One of the biggest misconceptions about crypto is that it’s just vaporware with nothing driving its value.

Turns out, in many cases, that might be true. But for about 200 crypto projects, a lot is going on behind the scenes in terms of building and enhancing the security of decentralized tech.

Most of the attention surrounding crypto activity focuses solely on the price movements of underlying assets. Or else the focus is on other market news that might ultimately affect the price.

Meanwhile, market watchers often pay little attention to the infrastructure behind crypto projects, the people building them, or how busy the builders are. One of the reasons is that getting a quick read of developer activity isn’t as easy as checking in on the latest price action.

But getting access to developer information is possible. One of the main attributes of open money systems is that they are public. Meaning they are built on open-source principles and tech stacks. Because of their openness, we can better understand how and where developers are building things.

If you know where to look, there’s nothing all that magical about magic internet money. Instead, open money is little more than one code commit after another, assembled in a way that creates valuable systems and applications for how we live now.

The developer report

This week, we looked at developer activity in two ways. The first was a dive into the 2023 Electric Capital Developer Report. The report analyzed 485 million code commits across hundreds of thousands of code repositories.

The biggest takeaway from this year’s report is that crypto developer activity is alive and well. The past 18 months have been difficult in the industry, thanks to a perfect storm of regulatory issues, negative media coverage, and choppy macroeconomic conditions.

Nevertheless, builders kept building. A wave of new developers entered the space following the bull run that culminated in late 2021, and then left following the down-market conditions of the past 24 months. But there is also a pronounced year-over-year growth trend of experienced developers.

Also noted in the developer report post, 40% of crypto developers work on Bitcoin or Ethereum projects. Interestingly, the proportion of developers working on Bitcoin and Ethereum compared to the rest of the crypto market has remained consistent since 2015.

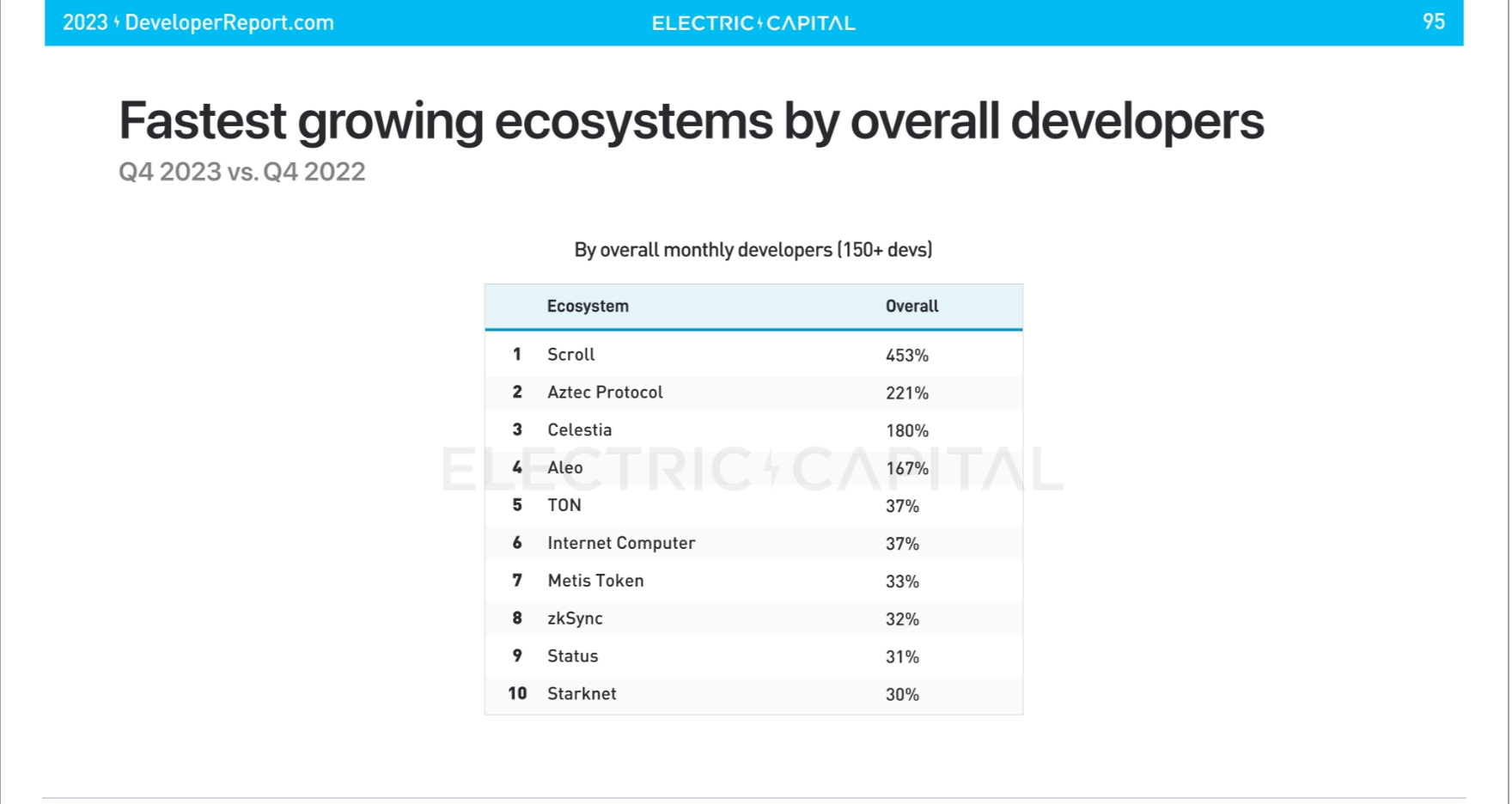

Likewise, a group of “newer” projects are receiving developer love. Here are a few examples:

Looking ahead

Waves of innovation, or new ideas testing the market, punctuate the move toward open money over the last 15 years. In the early days it was basic layer one functionality, like with the launch of Bitcoin and later Ethereum. That first wave led to a token boom and eventually decentralized finance and non-fungible tokens.

Before each of those waves, there was an uptick in developer activity — people building the functionality that eventually becomes new kinds of products and services.

In some ways, studying crypto developer activity helps us understand what’s coming next. In 2023, despite the down-market conditions, a few types of projects have attracted the attention of developers.

Working on Bitcoin ordinals (a means of creating smart contract-like functionality) is one example of an innovation currently attracting developer focus.

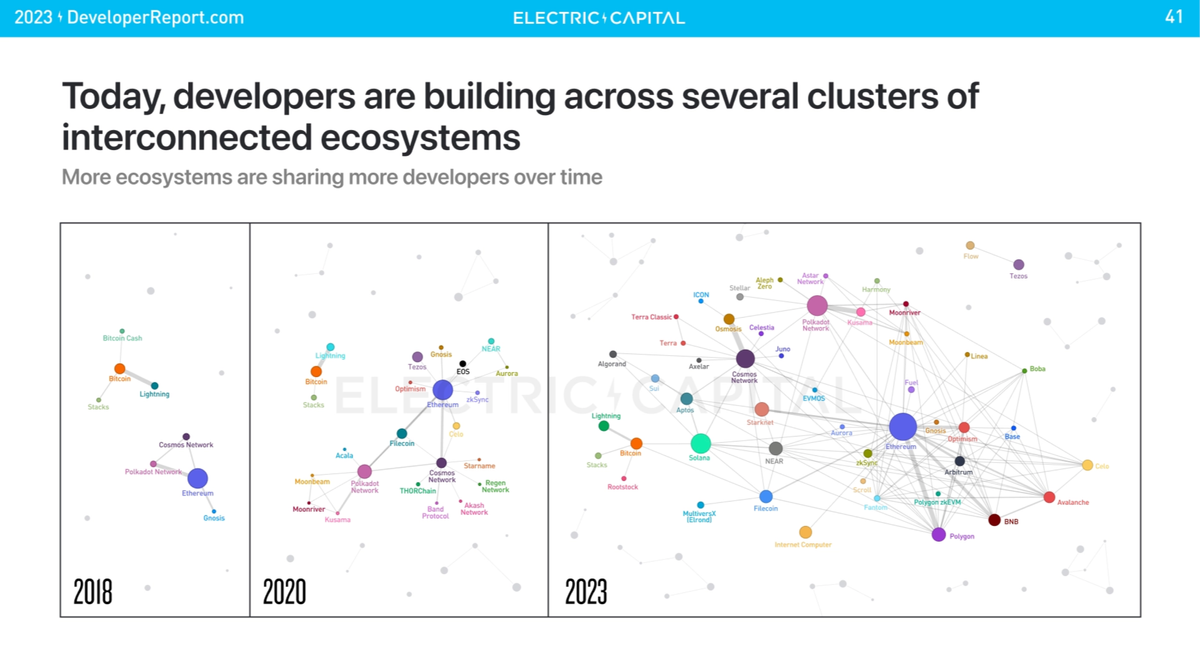

Another thing that sticks out is the increase of developers working on multiple chains. This is great news for the projects that require interoperability. Making it easier, faster, cheaper, and more secure to move across projects and ecosystems will continue to make digital assets stronger alternatives to traditional financial systems.

Zooming out to use developer activity as an investment research metric

Paying attention to developer activity helps us better understand the crypto story. Maybe more importantly, it gives us a more well-rounded vision for the future than just focusing on price swings alone.

For a number of reasons, adding developer activity to an open money research stack makes sense. If nothing else, it helps clarify which projects have active builders and which are little more than marketing and hype.

Until next week,

Building on public blockchains: A look at developer activity

This issue of the newsletter is a recap of a dive into crypto developer activity. We looked at what builders are building in two ways: by unpacking the 2023 Developer Report by Electrical Capital and then by looking at how developer activity fits into a basic crypto research stack.