What is APY in crypto and DeFi? | DYOR

APY in crypto or DeFi is short for annual percentage yield. APY is a somewhat standard metric for measuring the potential return on investment (ROI) of a crypto asset or DeFi project during one year.

APY in crypto or DeFi is short for annual percentage yield. APY is a somewhat standard metric for measuring the potential return on investment (ROI) of a crypto asset or DeFi project during one year.

The reason APY is used as standard predictive growth metric is that calculates how an investment will compound over one year if the original investment is kept in the market and any yield, interest, or earnings on that investment are re-invested with the principal over the course of a year.

APY is generally a pretty straightforward money metric and has its roots in things like standard savings accounts, money market accounts, or certificates of deposit that are found at traditional banks.

The big difference between crypto APY or APY in DeFi when compared to traditional financial instruments is that DeFi products especially have the potential to grow drastically in a year under the right market conditions. It should be noted that the opposite is also true and DeFi products can also lose a lot of money in a year under other kinds of market conditions.

Why is APY in DeFi such a thing?

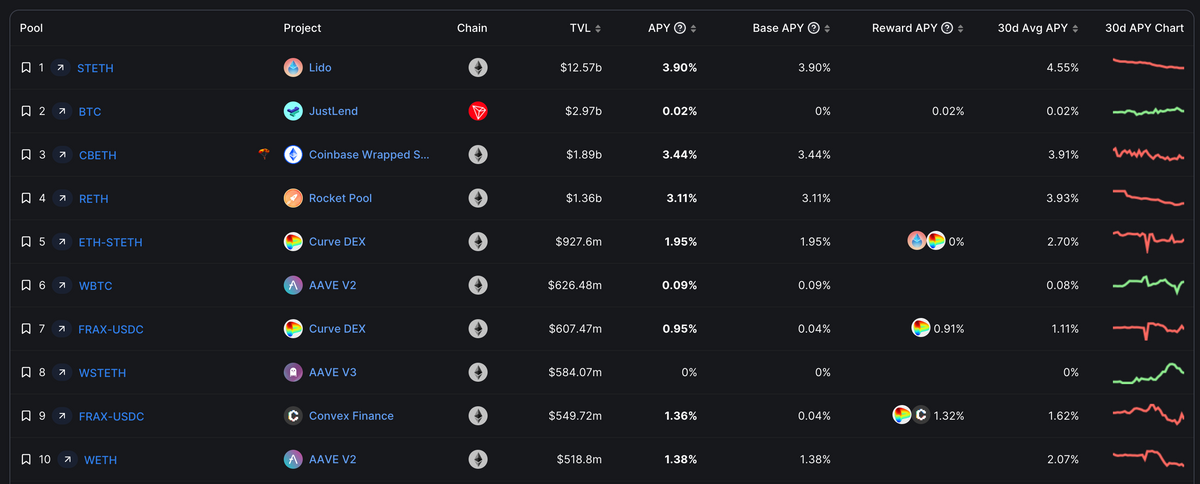

One of the most dominant uses cases for decentralized finance or DeFi is new ways to generate yield on financial assets. Often within DeFi yield comes in exchange for liquidity or pools money that are used for a variety of functions across the DeFi space.

Here are a couple examples of where APY might come into play and how offering yield helps:

Yield farming: Yield farming in DeFi is the practice of providing assets (or liquidity) to a decentralized exchange and then getting tokens, rewards, or interest on the principal. Yield farming incentives are often calculated (and marketed) using APY as the metric. Sometimes — especially during heated market conditions — yield farming APYs can get extreme.

Staking: Staking a crypto network often involves locking up assets native to the blockchain being staked in order to participate in the running of the network (check out this proof-of-stake backgrounder for more). Staking involves locking up assets for a certain period of time by joining a staking node and in return earning interest on the staked amount. The interest earned as part of a staking node or staking pool is also often described as APY.

Lending and borrowing: Basic lending and borrowing services are also available on DeFi protocols. Often lending and borrowing is a front-end thing and on the backend DeFi products are using the liquidity to support other objectives, which is why they can offer a yield in return for lending or borrowing. In a lot of ways, this is very much like the activities of a traditional bank. But, it’s also important to note that a lot of the lending and borrowing crypto apps had major problems — including freezing customer access to their funds.

Governance tokens: Another way that DeFi providers are offering yield is by incentivizing activity or participation in how a platform or protocol is managed. APY on governance tokes is often higher at the beginning of a project — or during the initial stages of adoption.

Why does APY in crypto feel like a default metric?

There are a few reasons why APY seems to be such a popular metric in crypto and DeFi.

The first reason is that people are already familiar with APY from the traditional financial world of banking and savings products. So applying an already familiar metric to new kinds of financial products and services makes intuitive sense.

Another reason for the widespread usage of APY is that in some ways it provides an easy-to-use standard to compare the yield and incentives across all kinds of financial products, which can range from traditional savings accounts to the latest DeFi protocols.

Lastly, APY is a helpful metric for understanding how investments can compound over a year. This can become a useful yardstick for trying to understand the longer term impacts of holding one investment. Since APY generally calculates what would happen if any earnings are reinvested during the year with the principal, it helps an investor understand the yield over time.

Final note about APY in crypto and DeFi

It can’t be overstated there is a correlation between APY or yield and risk. Often the higher the APY offered by a DeFi protocol or crypto project, the higher the risk.

So, while looking at APYs, it’s also important to understand why the APY or incentive is being offered, and why the rate is so high? Most times, projects with high APYs are using investors assets to offer liquidity elsewhere, which entails risk.

Also, APY-generating projects are often really attractive when markets are moving up, or during bull runs, but can also be volatile or move down during times of market volatility or when markets are trending down. So a “set it and forget it” approach to services and products that offer high APY can be risky when there are dramatic market moves.