What is liquid staking? + Liquidity staking derivatives explained

Liquid staking allows people to participate in staking a network, but to also have access to the value of the underlying stake.

Liquid staking allows users to participate in a proof-of-stake network without having to run a full validator node.

Ethereum’s recent successful Merge, which enabled proof-of-stake as a consensus mechanism has made it possible for people to participate in staking — and the potential to earn staking rewards for running a validator node.

But running a full node comes with a big risk, and a big upfront cost (in the case of Ethereum, running an independent validator node requires 32 ETH). The development of liquid staking protocols within DeFi allows users to come up with a fractional stake by pooling resources with others.

So let’s say that you have 2 ETH that you are holding longterm, but you’ve heard about liquid staking and you want to try and earn some yield. If you deposit your ETH in a liquidity pool, your deposit will become a liquidity provider token (LP).

Once in a liquid staking pool, you will be given a liquid staking derivative token (LSD) in a 1:1 ratio for the amount of LP tokens you contributed. In other words you might start with 2 ETH as your LP token, use a platform like Lido Finance to join a liquid staking pool, and then get 2 stETH in return for joining the pool.

While the original contribution of the 2 ETH are locked up in the liquidity, you can turn around and use the 2 stETH in another DeFi app.

When you want to withdraw you original LP tokens from the staking pool you would lock up your stETH, which makes the original ETH available to move again.

The purpose of liquid staking derivative tokens is to allow people to both stake their LP tokens and also have some level of access to those tokens while staking.

Done right, or under the right conditions, LSDs open the potential for participants to earn interest while staking and potentially find ways to make some yield elsewhere using DeFi protocols for things like yield farming or lending and borrowing.

Of course, there is a risk of losing the LSDs while looking for yield, especially if market conditions take a downturn.

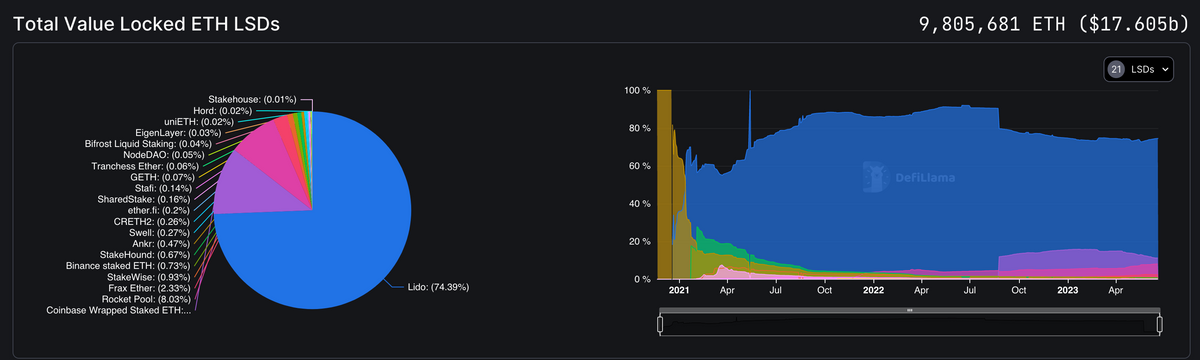

It’s worth noting that liquid staking derivatives have become a huge part of the DeFi market, making up ~20 percent of the total value locked (TVL) across all DeFi protocols, but with the majority of LSD activity attributed to Lido.