DYOR: An introduction to how and why to "Do Your Own Research"

The good news is that the ability to perform really solid crypto asset research is becoming easier — or at least more straightforward.

The need to Do Your Own Research or DYOR is used a lot in crypto and DeFi communities, but the processes or methodologies to build sound DYOR strategies are seldom outlined or explained.

In this post we’ll look at some of the basics of DYOR and start to uncover opportunities to learn more.

Jump to

What does DYOR in crypto mean?

DYOR means “Do Your Own Research.”

Within the crypto context, the concept refers to evaluating assets and projects to try and get a handle on their viability and/or performance.

Since the very early days there’s been a mantra in the crypto space to DYOR. But what does that look like?

In traditional financial markets there are professional disciplines dedicated to performing deep-dive analysis on various kinds of assets. There is also a long traditional of using data to gain insights about how markets might behave during different kinds of economic conditions.

In some cases this professional research and deep-dive analytics is also packaged up (or at least accessible) for public consumption. If you search the ticker for a publicly traded company, for example, a ton of relevant financial information is available right at your fingertips.

That’s not really the case with crypto — or at least not yet. But the good news is that the ability to perform really solid crypto asset research is becoming easier — or at least more straightforward.

For years, crypto insiders would tell people coming to crypto markets for the first time to “Do Your Own Research” without much in the way of guidance or instruction. That combined with a poorly-defined informational landscape meant that “Do Your Own Research” was basically a euphemism for figure it out yourself.

In a lot of ways, the early days of figuring it out yourself was fun and exciting — it was a little bit like being a detective and a little bit of interpretation or inference. But as the markets become more mature and more dynamic, it’s getting harder to stay on top of trends, movements, and opportunities.

Today, there are some really interesting tools that can help with DYOR. Not only does it make the entire process of doing your own research easier, but the ability to take deeper dives and to look at what is actually happening on individual blockchains (aka “on-chain”) is pretty amazing in terms of overall transparency and accountability.

These new on-chain DYOR capabilities are and not something that existed even a few years ago.

Historic phases of DYOR

Community news: In the early days of crypto, much of the news and analysis about crypto came through word-of-mouth or was shared among very niche audiences who were early adopters. The Bitcoin Forum is one great example of how early crypto news and “research” was shared.

A decade ago, it made sense that there would be little in the way of easily accessible information about digital assets. For some time, Bitcoin was the only asset available to use and for several years it didn’t even really exhibit all of the attributes of a new market class

Peak TA: Lots of market analysts still use TA or technical analysis to try and predict market movements. But there was a time, a few years ago, when it felt like the crypto TA analysis had taken over. Everywhere you turned, it was like people were posting TA charts, all drawing different conclusions.

There were a few issues with the crypto TA-mania. The first is that TA is one of those art and science kind of disciplines. And sometimes the art-part of evaluating financial assets can lead to wrong conclusions. The second reason is that TA solely focuses on price movements of an underlying asset, which might work fine for traders. But to get a deeper understanding for longterm investors (or even for people who are curious about how the tech works) requires a different set of tools.

Twitter and the rise of crypto-specific media: Rising from the very niche, very community-driven crypto media came the rise of crypto Twitter (and other social channels). While crypto social media was great for sharing info and adding more context and commentary to the latest developments in the space, getting all of your news from social media does have its unique set of issues.

The biggest downside to crypto-specific social media is that it created a sense of tribalism with crypto insiders developing followings and staking out specific positions to stay on brand. More recently, as the crypto social media scene becomes more fragmented, there is a noticeable echo chamber effect happening, with only certain hot takes making it to the surface.

During this time, crypto-specific media started to launch sites and podcasts. These media outfits are good for providing info and especially good at helping people curious about crypto get up to speed. The crypto media space is still developing and maturing, but one critique of the budding landscape is that it is too close to the industry with lots of money to spend on advertising and PR. The closeness could hamper objective reporting.

On-chain analytics: New apps, services, and platforms that allow for users to look at on-chain activity are the latest (and the most useful) in the DYOR realm. The greatest thing about looking at on-chain analytics is that it helps boost the overall utility of the underlying signal. Looking at on-chain data is like going directly to a source or looking at primary info.

The one drawback to looking at on-chain data is that there is a learning curve required, or the need to invest some time to figure out how to use the tools for research to support an investment thesis or to come up with new ideas or strategies.

DYOR basics

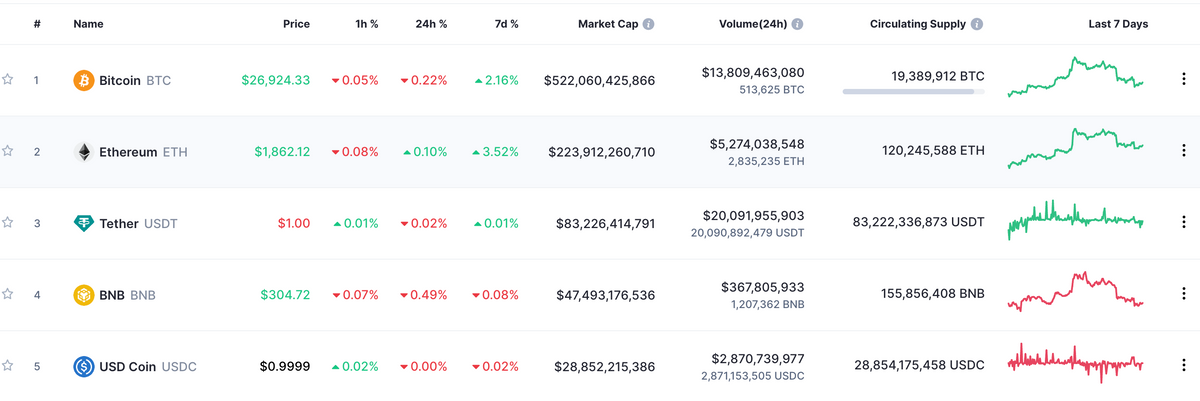

The first basic step in a simple DYOR framework would be to have a basic understanding of how traditional financial assets are evaluated and what some key metrics are. Terms like market capitalization, earnings and revenue, and the basics of supply and demand are some examples.

The second basic step is to familiarize yourself with some important crypto valuation metrics and how they are similar or different to traditional financial market research. Some of the terms like market capitalization and earnings/revenue will be the same. Other terms or metrics such as staked assets or token trading volume will be different.

The third basic DYOR step is to understand where financial markets and crypto/DeFi markets differ, why those differences matter, and the key metrics involved. Terms like total value locked or developer activity become important metrics when trying to evaluate the health and performance of a project as a network and not just simply as a financial asset.

Since a lot of the overall value of a crypto of DeFi assets comes from network effects, understanding how to look at network metrics, like total active users, and how those metrics relate to overall valuations.

One way to think about some of the basic financial or basic network concepts is that they are like building blocks. The more building blocks you can put together, the higher resolution model you can build. And as the resolution of the model improves, then comparing and contrasting that model with other models becomes easier and starts to make more sense.

Why learn how to crypto DYOR?

The point of creating DYOR resources on this website is to help highlight some of the new tools and services that let users actually look at on-chain activity and to get a better handle on what is happening in the crypto and DeFi world right now.

Understanding how to look on-chain for insights and to evaluate asset performance or figure out what is happening in the markets is now really accessible — and learning how to do this will be a lot like figuring out how to read and analyze traditional financial statements.

Just like there are a lot of interesting reasons to jump into the crypto and DeFi market, there are a number of reasons to understand the crypto DYOR tools available and how to use them. And that’s what will do with future posts. I’ll start tagging anything Do Your Own Research-related with a DYOR tag.