What is market cap in crypto? | DYOR

Market cap is a basic financial metric used across all markets and describes the value of a particular cryptocurrency. Part of the reasons why market cap is useful is that it also provides a uniform ranking system.

Market cap, or market capitalization is a key metric used to quickly evaluate the performance and position of a cryptocurrency relative to other assets in the market.

While market cap is useful from a high level when trying to compare and contrast different crypto projects, it is also sometimes misused as the only metric needed to evaluate growth and potential.

Nevertheless, understanding what market cap is in crypto and the role it plays is helpful — and looking at market cap is a good first order metric to use when starting to Do Your Own Research.

Understanding crypto market cap

Market cap is a basic financial metric used across all markets and describes the value of a particular cryptocurrency. Part of the reasons why market cap is useful is that it also provides a uniform ranking system.

In other words, by using market cap, we can stack rank cryptocurrencies based on valuation. Using the market cap method, we can say bitcoin is number one by market cap, ether is number two by market cap, etc.

A cryptocurrency’s market cap (or all market capitalizations for that matter) is found by multiplying the current price of the asset by the total number of that asset in circulation.

Here are a few examples of cryptocurrency prices by market cap (market info as of June 7, 2023)

| asset | price | circulating supply | market cap |

|---|---|---|---|

| Bitcoin (BTC) | $26,655.76 | 19,395,375 | $516,998,399,562 |

| Ethereum (ETH) | $1,858.65 | 120,231,505 | $223,320,817,377 |

| USD Coin (USDC) | $1.00 | 28,636,311,327 | $28,636,311,327 |

| Cardano (ADA) | $0.3334 | 34,896,249,855 | $11,606,207,474 |

| Dogecoin (DOGE) | $0.06767 | 139,668,116,383 | $9,451,906,134 |

One thing about the crypto market cap that should jump out right away by looking a the table above is that they price of individual crypto assets — as well as the total circulating supply — can vary widely. But by finding the product of price and circulation then we find an easy means of comparison.

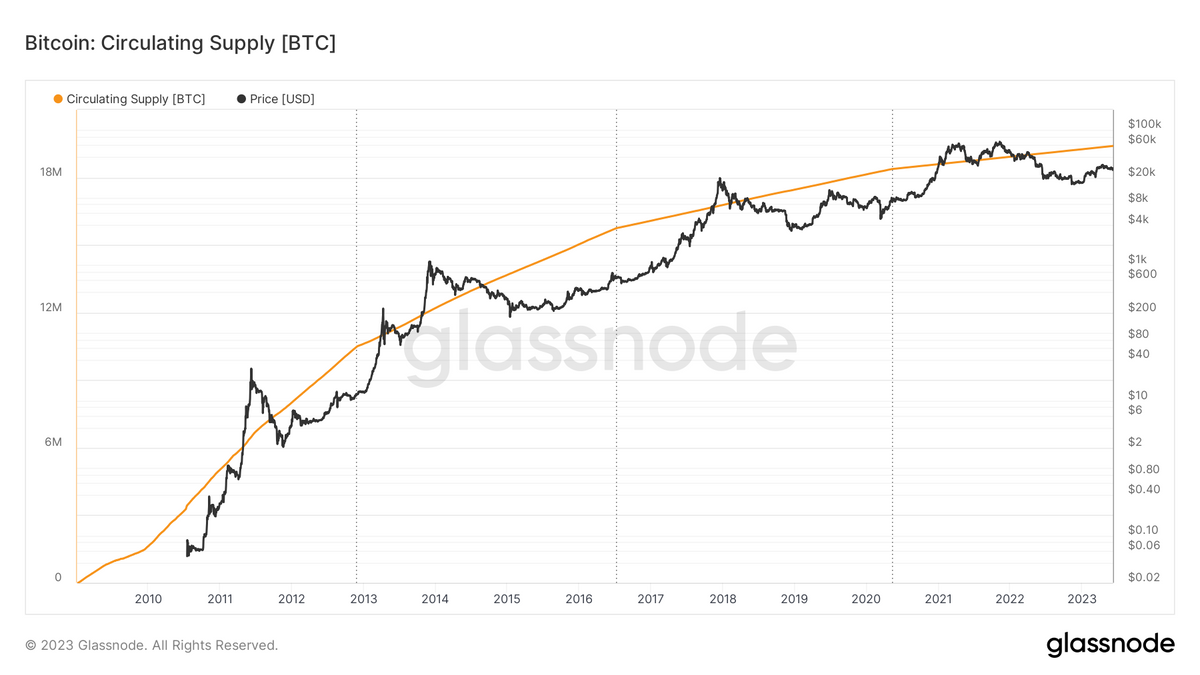

With cryptocurrencies specifically, market cap is kind of a directional indicator because the total circulating supply for many assets is not precisely known. Using bitcoin as an example, some BTC are lost or irretrievable, while others are controlled by a wallet and they haven’t moved in years (so it’s unknown whether they are lost or just in deep cold storage).

Why understanding market cap is important when evaluating cryptocurrencies

Understanding market capitalization provides a simple way to understand a method of deriving a high level valuation.

Market cap provides a great entry level set of data points to start some basic crypto analysis.

Beyond market cap other important metrics include total number of active users, or active address, network strength, transaction fees, and active developers — as just a few examples.

The important thing to keep in mind about cryptocurrencies in general is that these assets are in some regards similar to traditional assets in the way they can be valued or the way they behave in different kinds of market conditions. But they are also information networks that have other kinds of values or interesting metrics outside of just price multiplied by circulating supply.

Tools to use for finding crypto market cap

There are a number of places to dive deeper into crypto market cap. In fact, there are entire websites with dedicated methodologies that have cropped up to capture and report market cap as the crypto markets continue to mature.

- CoinMarketCap is considered one of the oldest crypto market cap tools and at one time most well-trafficked sites in the crypto space. The platform can help drill down deeper into market trends and research.

- CoinGecko is similar to CoinMarketCap in that its primary function is to report crypto market data. There are also additional layers of information that allow visitors to drill deeper into individual asets.

- Kryptview is another resource that packages market cap data along with educational resources.

- Messari’s screener tool gives visibility into market cap as well other useful metrics such as real volume in the last 24 hours.

- CoinDesk has an indices tool that provides market cap and market volume metrics. Additionally, the market information can be filtered on different sectors of segments such as “stablecoins” or “DeFi” or “Smart Contract Platforms.”

Market cap, circulating supply, and fully diluted market cap

One really important component of crypto market cap calculations is the circulating supply.

Cryptocurrencies and digital assets are different than some traditional assets in that the supply dynamics can vary widely.

Some cryptocurrencies like bitcoin, for example, have a fixed supply with a known issuance schedule. There will only be 21 million bitcoin ever produced and the last BTC will be issued sometime around 2140 (after that the network will continue to exist and be supported by transaction fees).

Meanwhile, an asset like Dogecoin has an unknown future supply. That means the overall scarcity and economics of doge versus bitcoin are way different.

One way to use market cap as a predictive metric is to calculate the fully diluted market capitalization. This metric is the product of the current price and the future supply. It helps directionally show what the future market cap of a cryptocurrency could be once all of the supply is issued.

Calculating the fully diluted market cap gets a little complicated because the future supply of some crypto projects can change over time as the underlying economics change.

Nevertheless, the fully diluted market cap metric is useful for providing a directional calculation that shows what a future valuation could look like.