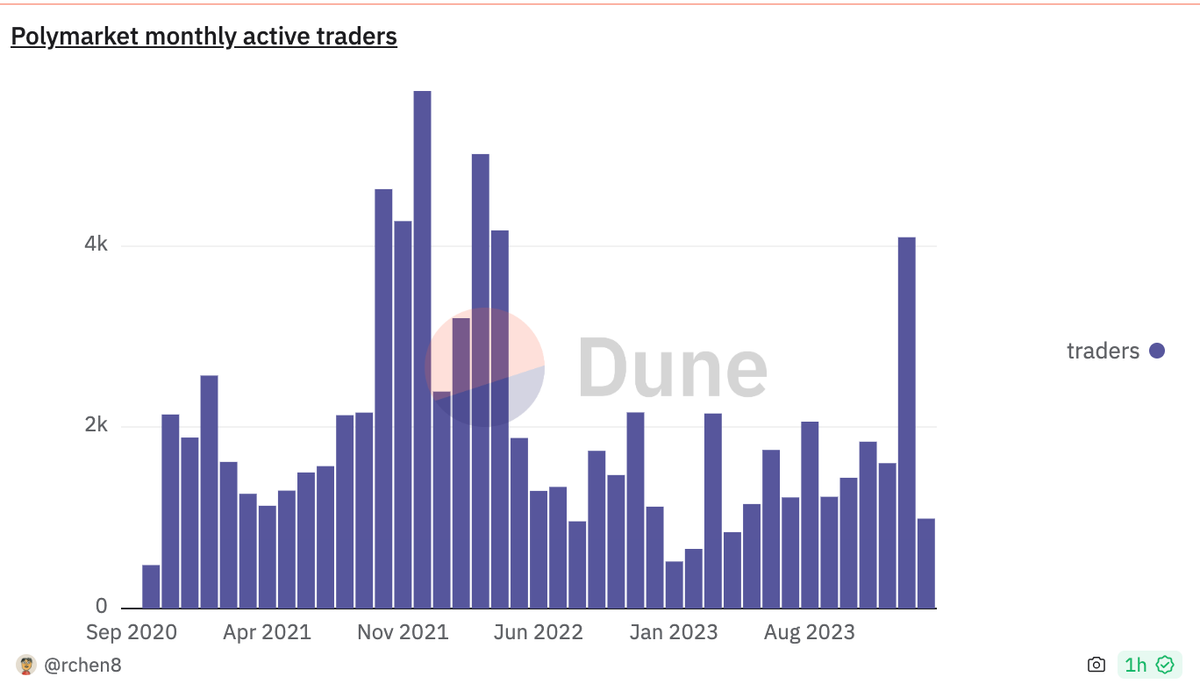

Meanwhile, while all of that stuff gets figured out, decentralized prediction markets are likely to keep growing.

Where this all goes from here is anyone’s guess (likely there’s a prediction market covering it somewhere).

One thing that will be interesting to watch is if and when prediction market analysis starts to become part of traditional news reporting stories. If so, maybe the idea about incentivizing the wisdom of the crowd goes more legit.