Paypal goes multichain. Amazon and Walmart launching stablecoins.

Stablecoins are becoming crypto’s killer app. PayPal, Amazon, and Walmart are quietly rewriting the rails of digital money — without changing the interface.

The headlines are adding up. On June 11, PayPal quietly expanded its stablecoin —PYUSD — to Stellar, its third blockchain after Ethereum and Solana. No splashy product video. Just a line in a press release: pending regulatory approval, PayPal’s dollar will soon move on a network known less for speculation and more for settlement. And then, days later, something louder: reports surfaced that Amazon and Walmart are exploring their own USD-backed stablecoins.

Each company has its own rationale. PayPal is building a global remittance loop with sub-cent fees and T+0 finality. Walmart and Amazon see a way to cut out Visa, slash interchange fees, and settle globally on programmable money instead of legacy rails.

But beneath the surface, the story is bigger than one product — or even three megacorps. It’s about what happens when web2 giants start embedding crypto in the backend.

This is what mass adoption looks like.

The killer use case was always going to be money

When the web first arrived, it wasn’t gaming or streaming or news that broke it wide open. It was email — boring, basic, wildly useful. On smartphones, it wasn’t sci-fi-sounding functionality like blockchain or LLMs (they didn’t exist yet). It was maps, messaging, ride-hailing. Tools that did what we already understood — but faster, cheaper, and in our hands.

Stablecoins are crypto’s email. The first use case that’s both comprehensible and indispensable. And like email, they don’t require belief. You don’t need to know how SMTP works to use it. You don’t need to “get crypto” to benefit from a dollar that settles in five seconds, not five days.

That’s what makes this week’s moves from PayPal, Amazon, and Walmart so pivotal. They don’t require users to learn new habits. They retrofit the rails beneath existing flows. The frontend remains familiar. The backend becomes programmable.

From gas fees to grocery aisles

Take PayPal. By adding Stellar to its PYUSD architecture, it’s targeting remittance corridors that have long been underserved and overcharged. Xoom, PayPal’s international cousin, could now fund payouts through a Stellar anchor, avoiding FX hops and Sunday-night delays. A merchant in Guatemala gets dollars in five seconds, not five days, without touching Ethereum gas or Solana wallet keys.

Under the hood, it’s elegant. Paxos mints PYUSD natively on each approved chain — no wrapped tokens, no bridges, no DeFi complexity. Transfers between chains use LayerZero’s canonical burn-and-mint flow. One reserve ledger. One supply cap. Multichain, not multi-copy.

Meanwhile, Amazon and Walmart are circling the same architecture for different reasons. Their motivation isn’t an embrace of the deeper philosophy of Open Money — it’s cost. By issuing their own stablecoins, they can bypass payment processors and reclaim billions in interchange fees. For Amazon, that might mean faster payouts to third-party sellers. For Walmart, it could mean programmable coupons that settle like cash.

Stablecoins make money programmable. For global platforms, that’s not a crypto experiment — it’s a business model upgrade.

A smoother road to mass adoption

The pattern is becoming clear. Web3’s path to scale won’t look like a flash migration. It will look like slow integration. Old frontends — e-commerce platforms, payment apps, embedded checkouts — will start working with new backend systems. And most users won’t notice.

Stablecoins are the bridge. They let companies cross over without asking their customers to change behavior. No need for seed phrases or MetaMask. No onboarding funnel for a ledger you don’t see. You tap “Pay,” and somewhere in the background, a token moves at the speed of software.

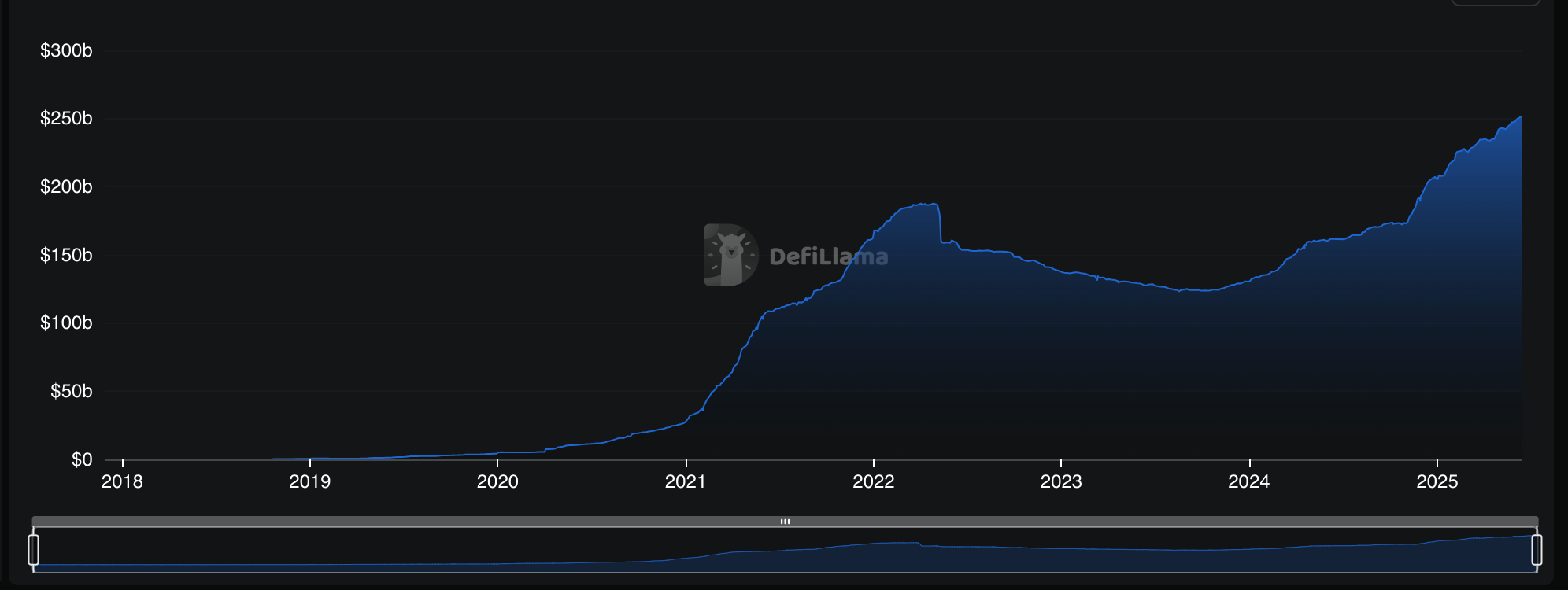

The data points are stacking up

- PYUSD is already multichain: Ethereum, Solana, and now Stellar — each with different economics, audiences, and performance.

- Transaction costs are collapsing: Stellar clocks in at under $0.0001 per send. Solana hovers around $0.002.

- Interchange is the enemy: Walmart and Amazon process hundreds of billions in transactions each year. Even a 1% fee cut means billions reclaimed.

- Regulation is catching up: The GENIUS Act is advancing in Congress. If passed, it gives companies like Walmart and Amazon a blueprint for compliance — full reserves, transparent attestations, 24-hour redemptions.

- Traditional networks are reacting: Visa and Mastercard shares dipped on the news.

What this means for Open Money

We’ve said it before: the real taxes on capital aren’t printed on receipts. They’re hidden in delay, fees, and trust gaps. Stablecoins collapse those costs:

- Latency drag becomes seconds, not days.

- Fee drag shrinks to dust.

- Trust drag dissolves under attestations and reserves.

In practice, this means dollars start behaving like messages. Fast, flexible, verifiable. You don’t need to change your behavior — you just get more liquidity, faster settlement, and fewer middlemen.

That’s the future Open Money is moving toward. Not a new system, but a better one — delivered invisibly behind the interfaces people already use. The fact that Walmart, Amazon, and PayPal are building that backend now tells us everything we need to know.

Open Money project update

There’s been a welcome influx of new subscribers over the past few weeks. If you’re one of them — hello, and thanks for joining. I’m glad you’re here.

I always appreciate feedback, pointers, or nudges toward things I might be missing. Feel free to reply to this email or connect with me on X or BlueSky. I read everything, even if I can’t always respond right away.

I usually use this space to share a quick update on the Open Money Project — a book I’m writing to weave together the threads we explore each week in this newsletter. It’s a way to build a coherent story around how crypto, web3, and programmable money are reshaping the economic infrastructure of the internet.

If you’re just getting up to speed, here are a few past issues that sketch out the broader idea of Open Money.

They’ll give you a sense of why we keep returning to this frame — and why now feels like an inflection point not just for crypto, but for the way capital itself moves on the internet.

Thanks again for reading — and please don’t hesitate to reach out.