Prediction markets and the thin line between utility and chaos

Prediction markets promise sharper foresight about the future — but do they actually deliver truth, or just monetize vibes? As billions flow into these new kinds of markets, what are we actually betting on?

Prediction markets are back in the headlines. Polymarket is clearing tens of millions of dollars a day. Kalshi, once a quirky fintech experiment, is now a $2 billion company with regulators seemingly content to let it blur the line between trading floor and sportsbook.

If you zoom out, the ascent of prediction markets looks inevitable. They’ve been the dream of economists for decades, with the main concept that the systems could become “markets in truth” — financial infrastructure for aggregating dispersed knowledge into accurate forecasts.

What could be more useful? A world with sharper expectations about elections, wars, pandemics, or inflation. A world where the wisdom of the crowd is not just idle chatter but priced into the ledger.

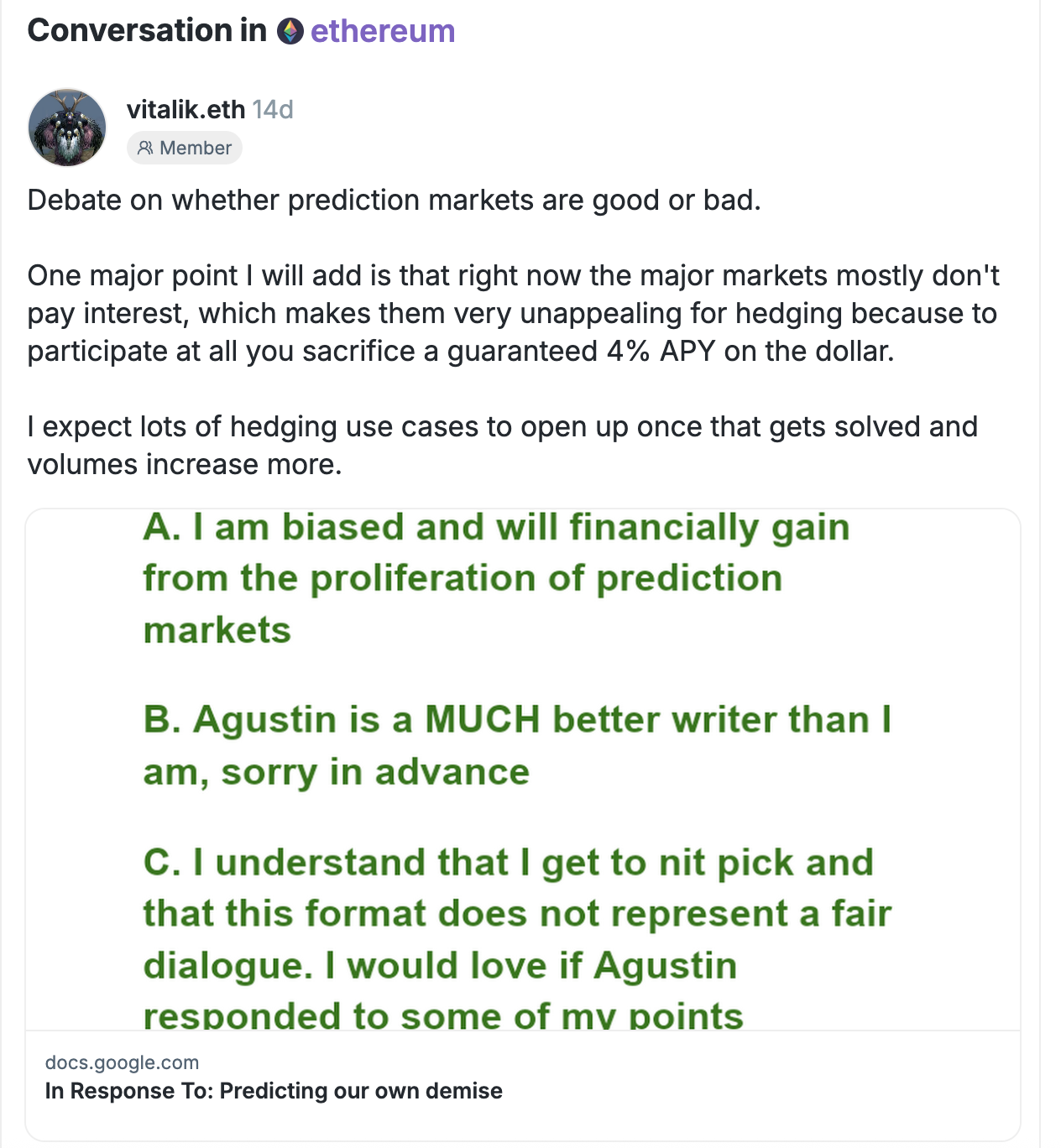

This week, across the crypto chat, there was a healthy debate about the role and impact of decentralized prediction markets as they rapidly mature.

To summarize the critique of prediction markets is that dream may already be morphing into a nightmare.

Prediction markets, the argument goes, are bad markets — poorly designed, socially corrosive, and ultimately destabilizing. They don’t aggregate truth as much as they monetize vibes. At scale, they risk turning fragile democracies into casinos, where the odds themselves nudge reality off balance.

1/ I wrote a longer piece about the dangers and downsides of prediction markets.https://t.co/QO79Ox96Sy

— Agustin Lebron (@AgustinLebron3) August 18, 2025

But there’s a flip-side too. Supporters of prediction markets point out that all markets look degenerate in their infancy. What starts as gambling evolves into risk transfer.

Just as financial markets grew from speculative pits into the backbone of modern capitalism, prediction markets could become vital hedging tools — letting farmers insure against droughts, airlines against storms, or defense contractors against budget fights.

It’s the inherit hedging mechanism for, well, just about everything, that gives prediction markets the bulk of their utility or value.

In Response To: Predicting our own demisehttps://t.co/ERClZEv9R9 https://t.co/0lNs3CFggy

— Jae (@TomJrSr) August 22, 2025

This debate — prediction markets as either degenerate gambling dens or nascent truth engines — isn’t just about trading mechanics. Prediction markets also help surface some of the tension of the Open Money framework: open systems can both democratize access and raise the risk that those same systems amplify noise, speculation, and collapse.

The problem with prediction markets

The critique starts with market design. Good markets, like Treasury futures or the S&P 500, share common traits: standardized products, many participants, low transaction costs, and most importantly, a range of actors with different risk preferences.

In these markets, hedgers and speculators coexist. Farmers offload weather risk, while funds speculate on prices. Together they create deep liquidity and efficient pricing.

Prediction markets, by contrast, offer binary outcomes — yes/no, one bit of information. These contracts are hard to hedge. If you’re short “Candidate X wins the election,” there’s no underlying asset to offset your exposure. Liquidity providers can’t neutralize their risk; they can only limit their bets and hope the law of large numbers saves them.

That leaves two types of participants: the gamblers and the sharps. The gamblers eventually lose their bankrolls while the sharps eventually run out of counterparties. Without hedgers, without diverse motivations, the market collapses into the no-trade theorem.

Even worse, the critique continues, once prediction markets get big enough they stop reflecting reality and start shaping it.

A billion-dollar market on whether a candidate drops out doesn’t just predict the event—it becomes part of the causal machinery, influencing donor confidence, media coverage, and voter psychology. In other works, the market that was supposed to predict the future instead starts to influence it.

And in a world primed for bad vibes, prediction markets will naturally gravitate toward catastrophic wagers: civil war by 2030, assassination plots, pandemics, sports collapses. These bets have salience, upside, and attention gravity. They pull capital and energy toward fragility rather than resilience.

The upside of prediction markets

The rebuttal doesn’t deny these concerns but insists they’re short-sighted. Prediction markets today are immature, but so were financial markets once. Heterogeneity doesn’t appear at launch, but if prediction markets actually have utility then they will become more efficient as they scale and attract more liquidity.

More importantly, the line between speculation and hedging isn’t fixed.

Speculation often begets hedging. Early volume creates price signals, which attract counterparties with real economic exposure. Airlines, insurers, pharma companies — all could eventually use prediction markets to cheaply manage event risk that current financial instruments fail to cover.

And those binary contracts? They are the underlying. If your exposure is to “FDA approves this drug” or “OPEC cuts output,” then the binary outcome is exactly the thing you want to hedge. Someone will always be willing to take the other side for a premium.

As for reflexivity — the idea that markets distort the very outcomes they predict — the rebuttal argues that it is self-limiting. If your trades move the odds in ways that hurt you, you become the dumb money. Rational traders avoid markets where participation debases the signal. Manipulation can happen, but it eats itself.

Far from society-destroying, prediction markets could provide new forms of resilience. They reward accurate foresight, penalize bad takes, and give businesses a simple way to manage risks currently hedged through expensive, opaque channels. Instead of monetizing vibes, they could channel capital toward truth.

Open Money and the paradox of truth

Both sides, in their own way, are circling the Open Money paradox: openness creates both opportunity and fragility.

- Open rails: Prediction markets lower the barriers to entry. Anyone can buy exposure to the future, whether you’re a hedge fund or a taxi driver worried about fuel prices. That’s pure Open Money: breaking closed systems and giving individuals direct access to financial truth.

- Vibes risk: But openness also means amplification of noise. The same mechanisms that democratize access can supercharge destructive memes. A market in “civil war by 2030” is both open expression and collective pathology.

- Speculation vs utility: Speculation is unavoidable in open systems. The key question is whether it matures into utility. Crypto itself faced the same critique — casino tokens masquerading as innovation — yet out of that speculation emerged real infrastructure: stablecoins, onchain settlement, censorship-resistant rails. Prediction markets may follow the same arc.

- Truth vs tautology: This is perhaps the sharpest tension. Can markets buy us better truth, or do they collapse into reflexive loops where money manufactures the very outcomes it bets on? In Open Money terms, can openness sustain verifiable information, or does it devolve into vibes all the way down?

Markets as mirrors

Maybe another way to think about it is that prediction markets, like all open systems, are mirrors. They show us what kinds of futures we’re willing to bet on. If society is captivated by collapse, the markets will reflect that. If society is oriented toward resilience, they’ll reflect that too.

This is the broader Open Money lesson: open systems don’t save us from ourselves. They amplify what’s already there. Crypto amplified both casino culture and censorship resistance. Social media amplified both citizen journalism and conspiracy spirals. Prediction markets will amplify both foresight and degeneracy.

The question is not whether prediction markets are good or bad. The question is whether we, as a society, can use them to channel speculation into resilience rather than collapse.

Can they become hedging infrastructure for industries exposed to real-world events? Or will they remain casinos for attention and vibes?

The fragile wager

What’s striking is how both sides of the debate — prediction market critics and proponents — agree on the stakes. Prediction markets are not trivial. They are experiments in monetizing truth. They force us to confront how fragile our collective narratives are, how easily markets can tip from measuring reality to manufacturing it.

And that is exactly why they belong inside the Open Money framework. They expose the tension at the heart of our financial future: the promise of openness colliding with the dangers of reflexivity.

The very tools that could give us sharper collective intelligence could just as easily become accelerants for chaos.