Issue 12: Time to mint an NFT

This issue of the newsletter includes both a 30,000-foot view of why NFTs are important and a very tactical view of how to actually mint one.

It’s likely several factors were behind bitcoin’s price retreat earlier in the week. Headlines included uncertain macro conditions (the Fed said the economy is healthier than it feels). Not only that, but a wallet held by the US government moved $2 billion in bitcoin. Whale moves like that can often cause market jitters.

Another potential explanation for the market volatility is a pre-halving pullback pattern. Historically, the price of bitcoin retreats before the halving, but then rebounds dramatically in the 12-18 months post-halving.

It’s worth noting that the halving is only two weeks away. We’ll get into what the halving is and why it matters in a future issue, but the basic concept is that the bitcoin supply will get cut in half.

This is all pre-planned and pre-programmed, and it’s part of the asset’s scarcity model, which is what will theoretically keep driving the price up…forever. It’s easy to overcomplicate this, but it all comes down to basic supply and demand.

In other news, despite the broader market chop, the memecoin market continues to surge and draw more attention and “investors.” Notably, and sticking with the BTC-heavy theme, a meme coin has launched on Bitcoin, which is probably driving some maximalists insane.

The coin, called pups, leverages the recently created BRC-20 token standard. There’s not much in the way of overall utility, but the issuance using the new token standard is novel or at least noteworthy.

Not only that, but the pups marketing approach is pretty straightforward:

NFT, an introduction

Over the past few weeks, I’ve been trying to move more and more onchain. Along the way, I’ve been documenting some of these activities while trying new apps and services.

The process of moving onchain hasn’t been all smooth. I’ve hit some bugs and obstacles along the way, but so far nothing insurmountable. The slight bit of friction (like things not working the way that’s expected) is just a sign that we are still early on a lot of this stuff. While this tech is ready for deployment, it might not be dialed for mainstream access yet.

I did have one big lightbulb moment. I realized that non-fungible tokens or NFTs will play a massive role in the move onchain. This is the kind of thing that might sound obvious when you say it out loud, so let me back up.

Check out one of this week's posts about NFTs.

Before my recent onchain experiments, I largely dismissed NFTs as a niche kind of asset class. I mean the idea of digital collectibles, supporting digital artists, and building in digital scarcity all had an appeal. But I also felt like NFTs probably had a limited role in the future of open money.

Another thing that informed this view is that there were some barriers to operating in NFTs in the early days — mainly the fees required to mint or transfer NFTs.

But the more I move onchain, the more I realize that I was wrong about NFTs — or at least wrong about them being just a narrow asset class. More recently, I’m starting to understand that the ability to create, mint, collect, and share NFTs will become a key piece of onchain infrastructure.

On one hand, the NFT model fits the whole “Read Write Own” moment. In their simplest form, NFTs make it possible for anyone to create and “own” digital data.

But the other thing that I’ve realized about NFTs is that they are way more multifaceted than I originally thought. Everything from token-gated media, event ticketing, group membership, and collective ownership, among many other possibilities, are all enabled by the ability to quickly and cheaply create and interact with NFTs.

Worth a mint

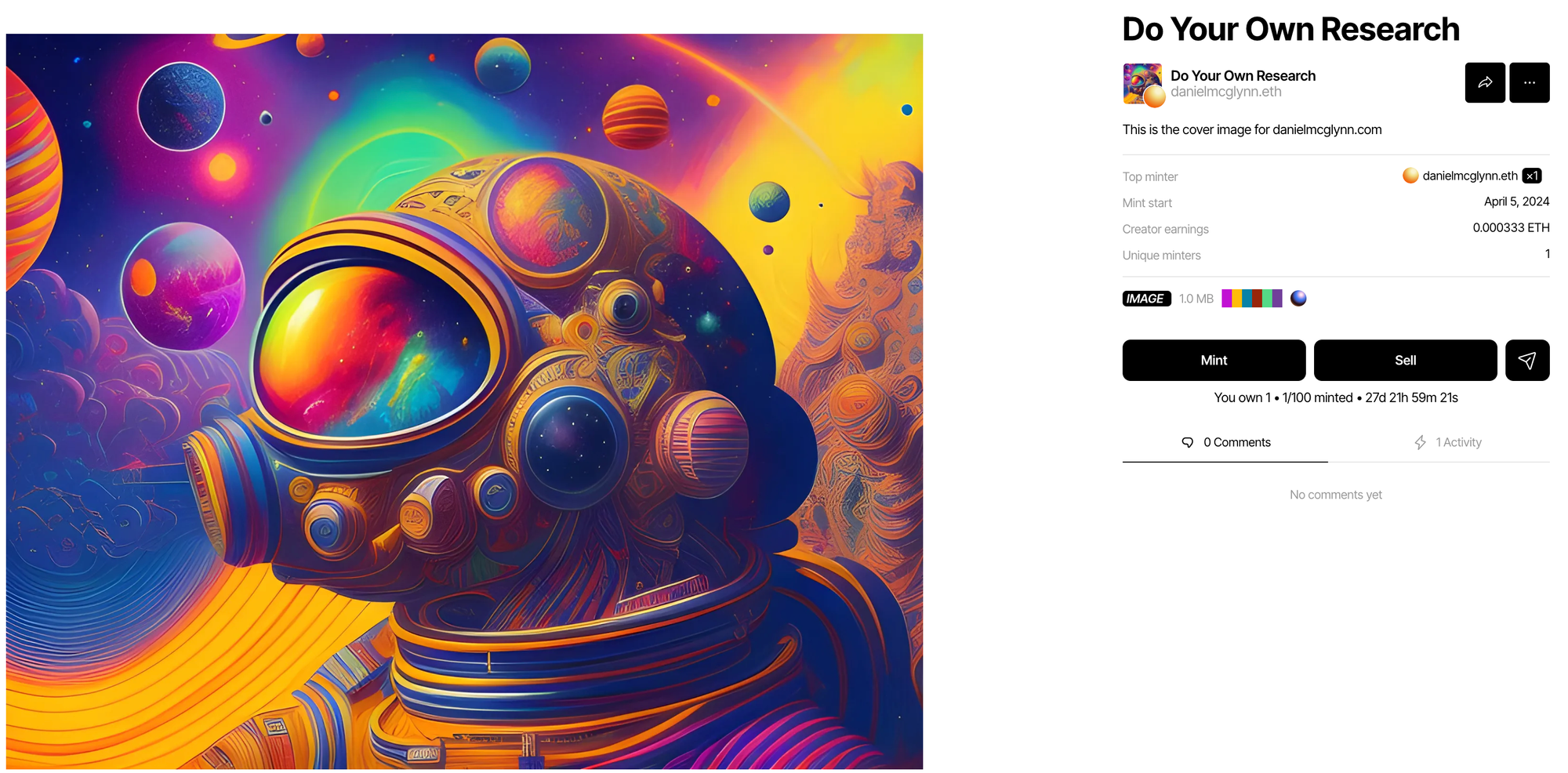

To learn more about the non-fungible token process, I started using Zora, a network that makes it easy and cheap to create and mint NFTs.

More background about Zora and how it works.

It only took a couple of steps to go from connecting my wallet and creating a profile to creating and minting an NFT. Here’s the result, which is the cover image for this site:

The greatest part is that it only cost a few cents to mint, which is way better than only a couple of years ago where both the fees and the general NFT minting setup were more intensive.

While I don’t see myself getting into the digital art business (but who knows?), I do like the idea of participating in more onchain activities, and I can see now how integral of a role NFTs will play in that experience.

My prediction is that creating and minting NFTs will become way more common, like as common as posting to social media is today. Eventually, we will create NFTs for all kinds of things — we mentioned earlier games and workouts, but I think NFTs will play a role in most internet-related tasks.

Not to get too dramatic here, but I think the timing of easier-to-use NFTs and the emergence of generative AI are important. Soon the practice of proving data provenance — no matter how simple — will be way more important and way more valuable.

More to come with the moving onchain series.

Until next week,

PS. Constructive feedback is welcome. The best place to reach me is @danielmcglynn on X and Warpcast.