Defining decentralization

DeFi is complicated to use. It’s also hard to define.

While the other onboarding issues will likely get solved through market maturity, it’s a lack of a firm definition that is grabbing all of the attention. DeFi is turning into a “know it when you see it” kind of thing.

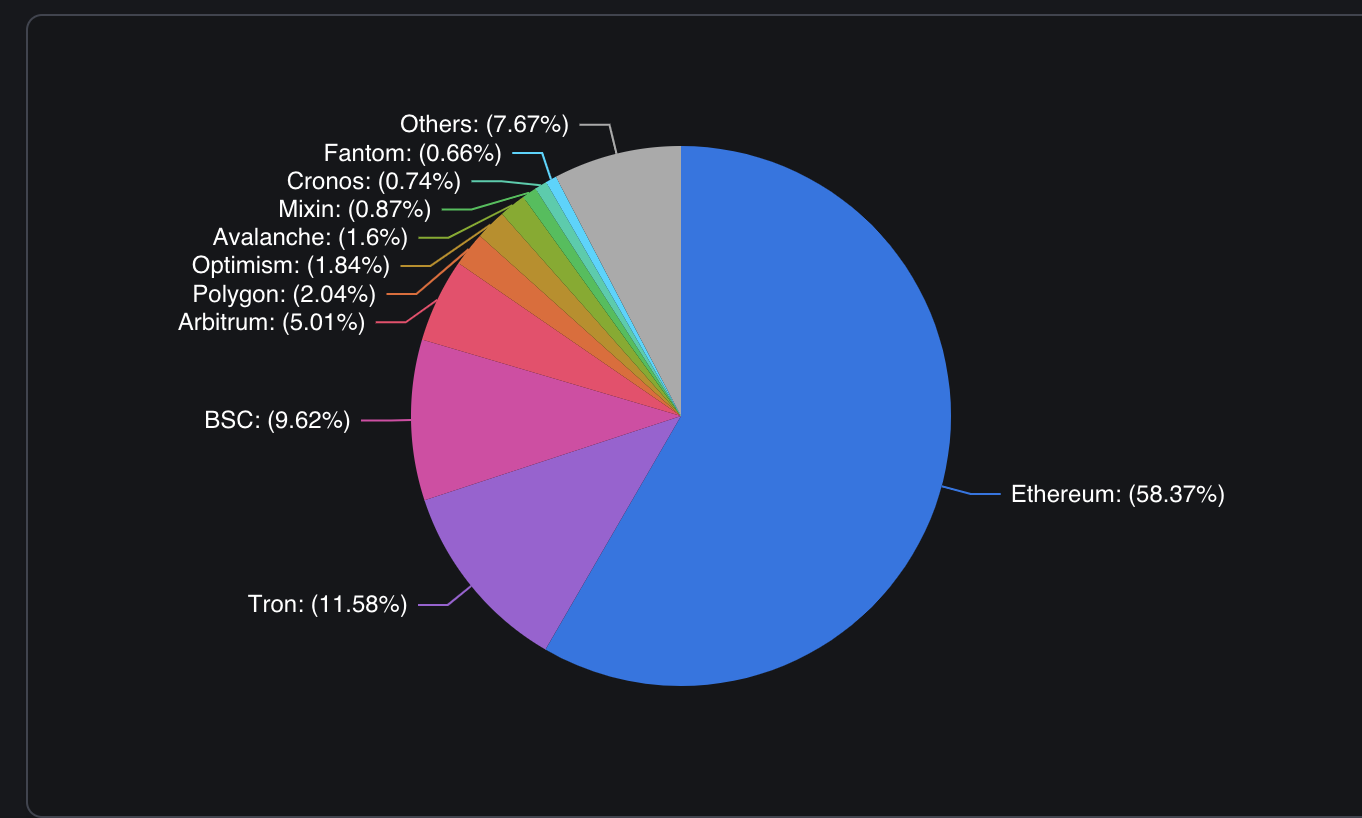

Right now it feels like any app or product that touches a layer one — or a foundational blockchain, like Ethereum — can be called decentralized.

But as DeFi continues to grow its user base and utility, and as law makers start to consider how best to regulate DeFi services, the wishy-washy definition of DeFi is causing significant issues. Underlying the need for clarity is a larger debate about how money-related software should be handled.

The intro of a recent report from the Department of the Treasury about the illicit activity cropping up across DeFi protocols and services, explains some of the reasons why a meaning for DeFi is so hard to wrangle:

“There is currently no generally accepted definition of DeFi, even among industry participants, or what characteristics would make a product, service, arrangement or activity ‘decentralized.’ The term broadly refers to virtual asset protocols and services that purport to allow for some form of automated peer-to-peer (P2P) transactions, often through the use of self-executing code known as ‘smart contracts’ based on blockchain technology. This term is frequently used loosely in the virtual asset industry, and often refers to services that are not functionally decentralized.”

At the simplest of levels, decentralization implies the ability to interact in a peer-to-peer way without the need to run assets or information through an intermediary like a company or organization.

In a decentralized world, computer code (software) replaces the need for traditional financial service handlers.

But this gets complicated because it feels like there should be absolutes when talking about decentralization.

A simple test for whether an app or service is decentralized is to ask: Is there any kind of off switch or choke point that would allow any kind of authority to turn off or take control?

But instead of a clear on/off switch model, most of the current DeFi tech stack exists on some kind of decentralized spectrum.

Some activities, including hosting some layer one nodes, or decentralized apps, continue to rely on centralized internet service providers, like Amazon Web Services (AWS).

Additionally, the test for whether something is decentralized or not changes — or at least takes on a different weight — depending if you are looking at it from a legal perspective, a technical perspective, or some kind of philosophical perspective.

The ultimate goal of decentralization is to leverage software to make money more efficient and more customizable for individual needs. The best way to achieve decentralization is for for people to hold assets in non-custodial wallets — essentially to have access to easy-to-use personalized digital vaults that interact with outside services.

Storing assets in a non-custodial wallet lets people control the number of off-switches and take full advantage of the security enabled by holding a private key.

There is a purity in the idea, or at least a strong philosophical underpinning, that a person could use software deployed on the internet to securely share money, assets, or data with anyone else in the world, and not need layers of handlers in between.

Ultimately, a completely decentralized system offers total ownership. In some ways, it’s about self-reliance in a time of digital dependence. Maybe during the rise of artificial intelligence, this becomes even more important.

Of course, this ideal of frictionless movement of financial and information resources does have its potential downsides — easily moving money across jurisdictions and around the world helps criminals as much as it helps small businesses, or far-flung families, or people who just want to be able to store their own assets as the banking sector goes through a historic meltdown.

And in the last few months there have been a number of reports, both from the crypto industry (here’s a recap of a crypto crime in 2023 report) and from the federal government examining how decentralized finance tools particularly are used by criminal to launder money, conduct scams, and generally avoid the existing financial safety guardrails.

DeFi is in the spotlight because there is an uptick in criminal activity on its growing universe of apps and services. There is an uptick of criminal activity because there has been an explosion of growth in the DeFi sector.

One of the offshoots of that explosive growth in overall usage is the number of analytics and data services that allow DeFi users to query on-chain information and see what is happening in almost real-time. The proliferation of easy-to-use data analytics services gives an overall better picture of what is happening “on-chain.”

And it turns out there are a lot of scams, digital heists, and old-fashioned money laundering taking place on-chain. It’s not to say that this is a dominate use of DeFi. In fact, by comparison, it’s a relatively small portion of the overall market. And it’s not to say that there is anything particularly novel about on-chain financial crime.

In fact, most criminals probably still prefer to get paid in cash, and to launder money in cash. It’s easier to hide because there’s no trail. After all, there aren’t a whole lot of analytics companies making easy to digest dashboards about how each $100 bill is moving. And, while DeFi has a promising future, it is still dwarfed by the hard to trace dollar-backed system. As of 2022 there was 18.5 billion $100 bills in circulation around the world (the number continues to increase — it was half that amount in 2013).

The Treasury Department’s report even says as much, “this risk assessment recognizes that most money laundering, terrorist financing, and proliferation financing by volume and value of transactions occurs in fiat currency or otherwise outside the virtual asset ecosystem via more traditional methods.”

Nevertheless, one of the advantages of DeFi is the sense of transparency. What’s fascinating about the state of DeFi right now is that we can watch how money moves.

And it’s in the movement — or through the transparency of the the underlying public blockchain technology — that a real definition of decentralized will emerge.

Ultimately, the picture will start to show that decentralized apps and services that ultimately rely on traditional web2, centralized tech will run into regulatory and technical challenges, while apps and services that are built on the crypto primitives of permissionless access and private key management will be successful — and ultimately easier to understand.