The misguided controversy around the GENIUS Act

The GENIUS Act brings clarity to stablecoin regulation, unlocking faster, cheaper, and more transparent payments. Fear-driven critiques miss the data: stablecoins aren’t a threat — they’re the upgrade path for modern money.

Stablecoins are the story that keeps on giving. When looking at the crypto stack, they’re probably the most boring — and that’s exactly why they matter. We’ve talked about this before, in pieces like Stablecoins are shelter and Stablecoins: The quiet revolution in crypto’s chaos.

As lawmakers in the US debate comprehensive stablecoin legislation — the Guiding and Establishing National Innovation for US Stablecoins Act, or GENIUS Act — we’re seeing a lot of noisy commentary. And a lot of it is wrong.

The New York Times, for example, published an op-ed on May 23 that paints stablecoins as a Trojan horse — a sleek code shell that conceals scams, sanctions evasion, and systemic instability.

That piece reflects a broader pattern in the media: arguments that misidentify the real risks (such as whether stablecoins could become another “too big to fail” system) while offering critiques that reveal a shaky grasp of the technology itself. Too many of these takes conflate stablecoins with “crypto” more broadly, blurring critical distinctions. Worse, they ignore data, real-world use cases, and the people who stand to benefit most from clear, enforceable rules.

Let’s trade in the hand-waving for receipts. What could smart legislation unlock for small businesses, working families, and the future infrastructure of money?

There are risks — but the fix is clarity, not retreat

Let’s not pretend everything is perfect. There are legitimate concerns: political opportunism, run risk from opaque reserves, regulatory arbitrage by offshore issuers. But the problem isn’t stablecoins — it’s opacity.

The fix? Reserve transparency, real-time attestations, standardized audits. These aren’t lofty ideals — they’re requirements already baked into the GENIUS Act. And they’re table stakes for any credible monetary system in the 21st century.

The real scandal isn’t that criminals use stablecoins. It’s that without proper standards, we’re failing to use stablecoins’ inherent visibility to combat crime more effectively.

Stablecoins are not dog-coins

Not all digital assets are created equal. So let’s draw a hard line: speculative casino tokens and payment-grade, fully-reserved stablecoins are entirely different animals.

According to a recent Fireblocks survey, 88% of North American financial institutions say regulation would accelerate their use of stablecoins. Why? Because oversight makes them usable. Legibility breeds legitimacy.

Under the GENIUS Act, “usable” means serious: 1:1 reserves in cash or T-bills. Daily reporting. Custody under Fed-supervised banks. And thanks to crypto infrastructure, real-time public reporting is not just possible — it’s standard. That’s one of the key advantages of building Open Money systems.

Numbers, not narratives

The illicit share of all crypto transactions fell below 0.35% in 2024, according to Chainalysis. That’s lower than the UN’s estimate for traditional financial crime, which sits at 2–5% of global GDP.

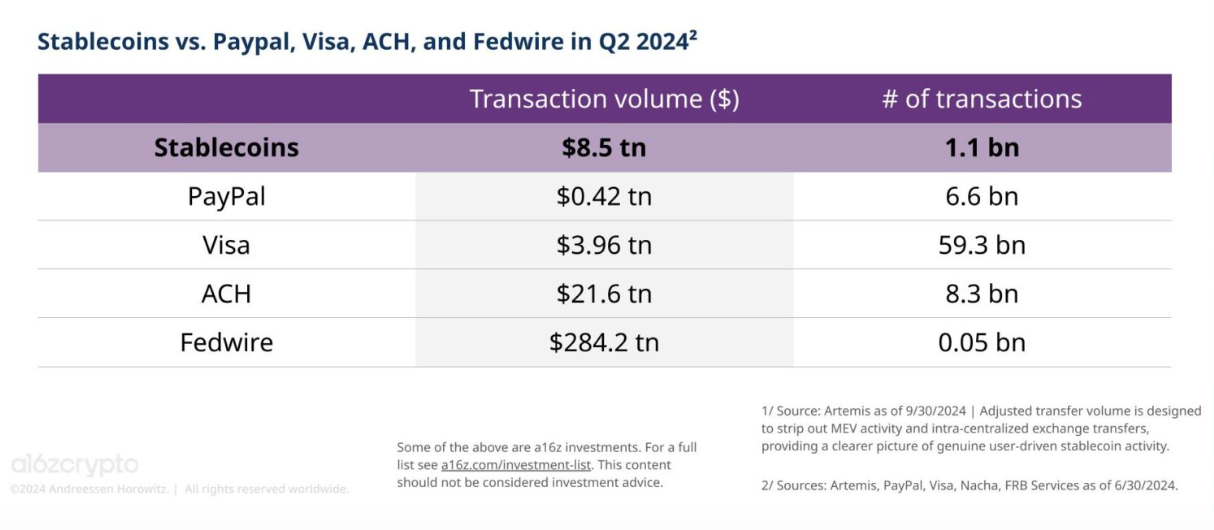

Meanwhile, stablecoin settlement volume topped $8.5 trillion last quarter — more than PayPal’s entire annual throughput. The market isn’t betting on meme coins. It’s voting with block-by-block infrastructure.

And here’s the kicker: unlike traditional financial rails, stablecoins are traceable. Tools like Chainalysis free sanctions scanning tool can flag tainted funds within minutes. Instead of making money laundering easier, stablecoins can make enforcement more precise, more programmable, and less reliant on subpoenas and spreadsheets.

Why Main Street should care

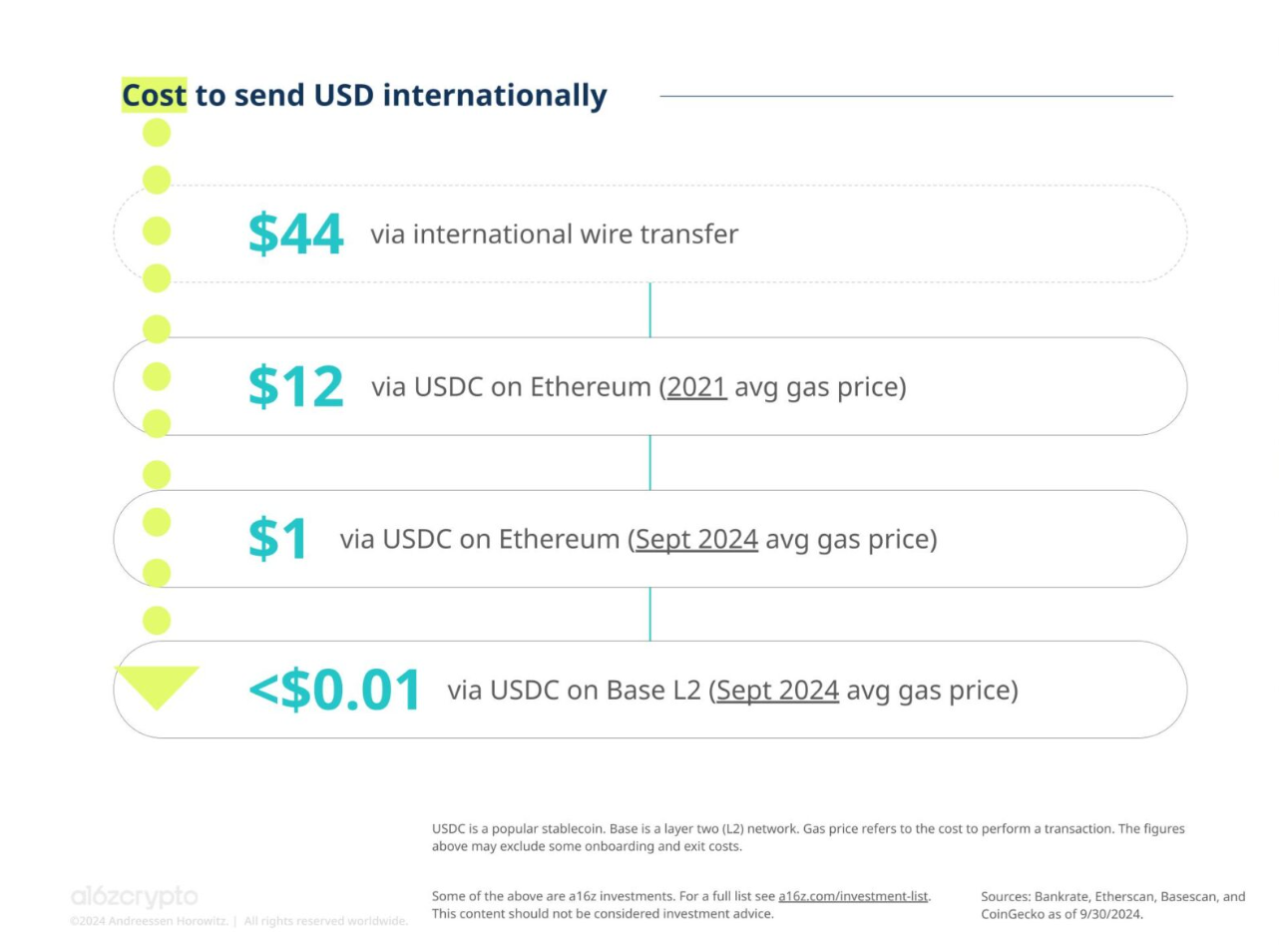

If you’ve ever paid 2.9% just to accept a payment as a small business, this matters. If you’ve waited three days for a bank transfer to clear — even between your own accounts — this matters. If you’ve sent money across borders and watched 8% vanish in fees, this really matters.

In Latin America and the Philippines, USDC-powered remittances already settle in under 30 seconds at costs below 1%. Small businesses in these regions are using QR-based point-of-sale systems that require nothing more than a smartphone and a wallet app.

If you want to reduce tech monopolies, give people well-regulated Open Money infrastructure.

And it’s not just happening at the margins. Freelancers, creators, and contractors are already using stablecoin rails to bypass ACH delays and get paid same-day. That’s not a speculative future. That’s a better financial present — already arriving.

Here’s what’s in the GENIUS Act

Let’s get specific. The GENIUS Act, as currently drafted:

- Mandates fully-backed reserves (cash and T-bills only)

- Requires real-time public attestations and third-party audits

- Segregates user funds in the event of issuer bankruptcy

- Authorizes mandatory kill-switches and a blacklist API for sanctioned wallets

- Creates an FDIC-style wind-down fund — so if a stablecoin fails, taxpayers aren’t left holding the bag

The Senate Banking Committee is scheduled to mark up the bill this Thursday. Expect fireworks over custodial wallet KYC thresholds, especially for small-dollar transactions.

Fear is easy. Building is harder.

There’s a long tradition of dismissing new infrastructure as dangerous before it’s understood — railroads, the internet, even email payments. Stablecoins are just the latest misunderstood upgrade. Yes, they need rules. But they also need vision.

Because the truth is: we don’t get to opt out of the future — we only get to shape it.

The real choice isn’t chaos versus control. It’s closed money — slow, fee-heavy, exclusionary — versus Open Money: programmable, interoperable, transparent by design. Money that moves at the speed of software, not spreadsheets.

The GENIUS Act isn’t a crypto giveaway. It’s a framework for transforming stablecoins into accountable public infrastructure — bringing speed, transparency, and precision to everyone from local shop owners to migrant families wiring money home.

So no, we don’t need more moral panic. We need architecture. We need intention. We need rails that honor both freedom and order.

We want to build a financial system where dollars move like messages, compliance is coded in, and access is permissionless — not because it’s reckless, but because it’s resilient.

Stablecoins aren’t a bug. They’re the upgrade path.