When markets break, bitcoin blinks back

As global markets stumble under geopolitical weight, bitcoin holds steady. Is this the beginning of a long-awaited decoupling — or just a pause before the plunge?

Hang around the crypto scene long enough and you’ll eventually come to a sobering realization: for crypto assets to truly flourish, something big has to go really wrong.

Why? Because for most people, the traditional financial system works well enough. It’s easy to get paid, send money, and save for major life milestones: a down payment on a house, a college fund, or retirement. These are the core financial goals that shape how most people think about money.

Framing crypto as a better way to handle personal finance is a hard sell. Concepts like privacy, self-sovereignty, digital identity, and efficiency sound appealing, but they often take a backseat to the day-to-day reality of paying bills and stretching paychecks.

An economy built on cryptographic proof instead of political policy might sound extravagant...until faith in the existing system starts to crack.

As long as financial stability is taken for granted, alternatives tend to sound like unnecessary risks.

It’s hard to pitch a new system to billions of people when the current one is still delivering, more or less.

But what happens when the foundation shifts?

When the status quo is suddenly disrupted, people start looking for alternatives.

Non-correlated assets, or at least assets less entangled with the vulnerabilities of traditional markets, begin to attract fresh attention.

When big shocks hit, the alternative stops looking fringe.

It starts looking like insurance.

What I’m getting at is this:

The recent use of the global free market as a political weapon has become a real-time, global-scale demonstration of why bitcoin — and by extension, crypto — matter.

Now the big question is whether bitcoin can actually perform like an uncorrelated asset in the face of systemic stress.

If it can, it will reinforce its value proposition in a tangible way — and potentially appeal to a much broader audience.

If it can’t, it risks being lumped in with speculative tech stocks, reacting to macroeconomic swings rather than offering refuge from them.

Quick context

Bitcoin was born in the depths of crisis. Launched in January 2009, its genesis block famously includes this embedded message:

“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

A direct reference to the financial chaos and the bank bailouts of the time.

Fast-forward to its second global stress test —the 2020 pandemic.

Bitcoin initially fell with broader markets, then roared back. That rebound was powered by aggressive government stimulus and a halving event that restricted new supply.

But today’s crisis is a different.

This isn’t a natural disaster or a virus — it’s a manufactured, politically- driven economic disruption.

Its objectives are unclear. The tools are risky. And the consequences? Likely brutal.

Is this time different?

So, how will bitcoin perform this time?

We’re still early in what could be a long and messy reordering of the global financial system.

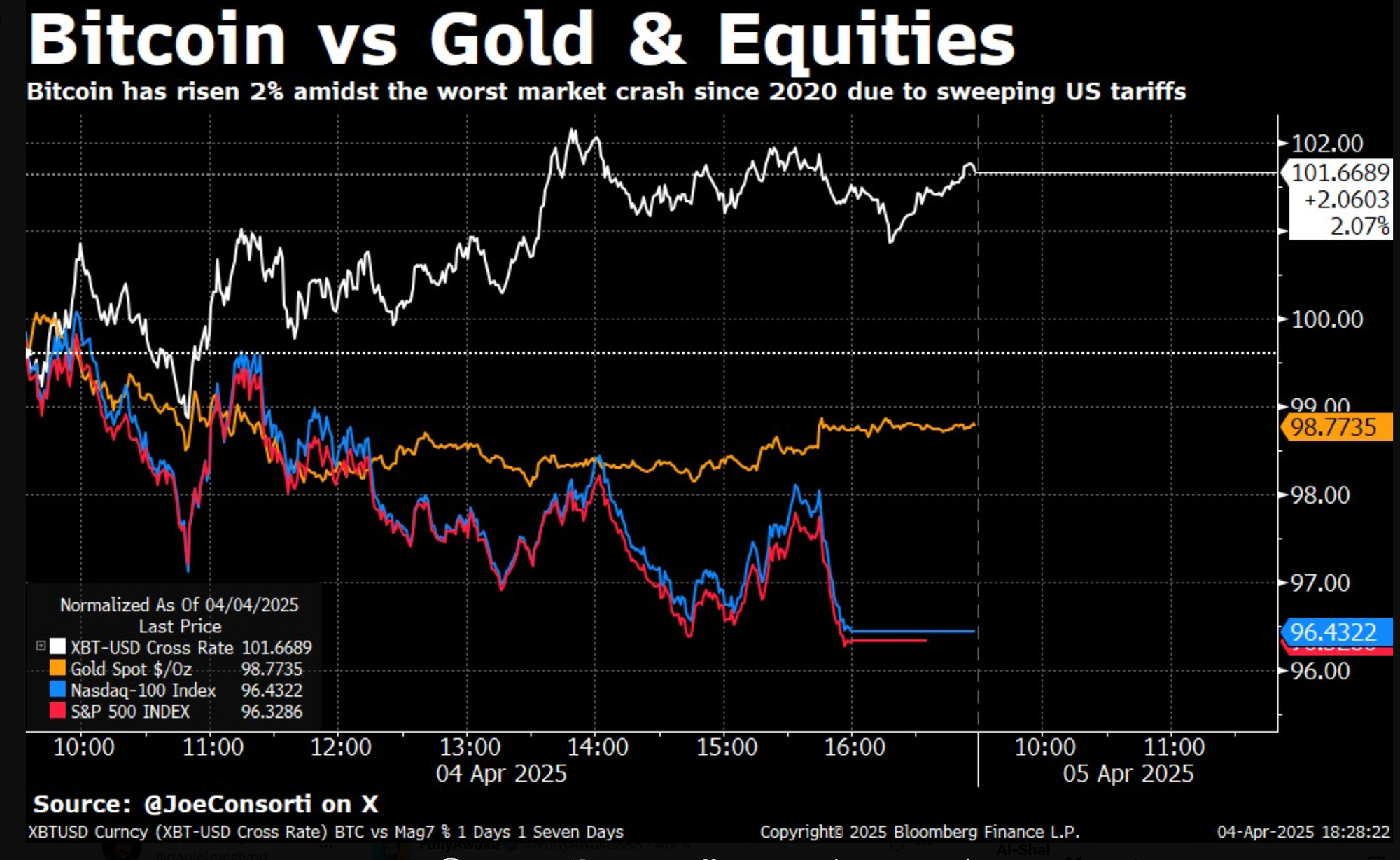

But last week delivered a historic shock:

Global markets shed trillions in value in under 48 hours.

And bitcoin? It stayed surprisingly stable.

That’s sparked conversation:

Is this the long-awaited decoupling?

Could bitcoin actually rise while everything else falls?

It’s too early to call. The data isn’t conclusive. But the setup — the alignment of conditions — demand attention.

Update on the Open Money Project

Like many of you, I spent a good chunk of this week watching markets react to the tariff news and the broader unraveling of what used to feel like a stable world order.

That meant I didn’t make as much progress on the Open Money Project as I’d hoped.

Ironically, though, we’re now working on the part that feels most relevant to everything happening: the real-world use cases.

This is where we’re exploring how Open Money can help address some of the deeper issues around how money, identity, and information work on the internet — and why those systems need to be more resilient, open, and user-owned.

In light of this week’s volatility, it’s a strong reminder that these aren’t just abstract ideas. They're the foundation for what comes next.

As always, feedback is welcome.

RECENT POSTS