Gold moves onchain and joins the race for neutral money

Gold tokens like XAUT and PAXG are booming in 2025. What’s driving demand? And how does gold fit into the future of digital money.

Stablecoins gave dollars 24/7 legs. Tokenized treasuries slapped a yield on them. Gold tokens? They’re giving a 5,000‑year store‑of‑value a refresh and move it onchain.

If you blinked this spring, you might have missed gold’s quiet re-entry into the conversation about the value of hard money — not through vault doors or central banks, but via smart contracts and wrapped metal.

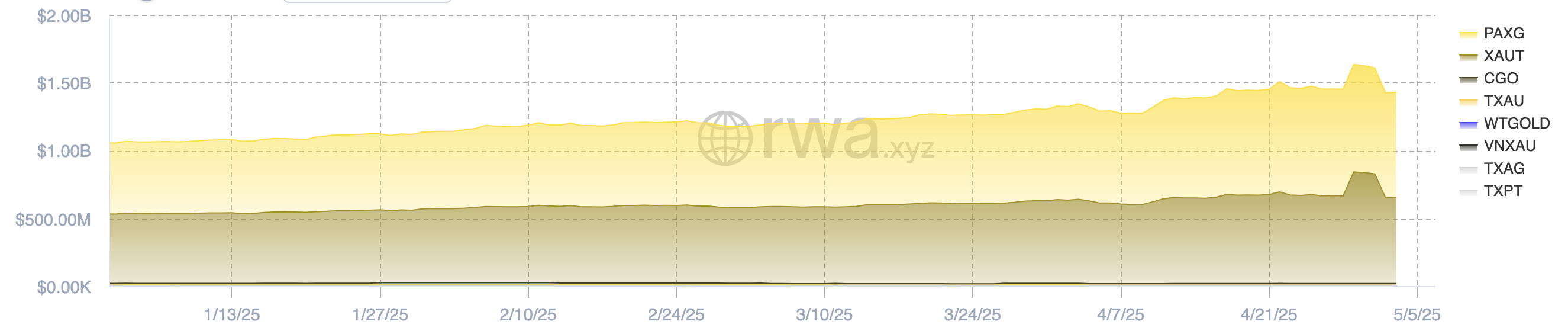

Tether’s latest quarterly attestation landed like a glittering inflection point: 7.7 metric tons of vaulted bullion now back its XAUT token, worth $770 million at today’s prices. That makes it the largest on‑chain gold product — nearly half of the $1.61 billion tokenized gold market.

For all the noise around tokenized treasuries — $6.16 billion in TVL, headlines, and yield-hungry liquidity — tokenized bullion is now the fastest-growing commodity segment in crypto. In the past 30 days alone, the gold-token market cap surged 22%, outpacing treasury wrappers in relative growth.

Gold’s algorithmic afterlife

For millennia, gold’s allure has been mythic: a universally recognized store of value, immune to political whim, slow to move, and costly to guard. Now, it rides on Ethereum rails, zipping between protocols, available around the clock. It can sit as collateral in DeFi, be swapped across chains, or, in theory, redeemed for a kilo bar — if you happen to be in Zurich or London and meet the 430‑token minimum.

The wrinkle is this: these tokens are not just shiny new wrappers. They’re a conceptual remix of money itself.

We’ve written before about tokenization as a language for expressing real-world assets in programmable terms. Treasury tokens translated state-backed yield into composable DeFi logic.

Following a similar path, gold tokens translate trustless scarcity into cryptographic liquidity.

The macro mood: inflation, war, and a wobbly dollar

Gold’s recent price surge — up 24% YTD, brushing against $3,200 an ounce — isn’t just a technical move. It’s a reflection of monetary anxiety. Sticky inflation, geopolitical tremors, and dollar debasement fears are fueling both retail and institutional demand. Central banks themselves are stacking bars: over 1,000 tons bought for three straight years, reinforcing a creeping de-dollarization narrative.

Crypto-native investors, meanwhile, are sniffing the same wind — and responding in kind. If you’ve already embraced BTC’s volatility and ETH’s yield games, XAUT and PAXG offer a familiar volatility profile with a different philosophical underpinning than say dollar-backed or treasury-backed stable coin reserves: non-sovereign stability.

Stablecoin fatigue and the search for neutral ground

Stablecoins solved one half of the problem — the around-the-clock liquidity problem — but not the other half: trust in the peg. While dollar‑backed tokens dominate on-chain, their backing instruments (short-term treasuries, commercial paper, reverse repos) are exposed to monetary policy and regulatory overhang.

Gold tokens sidestep that. They peg not to policy, but to geology.

There’s no Fed risk. No rate cut angst. No bank-run contagion. Just the physics of scarcity and the liquidity of code. And in a year where political cycles are fraying global consensus, that neutrality is attracting capital.

Treasuries vs. tokens: different hedges, different hearts

Still, there are trade-offs. Tokenized treasuries yield a solid 4–5%, pay out in USDC, and boast frictionless redemption. Gold tokens yield nothing, carry storage fees, and require (mostly fictional) physical pickup logistics. If you’re hunting yield, treasuries still remain the best option.

But gold isn’t about yield. It’s about narrative durability.

It’s the original hard money meme — ancient, borderless, and sovereign-less. For investors seeking a hedge not just against inflation but against institutional fragility, tokenized bullion reads like crypto’s latest retread of a time-tested idea.

And the infrastructure is catching up. XAUT, PAXG, and a handful of smaller entrants are now swappable, composable, and (almost) frictionless across L2s and DeFi.

Open money and the idea of neutrality

One of the goals of Open Money is to think more about what constitutes neutral money: forms of value not owned or issued by a single nation, bank, or company.

Bitcoin pioneered that model in software. Gold pioneered it in matter. Tokenized gold attempts to merge the two — a monetary artifact that carries the physics of scarcity and the logic of composability.

That’s why this shift matters. Gold tokens don’t just diversify DeFi portfolios. They widen the spectrum of what money can mean onchain.

It also connects directly to the themes we explored in our last issue on tokenization: the transformation of "real" assets into programmable, interoperable primitives.

In a times of increased risk, uncertainty, and increased fragmentation, there’s something interesting happening with the old hard money meets new hard money story that is resonating.

Recent updates to the Open Money Project

In the most recent section of the Open Money Project we are still using comparisons and analogies to help illustrate some of the benefits and tradeoffs of the Open Money system versus more legacy systems.

The next part of the project will be to take a deeper dive into some of the risks of Open Money and try to get a better understanding of what those tradeoffs look like.