What is TVL? Total value locked explained | DYOR

TVL, or total value locked, is a quick way to compare the utility of different kinds of DeFi protocols.

Total value locked (TVL) is an important metric used to quantify and compare the size and scope of different DeFi protocols. TVL is a quick way to combine all of the different kinds of assets that are using the protocol (this could be stablecoins, smart contracts, or staking activities. TVL is often reported in USD, which makes comparing different DeFi projects more standardized.

Calculating TVL is pretty straightforward. The metric is the sum of the different kinds of assets locked on the protocol multiplied by the current market value for each asset. Those totals are then added up to come up with the TVL.

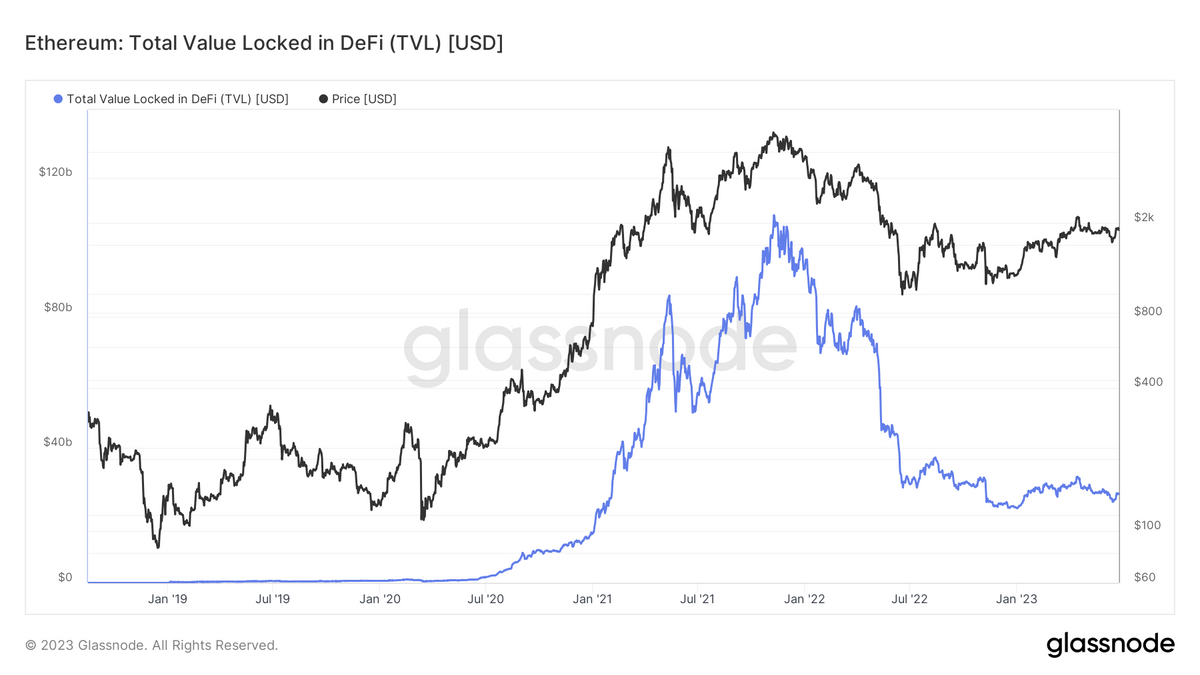

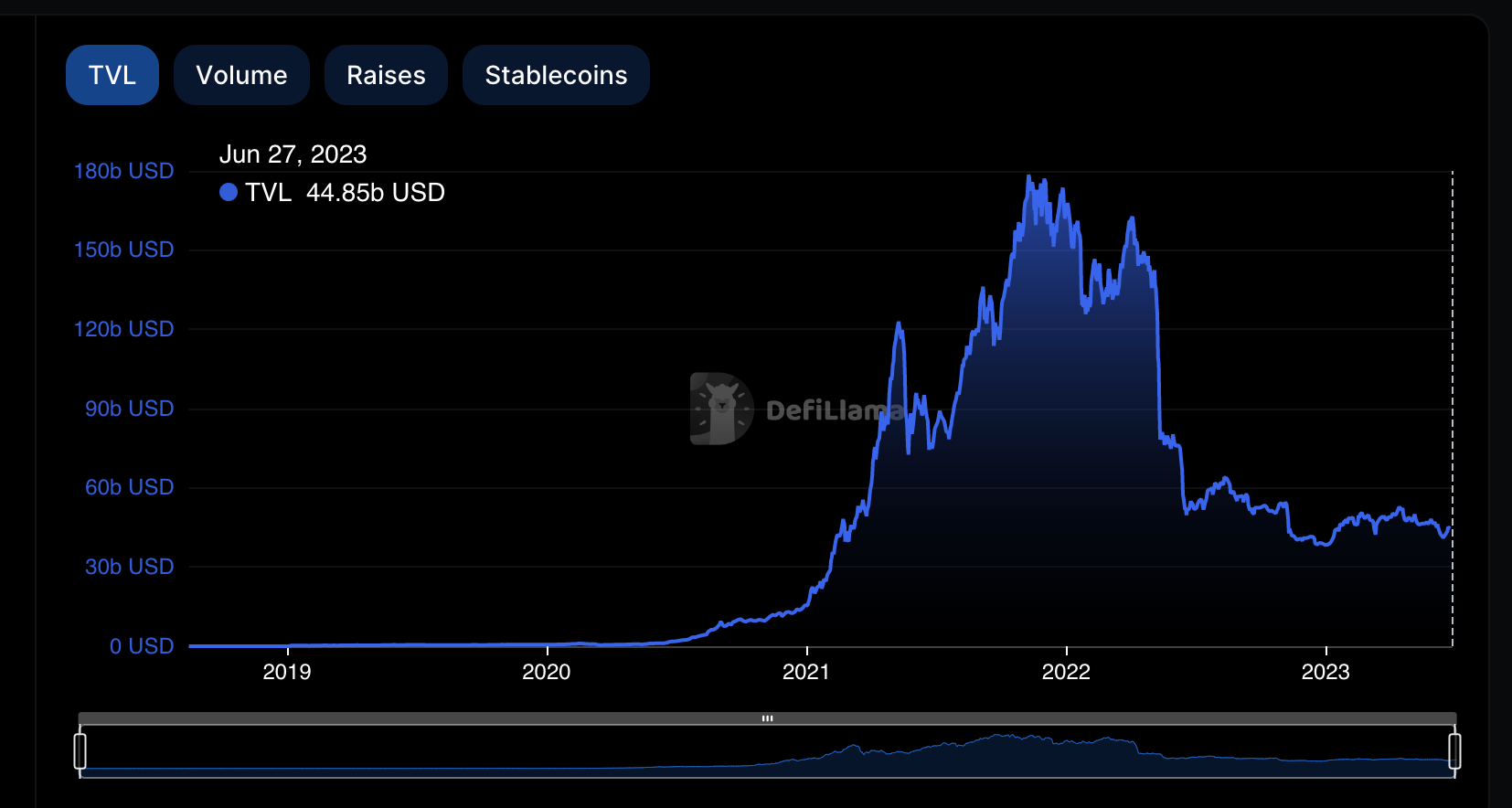

The TVL of a DeFi protocol can be a moving target, especially during times of market volatility when prices of assets are moving rapidly.

Reasons why TVL is important or useful

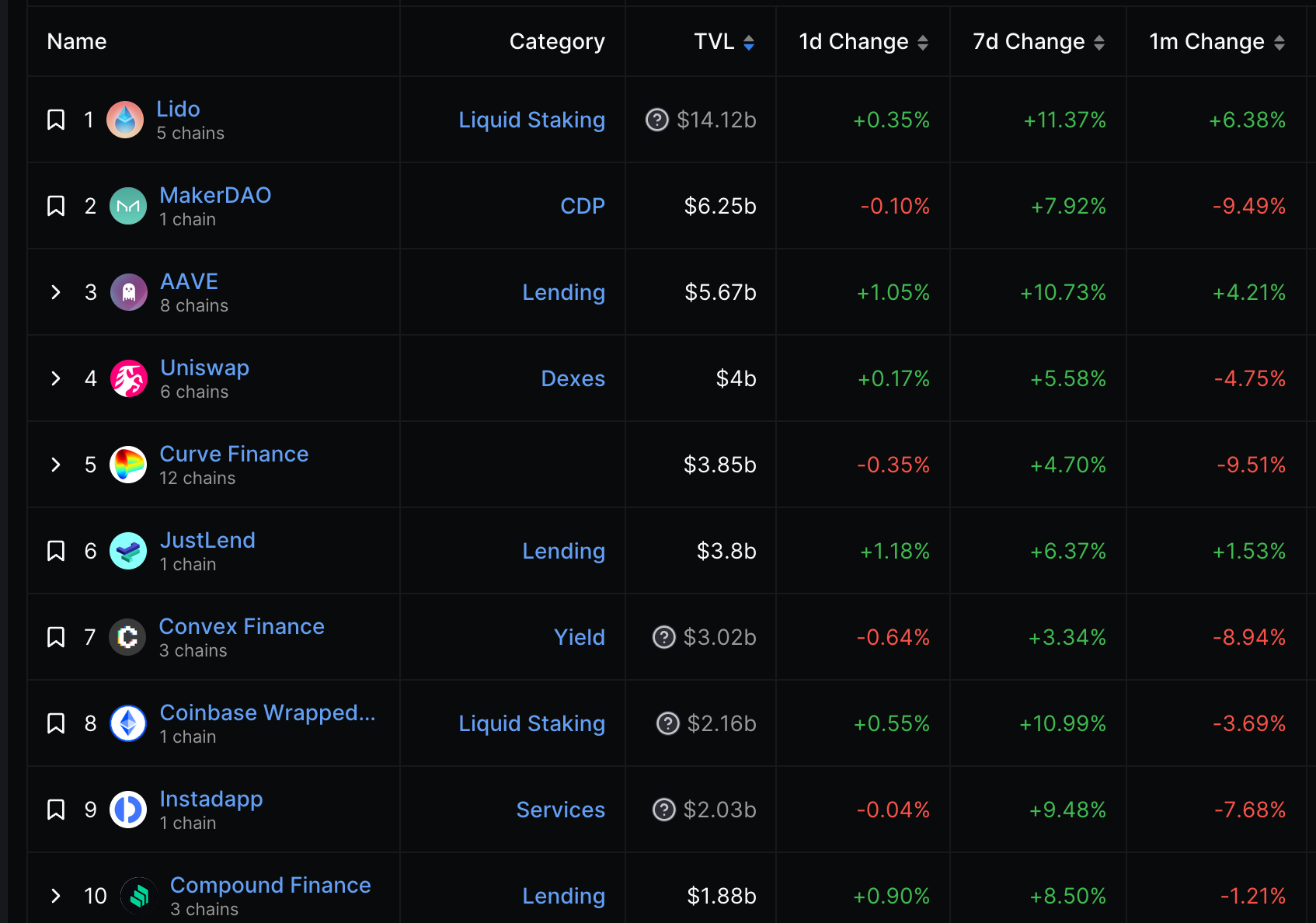

Utility: Sometimes, TVL is viewed as a reflection of the level of trust or legitimacy for a DeFi project or protocol. The higher the TVL, the more people are using and engaging with the protocol, which then attracts more attention and investment.

Measurable growth metric: During times of market stability, an increase in TVL can help demonstrate overall growth in protocol activity or interest. Overtime, protocols that demonstrate utility and good product market fit should also show a corresponding TVL. One note on growth is that an increase in TVL should not be used as a gauge of health or legitimacy. DeFi protocols use different tactics to gain market share and traction, including practices like offering high interest rate returns on activities like yield farming.

Liquidity monitor: DeFi projects with high TVL will also more liquidity in the system, which means they should overall be more stable and sustainable in the face of short-term volatility.

Transparent balance sheet: One of the main advantages of DeFi is that investors and participants can look at a DeFi protocol’s activities on-chain. This is like if a traditional financial institution had a public-facing balance sheet that was updated in real time. The ability to transparently monitor metrics like TVL is pretty incredible and a definite departure from the way things are handled in traditional finance.

The risks for using TVL as a legitimacy or growth metric

As DeFi becomes more complex in its offerings and abilities, the TVL metric will become less straightforward.

If a DeFi protocol or project offers liquid staking derivatives, which is a way of creating value by using assets that are locked in a staking protocol as collateral, then calculating the TVL is not as straightforward. (Would you add the liquid staking derivatives to the TVL, or do you have some kind of side calculation that factors liquid staking into the TVL, or leaves it out depending on preferences?

Or what if one DeFi protocol is dependent on another protocol for its services? How would TVL be calculated then? And would there be a risk of a double count?

While TVL does help provide a simple, high-level way of comparing different DeFi protocols, it doesn’t reflect the overall security or soundness of the underlying protocol. In other words, TVL might be a simple way to understand overall liquidity or popularity of a DeFi protocol, but it shouldn’t be used to gauge overall safety or legitimacy.

The takeaway

Overall, TVL is a good metric to make high level comparisons between DeFi protocols easier.

In some regards, TVL is like a market cap kind of metric for the DeFi world. While there are a lot of advantages to using high level metrics for quick analysis, they can also not reveal the entire story.